Modified on: February 2024

What is the value of financial advice?

What is the value of financial advice?

When most people think of a financial advisor, they think of someone who picks the best investments. By investing in the ABC fund, you’ll get a better investment return than by investing in the XYZ fund.

Whilst there is some truth to this, it’s only a small part of the puzzle. Of course, with some time and effort, there’s no reason you can’t select your own investments.

Quantifying the value of financial advice

The real value of working with a financial advisor is in avoiding expensive mistakes. It’s less about picking the best investment and more about making smart decisions with all aspects of your money.

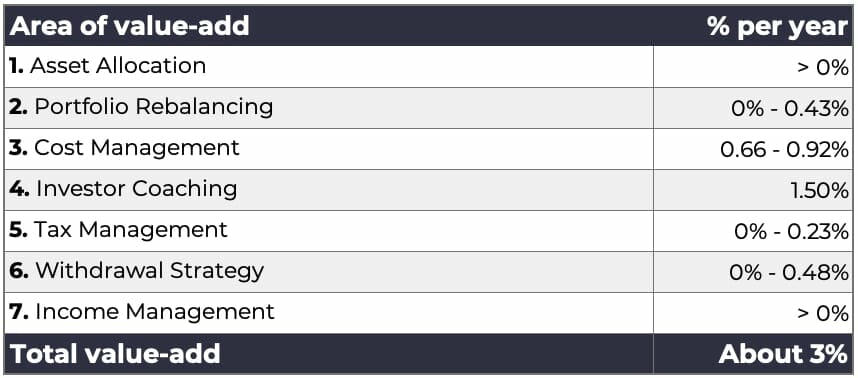

That’s a more difficult concept to get your head around, but it doesn’t mean that it’s not true. To try and provide some context, Vanguard commissioned an independent study to understand what is the value of working with a financial advisor.

Ignoring the difference in fund performance (ABC vs XYZ), it found that clients with a financial advisor on average earned about 3% per year more than those without an adviser.

Other studies confirm these findings. For example, the well-renowned DALBAR study finds that the average Do-It-Yourself investor underperforms by around 3% per year through poor decision-making.

The compounding machine

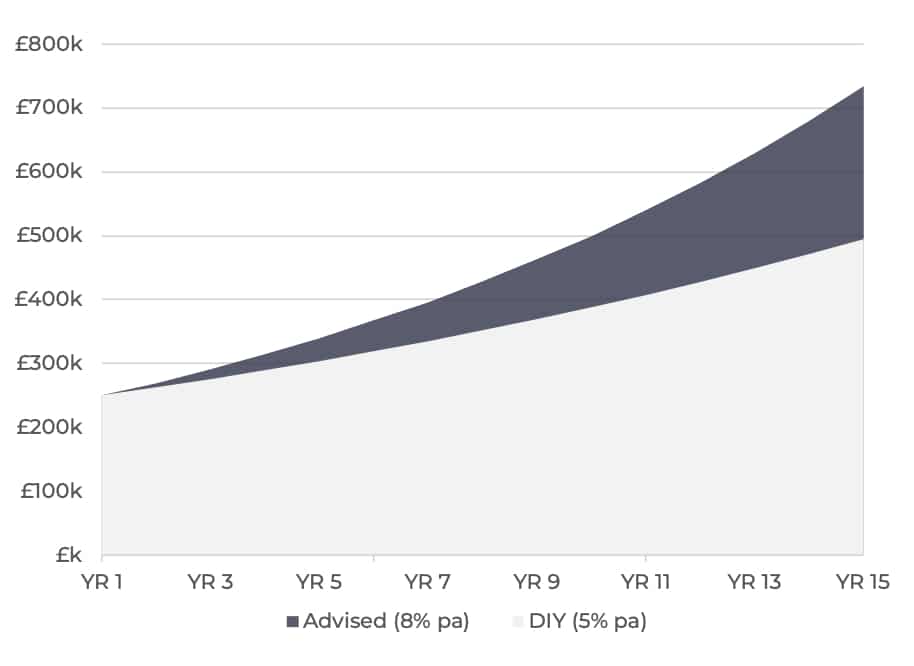

Whilst 3% per year might not sound like much, over time, it can add up to a very big number!

Let’s assume that you have £250,000 in investments. In an average year, these investments might grow by 5% per year. Over a period of 15 years, your investments would grow to £495,000.

If you work with a financial advisor and achieve the extra 3% per year, the same investment would grow to £734,000. Nearly £240,000 more!

Both studies show this isn’t about finding a better investment to generate an extra 3% per year. It’s about avoiding costly mistakes, like selling at the wrong time, taking too much risk or paying too much tax.

The moral of the story is that a good financial advisor should add significantly more value than it costs to work together.

The 7 Benefits of Working with a financial advisor

Here the are 7 main ways you will benefit from working with a financial advisor:

- Asset Allocation – Getting the right ‘mix’ of investments is the most important investment decision. How much should you invest in equities, bonds, cash and the like? Invest too cautiously and you won’t get the returns you need. Invest too aggressively and you’ll lose sleep at night. A financial advisor will help you define your objectives for the investment. They will create a well thought out investment policy statement, identifying the right mix of investments for you. This ensures that you take the right level of risk and are best placed to achieve the returns you need.

- Portfolio Rebalancing – To maintain the right mix of investments, you need to rebalance the portfolio every so often. This involves selling some of the investments and using the money to top up the others. Emotionally, this can be difficult to do, as we can become attached to certain investments. A financial advisor will review the portfolio objectively and rebalance as required. This ensures that you maintain the right mix of investments and don’t take too much risk.

- Cost Management – In most areas of life, you get what you pay for. If you pay more, you get more. But in the world of investing, you get what you don’t pay for. When you think about it, it makes sense. Costs matter, because every pound you pay in costs eats into your future returns. A financial advisor can reduce your charges by providing access to institutional investments with lower costs. This ensures you keep more of any investment return.

- Investor Coaching – Investing can provoke strong emotions. When our investments fall by 20%, we panic. When our investments rise by 20%, we celebrate. The problem is, we’re all human. We’re hard-wired to avoid pain and seek pleasure. So we sell our investments when they fall, and we buy them when they rise. A financial advisor will act as a voice of reason between you and an expensive mistake. They will provide sound, objective advice, helping you stick to the plan and remain invested.

- Tax Management – Taxes can be a major drag on your investment returns. Selecting the right ‘tax wrapper’ is just as important as selecting the right investment strategy. A financial advisor will help you work out which accounts are right for you based on your tax position. They will consider the tax rate you pay now and consider the tax implications when you come to withdraw the money.

- Withdrawal Strategy – How you withdraw money from your investments can have a big impact on your overall return. Which account should you withdraw from? Which investments should you sell? A financial advisor will create a withdrawal strategy for your investments. This ensures that withdrawals are as tax-efficient as possible and that you maintain the right mix of investments.

- Income Management – Your investments will produce income, such as dividends. Unless reinvested, this money will sit idle, producing no return. You may also need to withdraw some income from the portfolio. A financial advisor will reinvest any income the portfolio provides. They will also determine which investments are sold when you need to withdraw money.

There will also be non-quantifiable benefits, such as having clarity around your financial position and the peace of mind that comes with having a strategic financial partner.

How can we help?

As independent financial advisers, we can help you make smart decisions with your money and avoid making expensive mistakes.

If you want to know more about how we can help, feel free to schedule an initial consultation.

All the best,

James Mackay, Independent Financial Adviser in Bristol

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor based in Clifton, Bristol.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement masterclass

Retirement masterclass  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602