Modified on: May 2024

How to Become Financially Independent – Strategic Retirement Planning

Introduction: Strategic Retirement Planning

As you approach retirement, the prospect of finally reaping the rewards of years of hard work and dedication is exhilarating. Yet, the transition to retirement is fraught with complexities that, if not navigated wisely, can turn this hopeful period into one fraught with financial stress and uncertainty. This guide delves into the essentials of strategic retirement planning, helping senior professionals avoid common pitfalls and realise their retirement aspirations.

The Retirement Landscape for Senior Professionals

For senior professionals, retirement isn’t just about the end of a career; it’s a significant life shift. It involves saying goodbye to a long career and getting ready for a phase that could last decades, with its opportunities and challenges.

During this stage, there’s a notable shift from earning income actively to relying on savings and investments. These professionals, including executives and business owners, must adjust their retirement plans to match their unique journeys and future goals.

Strategic retirement planning is crucial in guiding them through the path to financial independence, ensuring a smooth transition to this next phase of life.

Common Pitfalls in Strategic Retirement Planning

After guiding numerous senior professionals through the retirement journey, we’ve noticed some common pitfalls that many encounter. They are:

- Budgeting Blind Spots: One of the most common blunders is underestimating retirement expenses. It’s not just about replacing your paycheck; it’s about accounting for lifestyle changes that can bump up your costs—things like leisure, travel, healthcare, and unexpected expenses. Precise planning here is critical to sidestep financial stress.

- Tax-Time Troubles: Retirement planning isn’t just about saving; it’s about managing your money smartly. Understanding how taxes play into your retirement funds and using tax-efficient strategies can mean significant savings in the long run.

- Diversify for Security: They say, ‘Don’t put all your eggs in one basket,’ and that’s especially true in retirement planning. Diversification is where you spread your investments across different asset classes helps cushion the impact of market ups and downs, ensuring a solid financial foundation for your retirement.

- The Longevity Factor: With people living longer, you’ve got to prepare for a retirement that could last way longer than you think. That means ensuring your savings can comfortably support you for three decades, accounting for inflation and changing lifestyle needs.

Working with an independent financial adviser can be your strategic move for a smooth retirement transition. They can help you steer clear of these common pitfalls and set you up for a successful retirement journey.

Setting and Achieving Retirement Goals

When it comes to retirement planning, it all starts with having clear goals that match your values and the kind of life you want in retirement. This is where cash flow planning comes in.

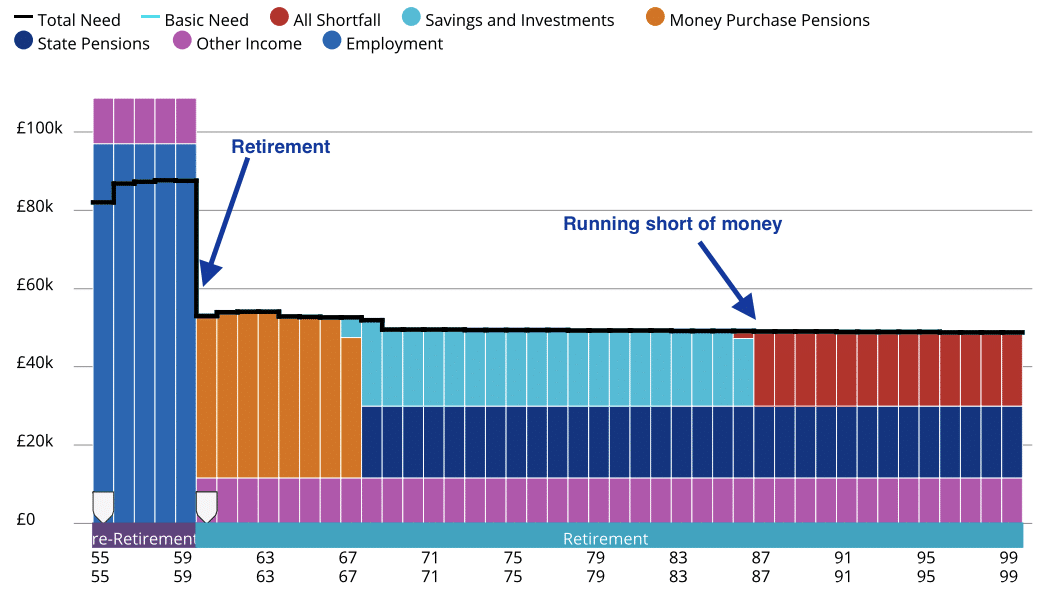

Cash flow planning is like creating a roadmap for your money. It helps you see how your income and expenses may play out in the future. This means figuring out things like everyday living costs, potential healthcare expenses, and what you’ll spend on extras. It then overlays your income and expenses with your assets, things like your savings, investments and pensions.

A comprehensive cash flow plan will answer several questions, including “how much is enough?”, “when can I afford to stop working?” and “how much can I spend in retirement?”.

In simple terms, retirement planning is not just about saving money; it’s about ensuring your finances are sufficient for your desired lifestyle.

Maximising Your Pension and Other Retirement Benefits

For senior professionals, pensions often represent a substantial chunk of their retirement income. Making strategic choices is the key to getting the most out of your pension benefits. This means carefully considering how much to pay into your pension and how the money should be invested.

Understanding the benefits offered by your employer is another critical piece of the puzzle. Knowing the ins and outs of what’s available and how to optimise them can significantly impact your financial security in retirement.

The Role of a Financial Adviser in Retirement Planning

A financial adviser is your trusted ally on the path to retirement success. They play a pivotal role in guiding senior professionals through the intricacies of retirement planning, offering personalised advice that fits your unique financial situation, goals, and risk tolerance.

These experts can assist in optimising your pension, crafting tax-efficient withdrawal strategies, diversifying your investments, and continuously monitoring and adjusting your retirement plan to keep it on track. With their expertise and perspective, financial advisers help you navigate the complex financial landscape, avoid common pitfalls, and work towards achieving your retirement objectives.

Conclusion: How to Become Financially Independent

As retirement approaches, it’s crucial to grasp that it’s not just the end of your career; it’s a significant life shift. This journey demands a deep understanding of retirement’s landscape, recognising potential pitfalls, and adopting effective strategies. From prudent budgeting to optimising pensions, understanding taxes, and diversifying investments, these steps secure your financial future.

You don’t have to navigate this path alone. A financial adviser is your dedicated partner, offering tailored guidance. They help maximise pensions, create tax-efficient withdrawal plans, diversify your investments, and adjust your retirement strategy as needed. With their expertise, you confidently navigate the financial landscape, sidestep common pitfalls, and strive for a fulfilling retirement. So, as you embark on this new chapter, remember that strategic retirement planning, paired with professional guidance, leads to financial independence and rewarding retirement.

Take the first step today and schedule a consultation with an expert retirement planner.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor based in Clifton, Bristol.

About us: Frazer James Financial Advisers is a financial advisor based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to talk to a Financial Advisor Bristol, we offer an Initial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing but not personal advice. If you’re not sure which investments are right for you, please request advice. Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement masterclass

Retirement masterclass  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602