Modified on: July 2024

Teaching Kids About Money: Strategies for Instilling Fiscal Responsibility in Your Children

Teaching Kids About Money: Strategies for Instilling Fiscal Responsibility in Your Children

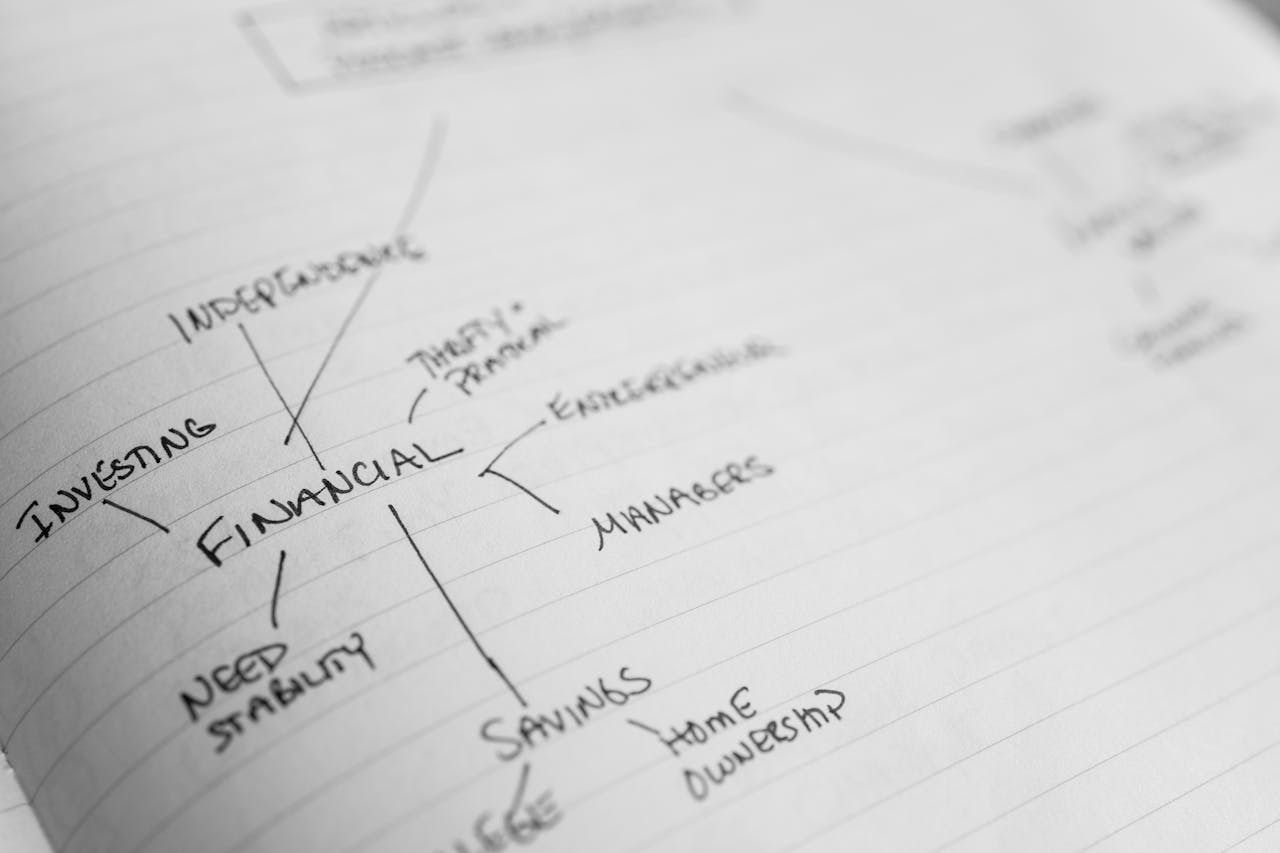

Instilling financial literacy in children from an early age equips them with skills vital for making responsible money-related decisions later in life. Learning about the concept of money, its value and the fundamental principles of earning, saving, and spending, lays the groundwork for a healthy financial future. Enabling children to understand money basics is the stepping stone towards their financial independence.

Developing practical money skills involves more than just the mechanics of counting cash; it’s about nurturing the ability to set financial goals and make informed decisions. Whether it’s through a piggy bank exercise to teach the habit of saving or creating a simple budget to understand the flow of money, each step is significant. As children grow, discussions about smarter spending choices, the potential of investing, and even the ethics of giving form a comprehensive approach to raising financially savvy children.

Key Takeaways

- Financial education for children prepares them for future challenges.

- Regular saving habits and budgeting are pivotal for financial well-being.

- Making informed decisions on spending and investment is a learned skill.

Understanding Money Basics

It is crucial for children to grasp the fundamentals of money, including recognising currency, understanding how one earns it, and the difference between saving and spending.

Currency and Its Value

Currency is the physical form of money and serves as an accepted medium of exchange for goods and services. Whether it’s coins or banknotes, each denomination has a distinct value. With younger children, one can introduce this by using real coins or play money, helping them to learn that different coins and notes represent different amounts of value. An effective way to do this is to use visual aids like clear jars filled with coins of different values or a simple table that lists currency denominations next to items they can buy, reinforcing the concept that money can be exchanged for goods.

The Concept of Earning

Earning refers to receiving money in exchange for work or services provided. Children should learn that money is not simply given but is typically the result of effort and work. For instance, a weekly allowance might be tied to chores completed around the home. The key here is to establish a firm connection between effort and monetary reward to instil a sense of value in hard work and the money earned therefrom. Contextualising this with real-life examples or activities can reinforce understanding.

Saving Versus Spending

Saving means setting aside money for future use rather than using it immediately, while spending is the act of using money to purchase goods or services now. It’s crucial for children to recognise the balance between the two. Using a simple chart or jar system can visually show the benefits of saving money over time for larger goals, in contrast to the immediate, but short-lived, gratification that comes from spending. Explaining the importance of budgeting personal finances can help them develop a healthy financial mindset early on, and resources like practical tips for parents can provide additional guidance for instilling these concepts.

Setting Financial Goals

Teaching children to set financial goals is instrumental in fostering financial acumen. It equips them with a sense of direction and purpose when saving and spending money.

Short-Term Objectives

When focusing on short-term financial objectives, children should learn to identify tangible items or experiences they wish to save for in the near future. For example, they might save towards a new book or a day out. Parents can facilitate this by helping their child to set a savings target and time frame for their desired purchase. Here’s a simplified approach:

- Item/Experience: New book

- Cost: £10

- Savings Needed: £2 per week

- Time Frame: 5 weeks

By breaking down the goal into manageable steps, children find it more achievable and motivating.

Long-Term Aspirations

Long-term aspirations might seem a bit too ambitious for younger minds, but they are crucial for teaching the value of patience and delayed gratification. Educators can introduce the concept of long-term savings for larger goals like a university fund or a significant trip. For instance, setting aside a small amount from weekly allowance consistently can help them understand how incremental savings contribute to a larger sum over time.

Parents and educators can demonstrate this through a visual savings chart or progress tracker, which gives children a clear view of how each contribution gets them closer to their goal:

| Week | Deposit | Total Saved |

|---|---|---|

| 1 | £5 | £5 |

| 2 | £5 | £10 |

| … | … | … |

| 52 | £5 | £260 |

By involving children in the process of tracking these goals, they learn to appreciate the impact of consistent saving.

Developing a Savings Habit

Instilling a savings habit in children sets the foundation for a lifetime of financial responsibility. It’s crucial they learn the value of money and the benefits of saving from an early age.

Opening Their First Bank Account

The act of opening their first bank account is a significant milestone for a child. It serves as a practical introduction to the world of finance and provides a sense of ownership over their fiscal decisions. When they deposit money into their account, children can tangibly see their savings grow over time, reinforcing the habit of saving consistently.

Learning About Interest

Understanding the concept of interest is key to developing a savings habit. Children should learn how money can grow through the power of compound interest, which is the interest on interest. Teaching them to compare different interest rates and to see how their savings could potentially increase with time encourages a deeper engagement with their financial future.

The Importance of Budgeting

Budgeting is a crucial skill that children can learn from an early age to help them manage their finances effectively throughout their lives. It equips them with the ability to plan and understand the balance between income and expenses.

Creating a Simple Budget

Children can start by creating a simple budget that outlines their income from allowances or gifts and planned savings for desired purchases. They might use a basic table to track these figures:

| Week | Income (£) | Savings (£) | Expenses (£) |

|---|---|---|---|

| Week 1 | 5.00 | 2.00 | 3.00 |

| Week 2 | 5.00 | 2.50 | 2.50 |

| Week 3 | 5.00 | 3.00 | 2.00 |

| Week 4 | 5.00 | 3.50 | 1.50 |

Monitoring Expenses

Monitoring expenses is another critical aspect, where children learn to keep track of where their money goes. They can categorise their spending to visualise how they allocate their funds, for example:

- Savings: 50%

- Entertainment: 25%

- Education: 15%

- Charity: 10%

This approach helps children to determine if they are spending more than they have and if their spending aligns with their priorities.

Smart Spending Decisions

Educating children to distinguish between needs and wants, alongside understanding the value of making informed purchases, is vital in developing their capability to make smart spending decisions.

Needs Versus Wants

When teaching children about financial literacy, it’s crucial to impress upon them the difference between needs and wants. A need is something essential, like food or shelter, whereas a want can be considered a luxury, such as the latest toy or gadget. For instance, the Money and Pensions Service suggests exercises like listing items around the house to classify into “needs” and “wants” as a practical activity to help children learn this important distinction.

Making Informed Purchases

Imparting the ability to make informed purchases means encouraging children to think critically about their buying choices. They should learn to assess whether an item is good value for money and how it fits into their budget. An approach is to involve children in everyday shopping decisions, highlighting how to compare prices and check for quality. Additionally, resources like Kids’ Money discuss the importance of explaining the purpose of different expenditures, to reinforce the concept of spending money judiciously.

Earning and Entrepreneurship

Teaching children about earning money and nurturing an entrepreneurial mindset equips them with crucial life skills. This section delves into age-specific earning opportunities and ways to inspire entrepreneurial thinking in children.

Age-Appropriate Ways to Earn

For younger children, simple tasks like organising their toys or assisting with minor household chores can be used to introduce the concept of earning money. It is essential to make these tasks age appropriate, such as paying a small amount for each task completed. As children grow older, opportunities can become more complex, like setting up a lemonade stand or doing garden work for neighbours, teaching them the value of effort and reward.

Fostering an Entrepreneurial Spirit

Encouraging children to solve problems autonomously can spark their entrepreneurial spirit. One can prompt their child to think creatively about earning money, perhaps through a hobby or skill they enjoy, such as making crafts to sell. Moving beyond simple transactions, it’s beneficial to discuss the aspects of goal setting and achieving milestones, which can give children a sense of ownership and accomplishment, and introduce them to the basics of running a small business.

Investing and Financial Growth

When teaching children about money, it’s essential to cover how it can grow over time through investing. This education can give them a crucial edge, empowering them to make smart financial choices for their future.

Basics of Investing

Investing might seem complex, but the fundamental concept is fairly straightforward: it is the act of allocating resources, typically money, with the expectation of generating an income or profit. It’s important for children to grasp that investing is not a guaranteed way to make money but rather a means to potentially increase wealth over the long term by taking advantage of various financial instruments. For instance, investing in shares of a company means buying a small piece of that business, with the hopes that the company’s success will increase the value of that share.

Compound Interest and Wealth Building

At the heart of wealth building through investing is the powerful concept of compound interest. Compound interest is the process where the value of an investment increases because the earnings on an investment, both capital gains and interest, earn interest as time passes. This effect can turn modest savings into significant sums over time, demonstrating why it’s important to start investing early. Learning about and understanding compound interest can encourage youngsters to save and invest regularly, showing them how their wealth can exponentially grow from these habits.

Giving and Philanthropy

When teaching children about money, it’s crucial to emphasise the importance of giving and the impact of philanthropy. Instilling generosity in children not only aids others but also enriches the child’s own life, fostering a sense of community and shared responsibility.

The Role of Charitable Giving

Charitable giving is a key component in raising socially responsible children. It reinforces the idea that one’s financial resources can create positive change. For example, by allocating a portion of their pocket money to charitable causes, children learn the significance of supporting others. Studies have shown that understanding the concept of giving from a young age can lead to a greater sense of fulfillment and purpose. This is highlighted through tips for instilling generosity in children, emphasising the development of empathy and the joy found in helping others.

Volunteering and Community Service

Beyond monetary donations, volunteering is another pillar of philanthropy. Getting involved in community service allows children to donate their time and energy to make a tangible difference. This hands-on experience can teach invaluable lessons about work ethic and commitment. It provides practical exposure to the needs within their community and the ways they can contribute. Volunteering often sparks conversations about societal issues and the many forms of contribution beyond financial, which is also noted in the context of making philanthropy fun and meaningful for children.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James is a professional financial advisor Bristol and Retirement adviser UK providing complex financial services including financial advice on business insurance planning, early retirement in the UK, investment planning advice, income protection for directors, wealth management for business owners and many more.

Need help with pensions advice or wealth management? Frazer James can help with that too.

If you would like to talk to a Financial Adviser, we offer an Initial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing but not personal advice. If you’re not sure which investments are right for you, please request advice. Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Frequently Asked Questions

In this section, we address common queries parents have while educating their children about finances. From the right age to introduce money management concepts to strategies for imparting financial wisdom, these FAQs are designed to guide parents on the path to raising financially adept offspring.

.

At what age should children first learn about managing money?

What activities are most effective for teaching financial skills to children?

How can parents instil a sense of money's worth in their children?

What are the key components of financial literacy that should be taught to 12-year-olds?

What strategies should be employed to raise financially savvy youth?

How can guardians effectively communicate the concept of wealth to their offspring?

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602