Modified on: June 2024

Diversification – how to protect your investments from falling in value

Diversification

A short story about investment diversification.

It’s January 2018.

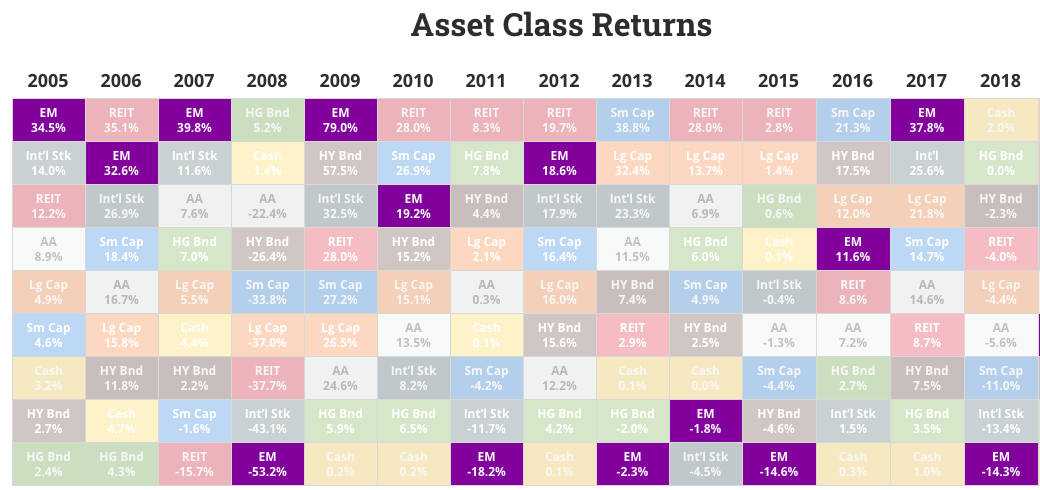

A client calls me, asking how to invest in emerging market investments.

“Why do you want to invest in emerging markets?” I ask

“They were the top-performing investment last year,” he tells me.

“But past performance is no indication of future performance”. I tell him.

“Remember diversification?” I ask. “Not putting all your eggs in one basket?”.

Fast forward one year. It’s January 2019.

That same client calls me:

“I’m glad we didn’t invest in emerging markets last year,” he tells me.

“Why’s that?” I ask.

“They were the worst-performing investment last year,” he tells me.

(Source – NovelInvestor)

The Evidence

But don’t just take my word for it. Lars Kroijer is the author of ‘Investing Demystified’ and a former hedge fund manager. He describes investment diversification as “the only free lunch” in investing.

He goes on to say that: “getting exposure to a very broad array of industries is better than buying individual stocks or even picking individual industries or countries. We’re always hearing about investors who bought just the right thing at the right time. But they’re actually in a tiny minority. Sure, you might get lucky – but why take the risk of being unlucky?”

So there you have it. Diversification is the smart thing to do. It helps to reduce the downside without necessarily reducing the upside.

All the best,

James Mackay, Independent Financial Adviser in Bristol

P.s – if you want a little more help with navigating your investments, check out the 7 Simple Steps to Investment Success. It provides you with a proven process to help you avoid costly mistakes and tilt the odds in your favour. You can get a copy by clicking here.

.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor Bristol, Clifton.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement masterclass

Retirement masterclass  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602