Modified on: June 2024

How a financial planner can help you reach your retirement goals

How a financial planner can help you reach your retirement goals

For many, thinking about retirement goals seems like something for the future. The fact of the matter is that the longer you leave it, the more expensive it is going to be. Here we lay out some of the ways working with a financial planner can help with your retirement planning.

How to set retirement goals

Although you don’t need a financial planner to help you with setting retirement goals, it can certainly help. A qualified retirement planner can help you answer the big questions, things like:

- When can I afford to retire?

- How much money do I need?

- How much can I spend each year?

- How much State Pension will I get?

We provide an initial consultation to help clients define their retirement goals and understand how realistic they might be. Whilst we can’t answer every retirement question you have during this first meeting, we will be able to provide a high-level overview of whether you’re on track for retirement.

At Frazer James, we have years of retirement planning experience, having helped hundreds of clients retire successfully and with confidence. Here we will list four ways in which a financial planner can help you to achieve your ideal retirement.

You may also be interested in the value of working with a financial planner. We have written about this in a separate post, here.

Having a clear vision

Understanding where you stand with regard to your finances is at the heart of planning for your retirement. In order to have a secure retirement plan, you will need to have projections for your financial situation going forward into the future.

A financial planner is able to help you create those projections, showing you the big picture when it comes to your retirement planning in Bristol or beyond. You can see an example report planning report here.

Once we have an idea of what your financial future looks like, we can come up with a plan to better prepare you for retirement. When building your retirement plan we will consider:

- Retirement Options – work longer with more income vs retire sooner with less

- Retirement Age – when you can afford to stop working and enjoy retirement

- Retirement Income – how much income you’ll receive in retirement

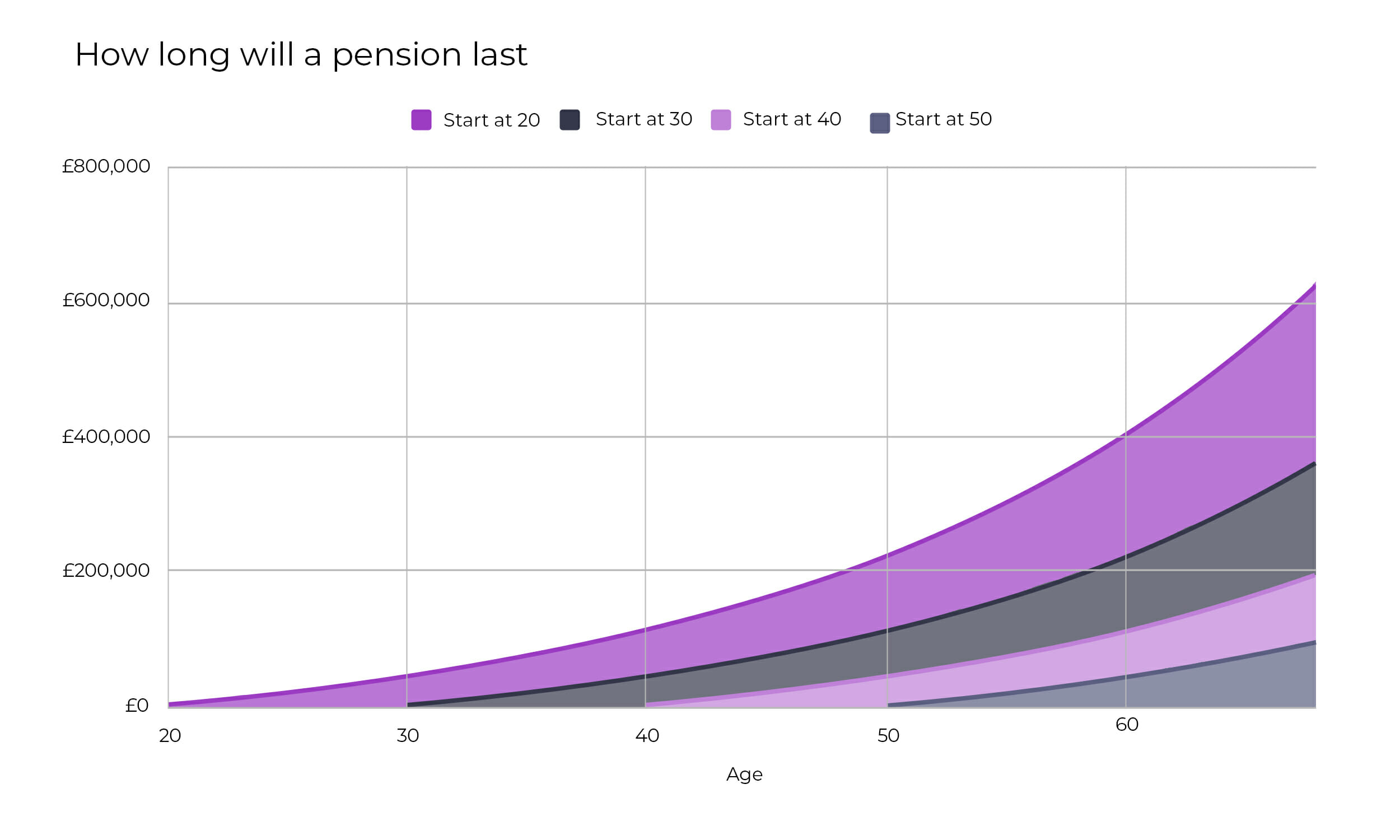

As this graph shows, the earlier you begin to plan for your retirement, the easier it will be to keep you on the right track.

Helping you set retirement goals by age

Although you may have a clear idea of what you want your finances to look like by the time you reach retirement, a financial adviser can help you determine which milestones you need to reach every year in order to get there.

Whilst there are rules of thumb to help you work out how much you need to retire (such as 1x income by 30, 2x by 40 etc…) – these don’t take into account your unique circumstances. Your retirement plans are unique and the best way to achieve them will be unique to you. When you work with a financial planner like Frazer James you will receive a bespoke service that is tailored to your individual circumstance.

Guiding you through your investment options

Investing for retirement can be a great way to make your money work for you. If you invest wisely, the value of your money will grow over time, reducing how much you need to save. Investing however, takes a great deal of time and effort that may be needed elsewhere.

Another aspect of investments is keeping the portfolio on track over a long period of time. Having a reliable financial planner will mean that your investments will be reviewed regularly to make sure they continue to perform as expected.

The final point to consider is how much risk you should be taking. If you take too much, you may find that your portfolio falls in value at just the wrong time. Take too little, and your money will hardly grow. Our team of investment experts will review your situation to determine what the right level of risk is.

Helping you stay on track

Once you have a clear understanding of your financial situation and what the plan is to achieve your retirement goals, a financial adviser can help you stay on track. A large part of financial planning is staying disciplined and ensuring that you don’t panic during scary investment markets.

Inevitably investments are going to rise and fall in value. How you react during these moments determines your success as an investor. Research shows do-it-yourself investors are more prone to make expensive mistakes with their investments, such as selling at the wrong time.

As financial planners we act as a coach and mentor, guiding you through the ups and downs of investing. We help ensure that you don’t make the wrong decision, at the wrong time, for the wrong reason. In short, we help you to stay the course, providing you with the best chance of achieving your goals.

Retirement planning consultation

Planning for retirement is potentially the most important financial decision you will ever make, and as such, you will want to consult with the best possible people. Frazer James is an award-winning independent financial adviser consisting of a team of chartered and certified financial planners.

Our retirement strategy sessions offer you an initial consultation with a Certified Financial Planner to help you better understand your retirement options.

Take advantage of this unique opportunity to gain valuable knowledge and personalised financial advice from our team of financial experts.

Schedule your retirement strategy session today.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor based in Clifton, Bristol.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, retirement advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor Bristol, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602