Modified on: July 2024

How much income will a £1m pension generate?

How far will a £1m pension go in retirement?

A £1m pension pot sounds like a lot of money, but is it enough for your retirement? This article will help answer how far £1m will go in retirement and how much income it is likely to produce.

A word of warning. No two retirements are the same. How much you need for retirement will depend on how much you plan to spend – and how long you plan on living for! Whilst £1m will be enough for some, it will not be enough for others.

How much income would a £1m pension generate if you purchase an annuity?

Before the introduction of pension freedoms in 2015, the most common way to access your pension was to buy an annuity. This is where you exchange your pension pot for an income for life. In effect, you hand your pension over to an insurance company, in return they pay you an income for as long as you live.

Whilst you might not hear much about annuities today, they do still exist. People just don’t seem to use them very often, instead preferring to flexibly drawdown their income (more on this later).

If you purchase an annuity, a £1m pension pot will provide an income of £35,000 per year. This assumes that you purchase an annuity at age 55 and are in good health.

If you wait until you’re 68, a £1m pension pot will provide an income of £50,000 per year. This is because the amount of time the insurer has to pay an income is less than if you purchased an annuity at 55.

What determines annuity rates?

The income you receive from £1m when purchasing an annuity will depend on:

- How old you are

- Whether you’re in good health

- Whether the income remains the same or increases over time

- Whether the income continues paying to your spouse when you die

In recent years, the income received when purchasing an annuity has fallen dramatically. As interest rates have fallen, so too has the income provided by annuities. Whilst the income may not be particularly attractive, annuities still play a valuable role in retirement planning.

The only way to guarantee that you won’t run out of money in retirement is to purchase a pension annuity. This is because the insurance company is obligated to continue paying an income for the rest of your life – however long that may be. The alternative is to flexibly withdraw an income from your pension. This comes with a range of benefits, as well as risks.

What are the drawbacks of annuities?

An income for life sounds great, but annuities aren’t without their drawbacks.

A big drawback of annuities is that once it is set up, you cannot change how much income you receive. You may find that in your early retirement years, you want a higher level of income to spend on leisure and activity. However, as time goes on, and your State Pensions come in, you may not require quite as much income. Unfortunately, there’s no ability to change the income amount once an annuity is set up.

Another drawback is that by default, the income you receive will not increase by inflation. Over time, you will find that the income is worth less and less. You can select for the income to increase by inflation, however, this significantly reduces the amount you receive.

Finally, the biggest complaint regarding annuities is about what happens when you die. By default, when you die, your annuity income will stop and the insurer will keep the pension fund. Again, you can select an income to continue to be paid to your spouse, but this will significantly reduce the amount of income you receive overall.

How much would a £1m pension generate if you go into drawdown?

Since the introduction of pension freedoms, most people flexibly withdraw money from their pension pot instead of buying an annuity. This is where you leave the pension invested and take out as little or as much as you like, whenever you like.

For example, you might decide to withdraw more money at the start of your retirement, before reducing these withdrawals once your State Pension comes into payment. You may also take a one-off lump sum, for example, to pay off the mortgage or buy a new car. You have total control over how much and how often you withdraw money from your pension.

For most people going into drawdown, a £1m pension pot will provide you with an income of £40,000+ per year, rising with inflation. This reflects a 4% withdrawal rate per year – explained more fully later on.

However, it’s not without risk. If you take out too much, too quickly – you risk running out of money too soon. In effect, you are responsible for making sure you don’t run out of money in retirement.

What are the benefits of pension drawdown?

Although not without risk, pension drawdown has several benefits, particularly when compared to annuities.

The first is that you have total control over how much you withdraw. You have the flexibility to either increase or decrease the income to suit your needs.

Secondly, your pension will remain invested. If these investments grow over time (not guaranteed), you could potentially receive a much higher income throughout retirement than would be the case if you purchased an annuity.

The tax position of a drawdown pension is generally more favourable than an annuity. As you have control over when/how income is withdrawn, you can manage withdrawals within your tax bands, reducing your overall tax liability.

Finally, the death benefits of drawdown pensions are more favourable than annuities. When you die, any pension funds left unspent can be inherited by your beneficiaries, tax-free.

By working with an independent financial adviser, you will benefit from regular reviews of your drawdown pension, helping you to mitigate the risks and take advantage of the benefits. This will include ensuring your investments remain suitable for your needs, making sure any withdrawals are tax-efficient and sustainable over the longer term.

The 4% rule – how much can you spend in retirement?

Whilst there’s no hard and fast rule, there are some useful guidelines for determining how much you can ‘safely’ withdraw from your pension in retirement.

One frequently used rule of thumb for retirement spending is known as the ‘4% rule’. If you take 4% of your pension in your first year of retirement and adjust that amount for inflation in every subsequent year, you shouldn’t run out of money for at least 30 years. If you go into drawdown, a £1m pension pot will provide you with an income of £40,000 per year, rising with inflation.

Of course, there are no guarantees. You may find that unfavourable investment markets mean that the pension is depleted sooner than expected. Or conversely, if your pension performs well, it may grow over time.

You need to remember that drawdown comes with risk. Whilst the 4% rule is a useful framework, it’s not perfect. There are some important risks you need to be aware of when applying the 4% rule.

Why you shouldn’t rely on the 4% rule

The main drawback of the 4% rule is that it doesn’t account for the ‘sequence of return risk’. The sequence of return refers to the order of investment returns. If investment returns at the start of your retirement are unfavourable, your pension pot may be depleted sooner than expected.

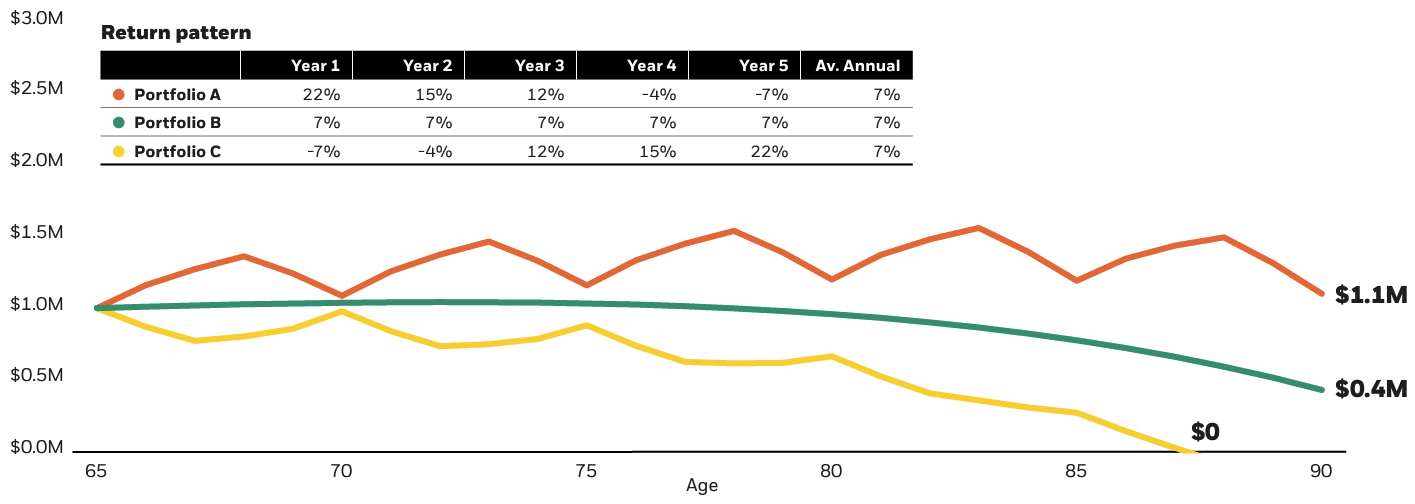

To understand this risk, let’s consider the sequence of returns under three five-year market scenarios. In each scenario, the amount you withdraw from the pension and the investment returns you receive are identical. The only difference is the ‘order’ (sequence) of these investment returns.

- In scenario A, the investment returns are positive at the start but negative by the end.

- In scenario B, the investment returns remain the same throughout.

- In scenario C, the investment returns are negative at the start but positive by the end.

Source: BlackRock.

Importantly, all three scenarios have average annualised returns of 7% per year. Despite having the same average return, Portfolio C is expected to run out of money within 27 years, whereas Portfolio A ends up with more money than it started with.

That’s the importance of ‘sequence of return risk’ – and why you shouldn’t blindly follow the 4% rule!

Volatility drag – the cruel math of retirement planning

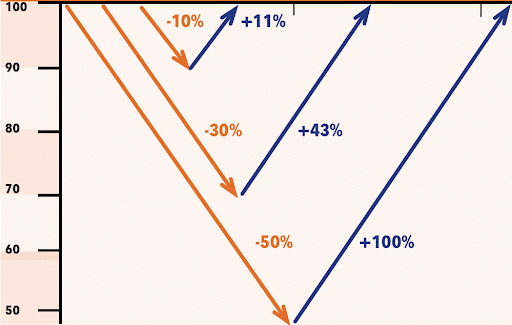

A related but distinctly different risk is ‘volatility drag’. Simply put, volatility drag is why it’s harder to ride your bike uphill than it is to ride downhill.

Imagine that your pension has fallen in value by 30%. How much does it need to rise by to get back to the same point? The answer is 43%.

Volatility drag is particularly important for retirement planning. This is because it is exacerbated when you are withdrawing an income from the pension. If you start withdrawing money from your pension when your investments are falling in value, you will find that your pension is depleted at a much quicker rate. Although the £ amount you withdraw will be the same, the % of your portfolio you withdraw has to be greater. This is because you will have to sell more of your investments to give you the same level of income. In effect, you are locking in losses at the start, which makes it harder to recover at a later point.

So what can be done to reduce the risk of running out of money in retirement? One option is to adopt a ‘bucketing strategy’ with your pension.

How to make your £1m pension last longer with a ‘bucketing strategy’

It’s common for most people to take less risk with their investments as they approach retirement. Typically, they will invest less in high-risk stocks and shares and more in low-risk bonds and gilts.

This can reduce the chance that your pension fund falls in value significantly at the point of retirement. However, it also hinders any potential growth.

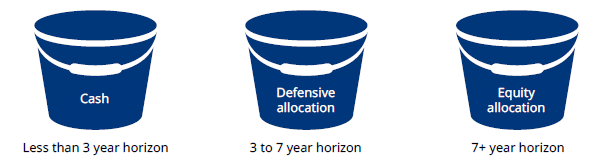

A potentially better option is to adopt a ‘bucketing’ strategy with your investments. This involves dividing your pension assets into three distinct buckets.

- The first bucket should be for the money you need in the short term. This bucket holds cash, i.e one year’s worth of income.

- The second bucket is for the money you will need in the medium term. This bucket can be invested in a blended mix of low, medium and some high-risk investments.

- The third bucket is the one that you don’t need to access for at least 7 years. Due to the long time horizon, this bucket can be invested in a slightly riskier mix of investments that provide more growth opportunities. Should the markets fall in value, you’ll be able to ride out the losses and give your pension time to recover.

Bucketing aligns your investments with your income requirements. It reduces the possibility of experiencing a bad ‘sequence of returns’ as you withdraw money, whilst providing the opportunity for growth with money not needed for the long-term.

How cash flow modelling can help you plan for retirement

Retirement planning is about a lot more than working out how much income you will receive from a £1m pension pot, selecting suitable investments and using a ‘bucketing’ strategy. It’s about making sure you have enough money for the rest of your life and dealing with any surprises or transitions along the way.

The problem is that life doesn’t always follow the exact path that you expect it to. More often than not, it’s full of unexpected surprises. You may have decided to retire at 55 and sail around the world, but then COVID-19 came along. Nobody planned for that.

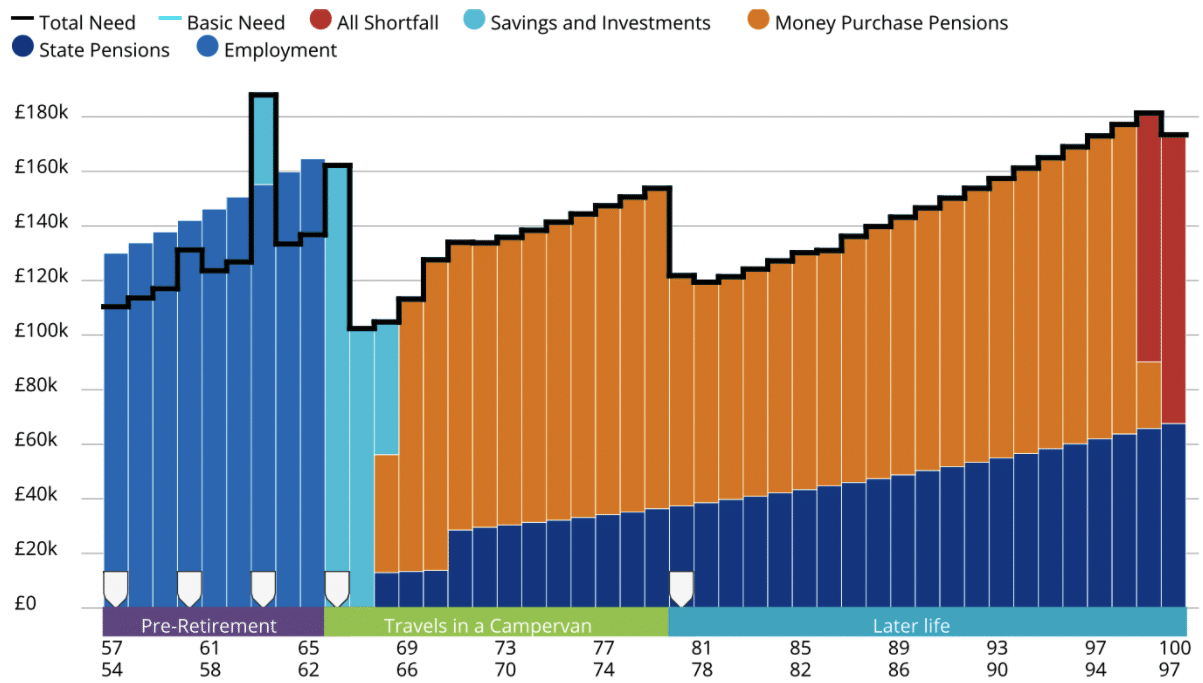

Whilst nobody can predict the future, we can plan for unexpected events. This is where cashflow modelling comes in. Put simply, cash flow modelling provides a forecast of your finances. It will show whether you are on track with your retirement planning, or whether some adjustments may be needed.

The outcome is a visual representation of your finances. It will show whether you have enough money to do the things you want, or not. If you don’t, it will highlight some different options available to you. This might include retiring a bit later, saving a bit more or spending a bit less.

Scenario planning with cash flow modelling

The power of cash flow planning is that it allows you to stress-test different scenarios and see the impact that they may have on your finance. For example, your cash flow plan will tell you what investment return you need to achieve your objectives. It will also show you what impact any fall in value from your investments will have on your retirement plans.

According to Professional Paraplanner, 92% of advisers say that cash flow modelling helps clients better understand their finances, yet 34% of advisers offer cash flow planning. At Frazer James, we are big advocates of cash flow modelling. We provide every client approaching retirement with a personal retirement forecast showing whether they are on track for retirement (or not), and what can be done to improve their financial situation.

Retirement planning masterclass

We specifically designed the retirement planning masterclass with people like you in mind.

In this 60-minute video session with our specialist retirement planner, we focus on creating a retirement plan that is as unique as you are individual. Here’s what you can expect:

- Personalised Retirement Strategy: We develop a plan that aligns with your specific retirement objectives, ensuring it’s tailored to your lifestyle and future aspirations.

- Financial Position Review: We’ll evaluate if your current financial trajectory aligns with your desired retirement age and lifestyle, offering practical advice on necessary adjustments.

- Sustainable Lifestyle Planning: Understand how to maintain a comfortable lifestyle in retirement, balancing your dreams with financial realities.

- Investment Insight: We’ll explore opportunities to optimise your pensions and investments, ensuring they’re working effectively towards your retirement goals.

Our masterclass addresses key questions:

- What does a comfortable retirement look like for you?

- Are you on the right path to retire when you wish?

- How can you ensure your retirement spending is both enjoyable and sustainable?

- Are there ways to enhance the performance of your pensions and investments?

- What steps can you take to bring your retirement date closer?

This masterclass is specifically designed for UK tax residents who are actively planning for retirement, particularly those within a decade of their desired retirement age and with £300,000 or more in pensions, investments, or savings.

Take the Next Step Towards Your Ideal Retirement. To join, simply book a convenient time using our calendar link. Following your booking, you’ll gain access to the Frazer James Secure Portal, where you can securely share your financial details for a more tailored session.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Adviser Bristol.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, retirement planning advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor Bristol, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602