Modified on: June 2024

How much do you need to retire?

Do you have enough to retire?

Working out how much you need to retire isn’t easy.

Fortunately, there are some simple rules you can apply to work out how much you need to retire.

When it comes to retirement, there are really only two outcomes:

1. Your money outlives you

2. You outlive your money

Given that nobody wants to run out of money before they run out of life, let’s focus on how to make your money last a lifetime.

What do you need to retire?

When working out how much you need to retire, you need to start with how much income you’ll need in retirement. You need to have a good understanding of what you’re spending each month.

To help you get started, download our one-page retirement expenses form. It’s simple and easy to you, all you need to do is fill it in and it calculates your total expenses.

Once you know what you’re spending, the next step is to work out how much you have saved up for retirement. You want to include everything that you can spend, things like savings, investments and pensions, but not your house.

You will then have two numbers:

1. What you spend

2. What you have

Annual withdrawal rate

You want to divide what you spend by what you own, to work out an annual withdrawal rate.

Let’s assume that you spend £20,000 per year and have £400,000 of assets.

£20,000 / £400,000 = 5% pa

This is your annual withdrawal rate. The higher the annual withdrawal rate, the more likely you are to run out of money.

The key question you need to confront is “How much can I withdraw from my investment or pension portfolio, to avoid the risk of running out of money?”

This is the question that Nobel Prize winner & Stanford finance professor, William Sharpe, called the single “nastiest, hardest problem in finance”.

A Starting Point – The 4% Rule

To address this problem, Bill Bengen, an aeronautical engineer turned financial adviser, proposed using extensive historical data to explore how well a withdrawal approach might fare under a wide range of market conditions. Quite simply, he wanted to understand how much people needed to retire.

Bengen’s idea is very simple; consider how your withdrawal would have fared in good times and bad times. Then, choose a conservative approach that survived most or all situations over the last 100 years or so. You’ll still have to adjust along the way, but you can be confident that market conditions would have to be worse than any we’ve seen in the past to be a problem.

Bill Bengen developed what became known as the Sustainable Withdrawal Rate (SWR). This is the annual amount you can withdraw each year, expressed as a percentage of the initial starting amount. Then, each year, you increase the amount you withdraw in line with inflation.

Using US historical data, Bengen established what is now known as the 4% rule. In other words, an initial withdrawal of $40,000 from a $1,000,000 portfolio invested in 50% US Equities and 50% US Intermediate Bonds would have lasted 30 years, in the very worst-case scenario.

The most important point to remember is the withdrawal percentage is based only on the portfolio value in the first year of retirement. So, for instance, a withdrawal rate of 4% from a £1,000,000 portfolio gives an income of £40,000 in the first year. This £40,000 a year then increases or decreases in line with inflation each year, regardless of the ongoing portfolio value

Why the 4% rule is wrong

Whilst the 4% rule provides a good starting point, it is just that – a starting point. For most people, it’s likely to either overestimate or underestimate how much you can spend in retirement. This is because the 4% rule assumes that:

1. Your portfolio is invested 50% in equities and 50% in bonds. Your portfolio is unlikely to have the exact same investment strategy as that used by Bengen.

2. Your retirement lasts for 30 years. Whilst I have no idea how long your retirement will last, I would be very surprised if it was 30 years on the nail.

3. There are no costs or taxes. If only we lived in such a world!

4. You spend the same amount each year. This is rarely the case, my experience has been that people tend to spend and travel more in their early retirement, before spending less later on.

5. There are no other incomes (for example your State Pension).

If you blindly follow Bengen’s rule and withdraw 4% per year, you’re either going to run out of money in retirement or be the richest person in the graveyard (neither is ideal!).

Proper retirement planning requires accounting for all of these variables and many more. If you want to understand how much you can spend in retirement, you’re welcome to schedule an initial retirement consultation.

How to retire with more income

Back to Bengen’s study. One of the key assumptions is that you spend a fixed amount in retirement each year. Each year, your income remains the same, except for inflationary increases.

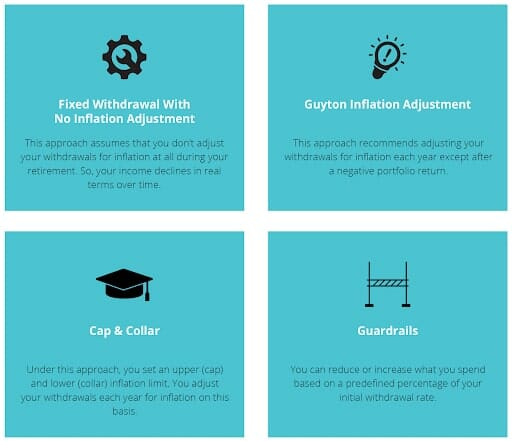

However, there is a way to increase your retirement income, without running out of money. This is known as ‘rule-based withdrawal strategies’.

Some of the most popular & effective strategies are as follows:

Withdrawal policy statement

The right withdrawal strategy for you will depend on your individual circumstances. This is where a withdrawal policy statement comes in.

It is a plan that states:

- How much you can withdraw each year

- Under what circumstances you can increase your income

- Under what circumstances you need to decrease your income

It allows you to withdraw as much money as possible, without the risk of running out of money in retirement.

Here is an example withdrawal policy statement:

Your withdrawal policy statement will be unique to you. There’s no one-size-fits-all solution to your retirement. The law of averages works in the whole, but not as an individual.

Want to know more?

Are you eager to progress your retirement planning and secure your financial future? Our Retirement Strategy Session is designed just for you.

Our retirement strategy sessions offer you an initial consultation with a Certified Financial Planner to help you better understand your retirement options.

Take advantage of this unique opportunity to gain valuable knowledge and personalised advice from our team of financial experts.

Schedule your retirement strategy session today.

All the best,

James Mackay, Independent Financial Adviser in Bristol

.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor Bristol, Clifton.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, retirement planning advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602