Modified on: July 2024

9 ways to pay less inheritance tax

Avoiding inheritance tax – how to reduce inheritance tax UK

Without proper guidance and financial support, Inheritance Tax (IHT) can cost families thousands of pounds. Although complicated to understand at first, there are various ways to avoid paying inheritance tax legally. Working with a financial adviser will ensure you make smart financial decisions and avoid paying the price in tax.

What is Inheritance Tax?

Inheritance Tax is a tax on the estate of someone who has died. This includes all property, possessions and money. Following death, the executors of the Will must calculate the value of all assets and deduct any liabilities (debts). The remainder is called your “estate”, and this is the value that’s liable to inheritance tax.

Which assets are within your estate?

Generally speaking, anything of value should be included in your estate for inheritance tax purposes. If the asset is jointly owned, then your share falls into your estate.

This includes property, bank accounts, investments, shares, ISAs, antiques, jewellery, personal chattels, vehicles, life insurance (not held in trust) and gifts (made in the past 7 years). The asset value is determined to be the value at the date of death.

What assets are not in your estate?

Some assets fall outside of your estate and are therefore not subject to inheritance tax. This includes most types of pension plans, life insurance (held in trust) and trusts generally.

When someone dies, their outstanding liabilities will be repaid from their existing assets. This will reduce the value of their estate for inheritance tax.

Funeral expenses are generally allowable deductions from a person’s estate for IHT purposes.

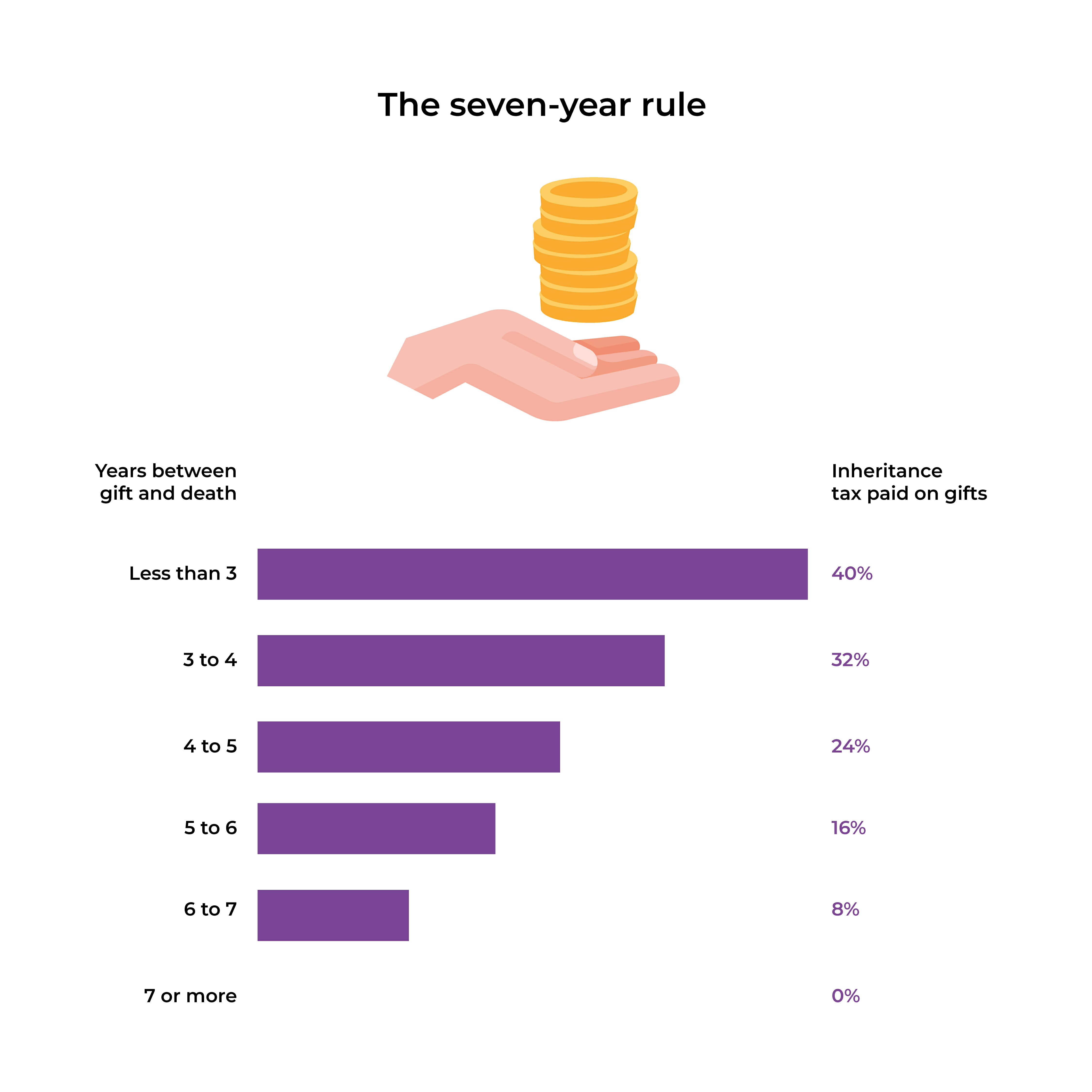

What is the 7-year rule in Inheritance Tax?

If you die within three years of making a gift, then the full value of the gift will be included in your estate for inheritance tax.

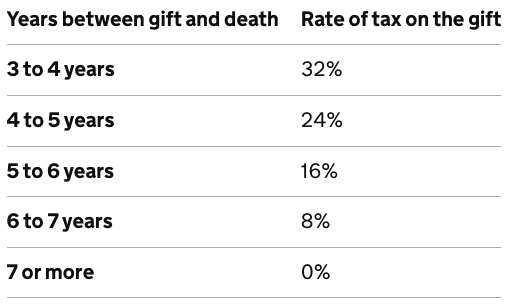

If you die more than three years, but less than seven years after making a gift, then inheritance tax will be charged at a reduced rate on the gift. This is summarised below:

If you die seven years after making a gift, then all of the money will be exempt, and not included when calculating your inheritance tax bill.

When does Inheritance Tax have to be paid?

Your executors need to pay the inheritance tax liability within six months following death.

If the tax is not paid within this timescale, then a penalty may be applied to your estate.

Residential status and IHT

If you consider the UK to be your permanent home (i.e, you are UK Domiciled), IHT is payable on your worldwide assets.

If you don’t consider the UK to be your permanent home, inheritance tax is usually only paid on your UK assets only. It is likely that the country you live in will also have its own rules and regulations.

What is the UK Inheritance Tax rate?

Currently, you will pay an inheritance tax rate of 40% on your taxable estate. However, estate values can be reduced in many situations, as detailed later on.

If you’re looking to reduce the amount of inheritance tax on your estate, speak to one of our expert advisors today.

How to pay less Inheritance Tax

There are a number of legal strategies to avoid inheritance tax in the UK. Here are 9 simple, time-tested ways to reduce your inheritance tax bill. These are tried-and-tested methods that can be used to avoid or reduce inheritance tax and are acceptable to HMRC.

Make a Will

Making a will is one of the simplest and easiest ways to make sure your money goes to the people you want, for the reasons you choose. It allows you to choose how your assets will be managed on death, allowing you to plan for and minimise your inheritance tax bill.

If you do not make a will, the government will decide how your assets are distributed (under the rules of intestacy). This is unlikely to be the most tax-efficient method. Here are. some of the benefits of making a Will:

- Control over your assets – writing a will allows you to retain control over how your assets are dealt with to ensure your loved ones are provided for. A will is essential if you are not married or want to allow for assets to be passed on to step-children.

- Tax-efficiency – wills are a great way to put your tax affairs in order and legally shelter your assets from inheritance tax. For example, you can use your Will to make gifts that use up your inheritance tax allowance or to set up trusts. You can also make sure that all the available inheritance tax exemptions are used at the right time. Ensuring you don’t pay more inheritance tax than you need to.

- Flexibility – you can make changes to a Will after somebody has died. This is known as effecting a deed of variation. This can help reduce inheritance tax, particularly where the intended beneficiary already has an inheritance tax liability. For example, many grandparents leave their estate to their children. However, if their children are already financially sufficient and do not require the money, it will just sit in their estate untouched. On their death, inheritance tax may be paid on this money. This is where a deed of variation comes in. It allows you to change the intended beneficiary. You could, for example, pass the assets straight onto the grandchildren, held in a trust until they are old enough. This would mean that the money goes straight to the grandchildren without paying inheritance tax.

Use your allowances

There are various different types of allowances, exemptions and reliefs which can reduce your inheritance tax liability. This includes the nil rate band, the residence nil rate band and annual gifting allowances.

- Inheritance tax threshold – you don’t pay inheritance tax on the first £325,000 of assets. This is known as your “nil rate band” or your “inheritance tax threshold. It is a tax-free allowance available for everyone. If you die and leave your assets to your spouse, they will inherit your tax-free allowance. They will then have two tax-free allowances, allowing them to gift up to £650,000 before inheritance tax is due.

- Residence nil rate band – this is an extension of the nil rate band. This provides you with an additional £175,000 tax-free allowance, however, must be set against your main residence and be gifted to a direct descendent (child or grandchild). As per the nil rate band, if you die and leave your main residence to your spouse, they will inherit your residence nil rate band. They will then have two allowances of £175,000, providing them with £350,000.

Combined, each person has an allowance of £500,000 that can be gifted without inheritance tax. Or, if you die and leave assets to your spouse, they will have an allowance of £1,000,000.

Make gifts

Gifting is an often overlooked but highly effective way of reducing the value of your estate for inheritance tax. There are no limits on the number of gifts you can make.

Giving away assets while you are alive still requires careful financial planning. You need to work out how much you can afford to give away whilst still ensuring that you have enough to meet your own needs.

Depending on how you structure the gift will determine how much inheritance tax is saved. There are two forms of gifting, known as “potentially exempt transfers” and “chargeable lifetime gifts”.

Potentially exempt transfers

A potentially exempt transfer is where you make an outright gift (i.e., you do not transfer money into a trust). You can make unlimited gifts in this way without any immediate inheritance tax charge.

If you survive for seven years from making the gift, it falls outside of your estate and there is no inheritance tax liability.

If you die within seven years, then some or all of the gift will be included in your estate for inheritance tax. The amount that is subject to inheritance tax will depend when the gift was made. If it was within 3 years, then the full amount is subject to inheritance tax. If it was between 3 – 7 years ago, then only part of the gift is subject to inheritance tax.

Chargeable lifetime transfers

A gift that is not a potentially exempt transfer, is known as a chargeable lifetime transfer. These usually are gifts made to discretionary trusts and corporations.

You can make chargeable lifetime transfers of up to £325,000 every seven years without any immediate tax implications. Any amount in excess of this will attract an immediate inheritance tax charge of 20%.

If death occurs within seven years, then the cumulative value of the chargeable lifetime transfers will need to be calculated. Any amount in excess of £325,000 will attract a further inheritance tax charge of 20%.

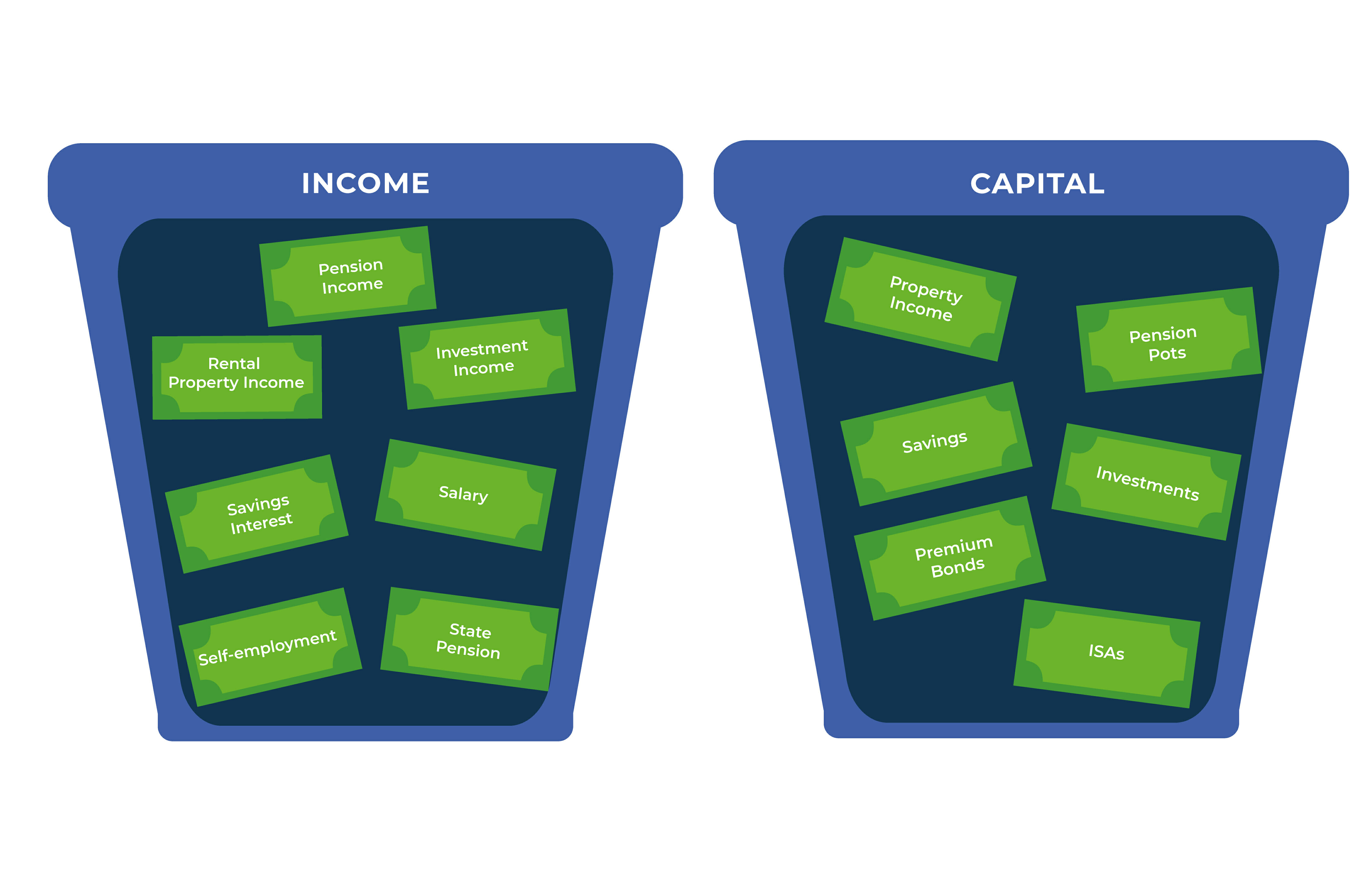

Gifts out of income

If you receive more income than you spend, you can make a gift from your surplus income without any inheritance tax charge. This is known as the “normal expenditure out of income exemption”. The only limit is that the gift must come from income and not capital. This will need to be structured carefully to avoid IHT.

You should document your gifts carefully, and it should be clear that your lifestyle is being funded by your usual income.

This means that you must be able to maintain your lifestyle from your income after making the gift. You cannot give away all your income and rely on your capital to fund your lifestyle instead.

Gift warnings

You may be tempted to think that you can pass on assets for less than they are worth, and this might get around the rules on inheritance tax. Unfortunately, if you sell an asset for less than its true market value (e.g. selling a property at a discount to your child), then the discount will be treated as a gift & subject to IHT

Many have tried to get around the inheritance tax gifting rules by ‘giving away’ assets. However, continue to enjoy their use of them (e.g. giving their home to a child while continuing to live there). This is known as a ‘gift with reservation’. If a gift with reservation occurs, then the gift will still be treated as part of the estate of the deceased, even if they no longer own the asset on death. As such, inheritance tax will be paid. The only solution to the ‘gift with reservation’ rules is to pay the market rent on the asset after making the gift. For example, you gift a property to your child at less than market value, but pay the market rate of rent to continue living there. This will then classify the gift as a potentially exempt transfer (detailed further on below).

If you’re looking to reduce your inheritance tax liability, book a consultation with one of our inheritance tax planning experts.

Use your gifting exemptions

Certain gifts are exempt from inheritance tax altogether. These include:

- Gifts to spouses – anything you give to your spouse during your lifetime or upon death (provided they live in the UK) is free of inheritance tax. This is just one of the many tax planning opportunities for married couples. For further information, check out this article on how married couples can reduce their tax bill.

- Annual exemption – you can legally give away £3,000 each tax year without attracting inheritance tax. If you have not used this allowance, you can carry it forward by one tax year, allowing you to gift up to £6,000. This allowance is per person, so if you are married, you can double this.

- Wedding gifts – giving cash gifts to newlyweds is a very common way to avoid inheritance tax. The level of tax relief varies depending on the relationship between the donor and those receiving the gift. Parents and step-parents can give up to £5,000 tax-free. Grandparents can give up to £2,500, and other relatives and friends can give up to £1,000. These gifts have to be given on or shortly before the date of the wedding or civil ceremony.

- Gifts to charities or political parties – there is no limit to the amount of money you can donate to charities or political parties. Gifts to charities in your Will also reduce the Inheritance Tax rate to 36%, provided that 10% of the “net estate” is passed to charity. Your “net estate” is the taxable value of your estate, after your residence/nil rate band and any debts/liabilities have been repaid.

- Small gifts – Gifts of up to £250 are defined as ‘small gifts’. You can make as many small gifts as you like without any inheritance tax implications. The only condition is that the gift cannot be part of a larger gift.

If you need help reducing your inheritance tax, speak to one of our experts today. We will ensure that your money goes to the people you want, with the least tax possible.

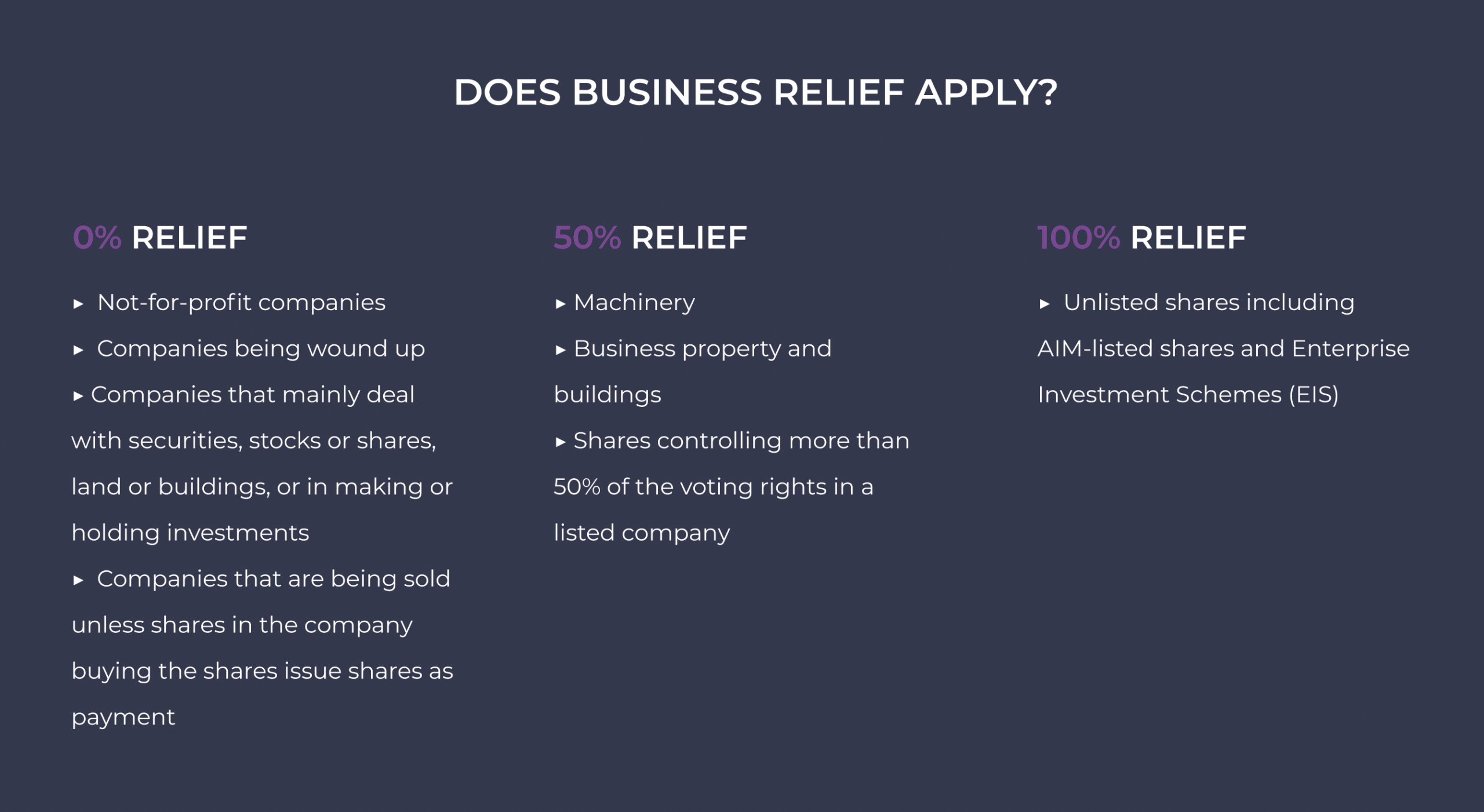

Use business relief

Certain types of businesses and investments are eligible for “Business Relief”. This allows some or all of the assets to be passed on tax-free. You can get Business Relief (previously known as Business Property Relief) on certain types of businesses and investments. To qualify for Business Relief, the deceased must have owned the qualifying assets for at least 2 out of the last 5 years before death and at the date of death.

Certain investments exist which allow you to buy into a scheme that qualifies for Business Relief. This is useful when you want to retain control over the assets purchased (in case you need to sell at some point) but also aim to qualify for 100% relief against Inheritance Tax. These schemes allow you to benefit from Inheritance Tax relief after two years, rather than to wait for 7 years if they make a gift. These investments are typically higher risk and you should seek independent financial advice before investing. The tax benefits on offer can be very attractive, but you need to make sure that you are comfortable with the risks.

Use life insurance

If you have a life insurance policy and die, your beneficiaries will receive a payout. If you haven’t placed the life in trust, then inheritance tax will be due.

Your life insurance policy needs to be written ‘in trust’ to separate it from your estate to avoid any inheritance tax. If done correctly, the net result is that your beneficiaries will receive your whole estate without a tax deduction.

You can either set up a ‘term’ assurance policy or a ‘whole of life’ policy. A term assurance policy will only cover you until a specific age. If you die within the term, it will pay out. A whole-of-life policy will pay out when you die, irrespective of when you die.

Term assurance policies are generally lower cost, as the risk of your death occurring within the term is not guaranteed. Of course, the longer the term of the policy, the higher the cost. Generally speaking, whole-of-life insurance policies are higher cost, but they are guaranteed to payout when you die.

The downside of using life insurance is the cost. It can become expensive the older you get. The upside is that insurance provides a simple solution whilst still leaving you in full control of your assets.

Use trusts

A trust is effectively a separate legal entity. If you put assets into a trust, provided they meet specific requirements, they no longer belong to you. As a result, assets in trust are not included in your estate for inheritance tax. The seven year rule however will still apply.

Using a trust provides a more sophisticated way to minimise your inheritance tax liability. Depending on the type of trust, it allows you to retain some control over how the money is used and who benefits. However, you should note that trusts have their own tax charges and costs, and the inheritance tax benefits may not always be worthwhile.

Before setting up a trust, you should consult with an independent financial adviser. They can advise you on the right type of trust to meet your needs. They will determine the best type to minimise inheritance tax whilst keeping other taxes and charges to a minimum.

Invest tax-efficiently

With careful planning and tax-efficient investing, you can effectively avoid inheritance tax altogether. These investments tend to be more complex, that’s why working with an experienced financial advisor is essential.

Some types of investments buy shares in one or more privately-owned companies that qualify for business relief. If you hold these shares for two years, their value on your death will qualify for business relief, making them exempt from inheritance tax. Examples of investments that qualify for business relief include:

- Seed / Enterprise Investment Schemes (SEIS / EIS) – Investments fall outside of inheritance tax after two years, there is an income tax relief of 50% for SEIS or 30% for EIS. Capital tax gain is deferred for 3 years allowing access to capital at any time. It’s a riskier type of investment as they tend to be in smaller companies.

- AIM Investments – Another method of obtaining Business Relief is through a portfolio of diversified holdings known as an AIM portfolio. This service provides investors with a portfolio of shares listed on the AIM index. In addition to the IHT relief, an AIM portfolio provides the potential for capital growth and dividend income. However, if you receive any income or withdraw any capital growth then this will fall within your estate for inheritance tax. To qualify for Business Relief, the portfolio must be held for two years, and the underlying companies must be deemed eligible. It is also possible to transfer an ISA to an AIM ISA to receive the above benefits tax-free.

Use Pensions

Pensions are one of the simplest and most effective ways to reduce your inheritance tax liability. This is because most pensions are treated as outside of your estate, meaning that they can be passed on tax-free. The inheritance tax benefits will depend on what type of pension you have.

Pension death benefits

When you die, you can nominate who you want to receive your pension. This does not have to be your spouse, you could choose for your pension to go to your children or anyone else for that matter. In most cases, the pension death benefits are free of inheritance tax, but this may not always be the case. This article is not a comprehensive guide but is instead intended to give you an overview of how most pensions are treated on death.

- Defined benefit pensions – With a defined benefit pension, the pension income will continue paying to your spouse or civil partner at a reduced rate (typically 50%). Some defined benefit pensions may provide an income for children and financial dependents (including non-married partners). In addition to a regular income, some defined benefit pensions provide a one-off lump sum. Whether your beneficiaries pay tax on the lump sum will depend on how the pension has been set up. It’s important that you have completed an ‘expression of wish’ as this can sometimes avoid inheritance tax being charged.

- Defined contribution pensions – with a defined contribution pension, the pension can be paid to anyone you choose. If you die before age 75, hen the lump sum can be made to anyone completely tax-free, provided that the death benefits are paid within two years of the member’s death. If you die after age 75, then the pension lump sum is added to the recipient’s income for that year and taxed accordingly. A big change in 2015 is the introduction of ‘beneficiary drawdown’. This allows your beneficiary to inherit the pension whilst remaining in the tax-efficient pension wrapper, and is much more tax-efficient when death occurs after age 75.

Spend more

One strategy to stop your estate from getting bigger and creating a larger inheritance tax bill is to spend more. Not only will this improve your lifestyle, this will also help you make sure that you pay less IHT as you stop your assets from growing.

However, finding the right balance between spending today and ensuring you are secure tomorrow requires a careful degree of planning.

Your overall goal should be to ensure that you reduce your inheritance tax liability, whilst ensuring you never run out of money. Therefore, you should be careful not to deplete your assets too quickly. Having regular meetings with a financial advisor will help you get the right balance between enjoying today and being secure tomorrow.

Next steps

Inheritance Tax is a complex area of financial planning. By working with an independent financial adviser, you can reduce your inheritance tax bill, increasing the amount of money received by your beneficiaries.

To get started, we offer a complimentary inheritance tax consultation. This will help you understand how much inheritance tax you are likely to pay and what can be done to reduce it.

If you want to reduce your inheritance tax bill, schedule your initial financial consultation today.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor based in Clifton, Bristol.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor Bristol, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602