Modified on: June 2024

Pension masterclass, everything you need to know

Pension masterclass, everything you need to know.

Your pension.

Boring, complicated, but incredibly important.

By reading this guide, you will:

1. Be better informed

2. Understand your options

3. Make better decisions

(Unfortunately, they will still be boring and complicated).

What types of pensions are there?

Let’s start with the main types of pensions. Broadly speaking, there are 3 types:

1. Final Salary/Career Average (Defined Benefit) – provides a guaranteed income for life.

2. Workplace Pensions (Defined Contribution) – provides a pot of money at retirement, income not guaranteed.

3. Personal Pensions (Defined Contribution) – Similar to the above, although typically not arranged through the workplace (i.e. no employer pension contributions).

There is of course also the State Pension. To keep things simple, we’re going to keep this to one side. It works completely different from the main types of pensions and is covered later in this guide.

What’s the difference between defined benefit and defined contribution pensions?

The key difference between defined benefit and defined contribution pensions is who bears the risk:

– Defined benefit pensions define how much benefit (income) you will receive in retirement. The employer bears the risk and guarantees the income you’ll receive.

– Defined contribution pensions only define the contribution you make. You bear the risk. The amount you receive in retirement is unknown and will depend on how much you contribute, how much is paid in charges and how the investment performs.

Defined benefit pensions aren’t called “gold plated” without good reason!

How do pensions work?

Pensions come with a lot of baggage (years of mis-selling will do that!).

But when you really break it down, a pension is just a pot of money with special tax benefits.

The basic premise is that it’s a place for you, the Government and your employer to pay money into.

When you pay in, the Government adds pension tax relief:

– If you’re a basic rate taxpayer, the Government puts in £20 for every £80 you put in.

– If you’re a higher rate taxpayer, the Government puts in £40 for every £60 you put in.

– If you’re an additional rate taxpayer, the Government puts in £45 for every £55 you put in.

Your employer may also pay into your pension, normally matching your contributions up to a certain level.

How much can I pay into my pension?

If you’re a UK resident under 75, you can usually pay in as much as you earn, up to £40,000 a year. If you don’t have any earnings, you can still pay in up to £3,600 per year (including pension tax relief).

You may be able to pay in more than £40,000 if you have any unused allowance from previous years. This is called pension carry forward. Before using carry forward, you need to use your current year’s pension allowance first.

There are some exceptions which result in a lower pension allowance. For example, if you have an income of more than £150,000, you will have a lower allowance. This is known as the ‘tapered annual allowance’.

What happens to my pension before retirement?

Any money you pay into your pension will be invested in the stock market. This provides it with the opportunity to grow over time, but it can also fall in value.

– With a defined benefit pension, investment performance doesn’t matter. It’s the employer’s responsibility to grow the pension so that it can provide you with a specified level of income. If the investments fall short, the employer makes up the difference.

– With a defined contribution pension, investment performance is very important. If your investments perform poorly, you will have a small pot in retirement. If they perform well, you will have a bigger pot. If you don’t choose an investment, you will be placed in the ‘default’ investment fund. This may not be the best option for you.

When can I access my pension?

In most cases, you can’t access your pension until age 55 (increasing to 57 in 2028). So you need to be sure that any money you save into a pension can be ‘locked away’ until then.

You don’t have to be retired to access your pension. You can take it whilst you’re still working, as long as you’re 55+.

What happens at retirement?

At retirement (or from age 55), you can start to withdraw an income from your pension:

– With a defined benefit pension, you will receive a guaranteed income, paid for life. The income is likely to increase each year in line with inflation.

– With a defined contribution pension, you have three options. You can either purchase a guaranteed income for life (otherwise known as an annuity), withdraw a lump sum or withdraw a flexible income. For further information, see below.

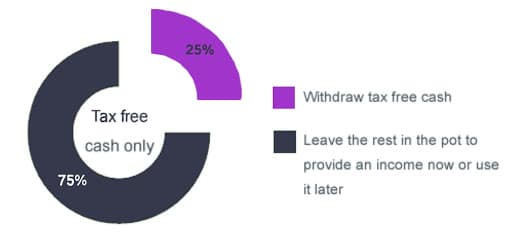

Both types of pensions allow you to take up to 25% tax-free. The remaining 75% will be taxed in the same way as employment income (i.e. PAYE).

How do I withdraw an income from my defined benefit pension?

Taking money out of your defined benefit pension is fairly simple. The only option you have is how much tax-free cash you want (with a maximum limit of 25%). The more tax-free cash you take, the less income you receive.

Some defined benefit pensions provide other options, such as taking more income at the start but with that income increasing at a slower rate. The right option will depend on your individual circumstances. If you’re unsure, just drop me a line.

How do I withdraw an income from my defined contribution pension?

You have 3 main options when it comes to taking an income from your defined contribution pension:

1. Lifetime Annuity – A guaranteed income for the rest of your life. No matter how long you live, you will continue to receive an income. Once it’s set up, you can’t change the income amount. You can usually take up to 25% tax-free cash when you buy an annuity.

2. Flexible Drawdown – Keep your pension invested, taking the income you want, when you want. As the income isn’t guaranteed, this can be a risky option. If you take too much income, you could run out of money. You can usually take up to 25% tax-free cash at the start.

3. Lump Sums – Keep your pension invested and take ad hoc lump sums as required. Each time you withdraw money, 25% is tax-free and 75% is taxable. This provides less flexibility than ‘flexible drawdown’ and can still result in you running out of money.

This video provides a little bit more information:

For many, a Mix & Match strategy works best. In this scenario, you use part of your pension to buy an annuity. This provides a secure income to meet your basic expenses (topped up by your State Pension). The remainder is used for drawdown or a lump-sum used to cover leisure/discretionary expenses.

What happens when I die?

The ‘death benefits’ differ depending on which type of pension you have:

– With a defined benefit pension, the pension income will continue paying to your spouse or civil partner, albeit at a reduced rate (normally 50%). Some defined benefit pensions provide an income for children and financial dependents, although this varies.

– With a defined contribution pension, there are up to three options. Your pension will either be paid out as a lump sum, will be paid as a secure income (annuity) or can be inherited whilst remaining in the tax-efficient pension wrapper. Most pensions payout as a lump sum, which can result in income tax and inheritance tax charges.

Pro tip – make sure you have completed an ‘expression of wish’ form. This makes sure that the pension is paid out in line with your wishes.

Should I consolidate my pensions?

Bringing your pensions together can make sense. It provides you with more control, more flexibility and means that you only have to deal with one provider.

Some pensions have valuable guarantees that would be lost and others have high exit charges. So consolidating won’t be right for everyone.

Transferring your pension might be a good idea if:

✓ You want to consolidate all your pensions in one place

✓ Your pension scheme is not good value for money

✓ You want to withdraw a flexible income in retirement (most pensions don’t allow flexible drawdown)

✓ You want to reduce the amount of tax paid when you die (most people have ‘lump sum’ death benefits which can create income and inheritance tax issues)

✓ You want more investment choice

In what circumstances should I consolidate my pensions?

Consolidating your old pensions can give them a new lease of life, which might mean a better life for you in retirement.

A clear overview

Having multiple pots can make it difficult to understand how much you have, where you’re invested, who to speak to. Consolidating into one place keeps everything organised, giving you a clear overview.

Less paperwork

One provider. One website. One phone number. One set of login details. In minutes, you can find out how much your pension is worth, where it’s invested and make any changes.

Potential for greater returns

Most traditional pensions restrict you to a handful of investments, which can limit the potential for better returns. Modern pensions give you more choice. And the better the investments you choose, the bigger your pot will be when you retire.

Remember, investments can fall as well as rise in value, so you could get back less than you invest.

In what circumstances shouldn’t I consolidate my pensions?

If you’re part of a defined-benefit (DB) pension, such as a ‘final salary’ scheme, transferring to a personal retirement plan is probably not in your best interest. Giving up a guaranteed income for life is rarely a good thing to do.

If you’re a member of your current employer’s pension, you’re also unlikely to benefit from transferring. This is because it would mean losing your employer’s ongoing pension contributions.

What’s my State Pension?

For most people, the State Pension comes into payment at age 66. Previously, this was 60 for women and 65 for men – but times are changing. Future increases are planned, depending on how old you are you may not receive yours until 67.

How much State Pension will I get?

If you receive the full amount, you will get £175.20 per year from April 2020 – that’s £9,110 per year.

Not everyone will receive the full amount. If you haven’t got 35 years national insurance contributions, or if you were contracted out, you may get less than the full amount.

To check how much State Pension you will receive, you can request a State Pension statement via the government website.

How can I increase my State Pension?

If you are due to receive less than the full amount, you may consider topping up your State Pension.

To receive this maximum amount, you’ll need 35 years of National Insurance Contributions (NIC).

It is possible to pay for gaps in your NICs history if you have less than the full 35 qualifying years. The first step towards determining if this is a good idea is to request a State Pension statement.

You should also see if you’re eligible for pension credit before deciding whether to buy extra years.

Free pension review

To get started, we offer a free pension review. We’ll provide you with a clear summary of your current pensions. This will tell you one of three things:

… ✓ Your pensions are doing a good job. No need to fix it if it’s not broken, leave things as they

… ✓ Your pensions are doing okay, but a few tweaks are needed. Either we can do this for you, or you can do it yourself

… ✓ Your pensions aren’t in good shape and some work is needed. We’ll organise this for you and put things back in better shape

All the best,

James Mackay, Independent Financial Adviser in Bristol

.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor Bristol, Clifton.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, advice on retirement planning, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602