Modified on: June 2024

Company share schemes – an employees guide

An employee guide to company share schemes:

There are many types of share schemes, but generally, they involve granting employees shares in the employer company, or the right to acquire such shares, at a beneficial price.

If your company offers a HMRC-approved share scheme, there are tax advantages for both you and your employer. The main benefit of share schemes is that they incentivise employees to stick around, providing them with a tax-efficient windfall.

There are five main types of company share plans:

- Share incentive plans (SIPs)

- Save as you earn (SAYE)

- Company share option plan (CSOP)

- Enterprise management incentives (EMIs)

- Growth shares

Share incentive plans (SIPs)

Share Incentive Plans (SIPs) allow employees to own shares in the company. There are tax savings and national insurance savings for employees and employers.

As an employee, you don’t pay any Income Tax or National Insurance on shares if you keep them for five years. You also won’t pay any Capital Gains Tax when you come to sell them (assuming they have been kept in the Share Incentive Plan).

Broadly speaking, there are four types of share incentive plans:

- Free shares – Your employer can award you up to £3,600 worth of free shares in any tax year. The amount you receive will usually depend on your individual or team performance. In effect, it is a non-cash bonus.

- Partnership shares – You can buy partnership shares using your gross pay. However, the limits on how much you can spend on partnership shares are the lower of £1,800 per tax year, or 10% of your total salary. Buying shares using your gross pay means that you will not have to pay Income Tax or National Insurance contributions (NICs) on the money that you use to buy them.

- Matching shares – If you buy partnership shares, your employer can match them by giving you up to two free shares for every partnership share you buy. You’ll need to check the details of your employer’s plan to find out if your employer offers any matching shares.

- Dividend shares – As a shareholder, you may be paid dividends on your shares. If you receive dividends on your free, partnership or matching shares, your employer may allow you to use those dividends to buy more shares held in the plan. The shares you purchase will be called dividend shares. You can purchase up to £1,500 of dividend shares per year. You won’t pay any Income Tax on these shares as long as you hold them for at least three years.If you receive dividends but don’t use the dividends to purchase more shares, you will pay dividend tax. This varies between 0% and 38.1% depending on your tax rate.

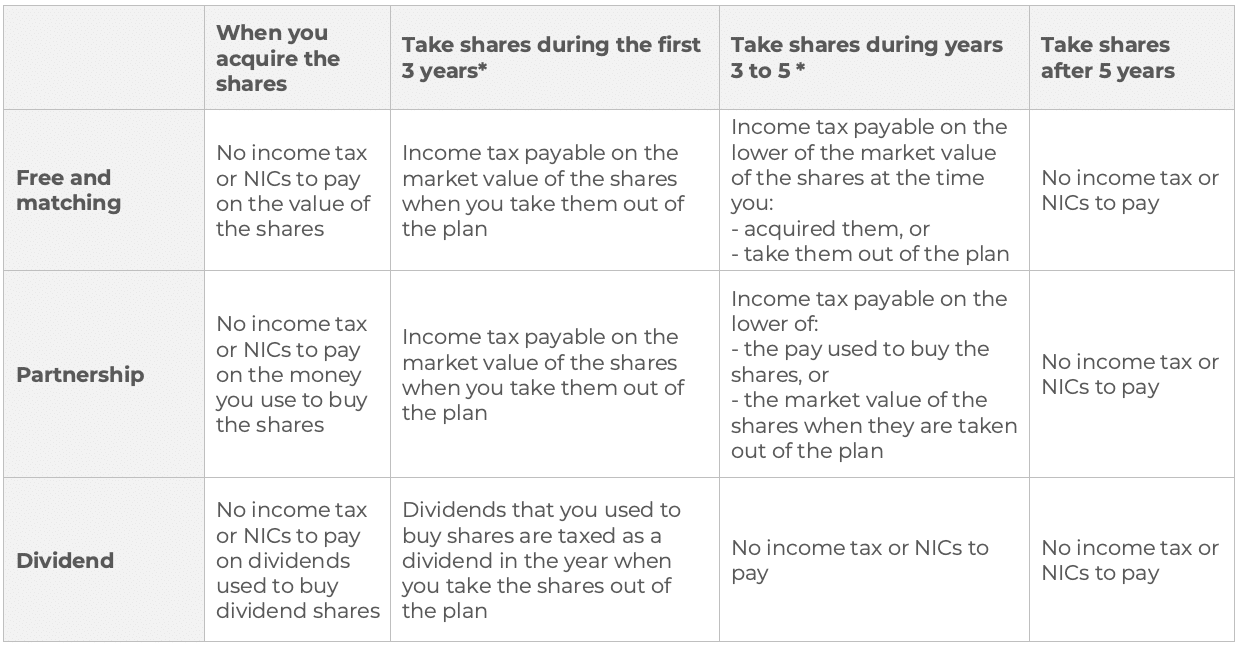

What Income Tax and National Insurance do I have to pay on my shares?

* You can take partnership shares out of the plan at any time. You cannot take free, matching or dividend shares out within the first 3 years. Your employer can extend this period to up to 5 years for free and matching shares. Your shares have to come out of the plan when you leave your employment so income tax charges may apply. This could be within 3 years, 3 to 5 years, of receiving them. The charges do not apply if the shares come out of the plan because you leave your job for an exempt reason.

Save as you earn (SAYE)

Under a SAYE plan, employees enter into a special savings contract for a period of 3 or 5 years. At the end, employees receive a tax-free bonus on the savings.

After 3 or 5 years, you can use the money in the savings account to exercise an option to buy shares in the company. The price for the shares will be predetermined at the start of the plan. This is usually the market value of the shares at the start, but can also be discounted.

The benefit is that if the share price rises in the interim, you will buy at the lower starting price. You may also get a discount.

Alternatively, you can choose to take the money out tax-free, for example, if the share price has dropped since entering the contract. You will not however receive any interest on the savings.

You can save up to £500 a month under the scheme.

When you sell shares, you might have to pay Capital Gains Tax if the shares have grown in value since you purchased them.

You potentially won’t have to pay capital gains tax if you put them into:

- an Individual Savings Account (ISA) (within 90 days), or;

- a pension (as soon as you buy them)

Company share option plan (CSOP)

A CSOP gives you the option to buy up to £30,000 worth of shares at a fixed price (these are called Share Options).

CSOP tax advantages:

- No income tax or NICs on receiving the option;

- No income tax or NICs on exercising the option (certain conditions required);

- Capital gains tax on the sale of the option shares with no minimum holding period;

The conditions are met if the option is exercised within 10 years of the grant and at least three years after the grant date.

When you sell the shares, you have a capital gains tax allowance. This means that the first £12,300 of profits are tax-free.

Any profits above this are taxable, either at a rate of 10% (basic rate) or 20% (higher rate). How much income you earn will determine if you pay the basic rate or higher rate of tax.

Enterprise management incentives (EMIs)

EMI schemes are highly flexible for companies and one of the most tax-advantageous options. These have fast become one of the most popular options for smaller companies that qualify (companies with assets of less than £30 million and fewer than 250 employees).

Your company can grant you share options up to the value of £250,000 in a 3-year period.

EMI tax advantages:

- No income tax or NICs on receiving the option;

- No income tax or NICs on exercise the option (if exercised within 10 years of grant);

- Capital gains tax at the lower rate (10%) on the sale of the option shares (so long as the sale is at least 24 months after the grant of options);

As an employee, you won’t pay Income Tax or National Insurance when you buy the shares. The price you pay for the shares is the price set at the start of the incentive scheme (not the share price when you come to buy them).

However, if you were given a discount on the market value, you’ll have to pay Income Tax or National Insurance on the discounted difference.

Growth shares

Growth shares are a special class of shares created (usually) by unlisted companies to provide equity incentives to management and key employees.

They reward participants for the growth in value of the company above a “threshold” or “hurdle” which is specified at the time of issue.

Growth shares generally allow gains to be taxed as capital (rather than income) for employees. Therefore, the rate of tax paid is lower (either 10% or 20%, rather than 20 – 45%).

Most unlisted companies which do not meet the conditions necessary to grant the tax-advantaged share options described above or who wish to offer incentives to non-employees (such as consultants and non-executive directors) consider structuring their equity incentives using growth shares.

Financial advice for your share scheme

If you want a bit more help, we can review your share scheme.

We will look at the share scheme available and explain the benefits and drawbacks to you.

If you would like to understand more, feel free to schedule an initial consultation.

All the best,

James Mackay, Independent Financial Adviser in Bristol

.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor Bristol, Clifton.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602