Modified on: June 2024

Coronavirus – Keep Calm & Carry On

If your inbox is anything like mine, you’re getting far too many emails about the Coronavirus.

So while I don’t want to add to the pile, hopefully, this message is a little different.

Over the last two weeks, Governments have responded to the coronavirus by pouring eye-watering amounts of money into the economy.

The equivalent of 3% of the world’s GDP is being pumped into financial markets globally to stem the tide.

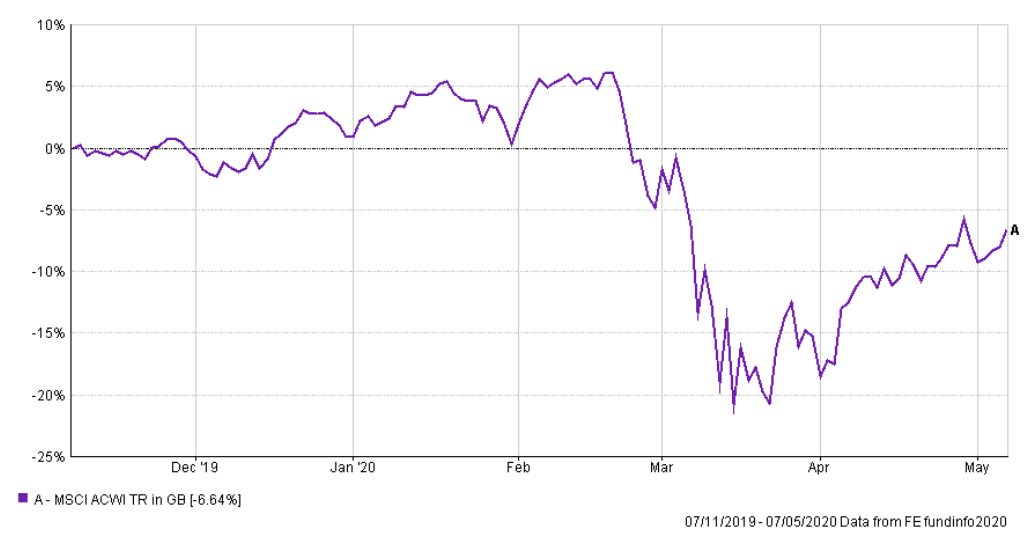

It seems markets are beginning to trust that there is light at the end of the tunnel.

Of course, the media continues to criticise every government’s approach to dealing with this health crisis, and so it should.

But it’s easy to submit to worry or panic when ‘breaking news’ occurs every half an hour.

So what should you be doing..?

Keep calm

‘Keep calm and carry on’ was a poster campaign created by the UK government in 1939, in preparation for World War II.

The campaign evoked the archetypal British qualities of discipline, fortitude, and staying calm in adversity.

The campaign posters re-emerged about 15 years ago and found their way into popular culture.

All well and good, but when it comes to your investments and pensions – is “keep calm and carry on” the right advice?

We believe it is.

6 reasons to keep calm & carry on

- Investing rewards the patient – the price you pay for long-term returns is the volatility we’re currently experiencing. You don’t get one without the other.

- You are invested in more than the stock market – When you see ‘the market’ has dropped 4%, this doesn’t represent your investments. Remember that your portfolio contains other assets (property, bonds, etc) that help to cushion the blow.

- You don’t need the money today – Investing is long-term. Anything less is speculating. The metric that matters most, is the return over multiple years. The daily changes in value are immaterial.

- Only prices have changed – If your investment ever falls, remember that you still own everything you did before. The same number of shares in the same companies. You’ve not actually lost anything.

- All market declines are temporary – With history as our guide, a globally-diverse portfolio has never suffered a permanent loss. The only time you would have lost money is if you sold your investments at the wrong time. Check out this article on how investments performed during previous pandemics.

- You’re in good company – We’re here for you. If you’ve got a question, concern or worry, please pick up the phone. This is also extended to any family or friends that are worried about money. We’ll help wherever we can.

Your financial advisor

For the team at Frazer James, it’s business as usual.

As ever, we’re here for you whenever you need us, so please don’t hesitate to pick up the phone.

All the best,

James Mackay, Independent Financial Adviser in Bristol

.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor Bristol, Clifton.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602