Modified on: June 2024

How to outperform the market (based on evidence)

How to outperform the market (based on evidence)

Everyone wants to outperform the market. But what’s the best way to go about it?

It has been said that investment markets are similar to weighing machines. On the left-hand side, you have all the people that want to sell investments. On the right-hand side, you have all the people that want to buy investments. The price of any investment is determined by the balance.

The global financial markets process millions of trades worth hundreds of billions of pounds each day. These trades reflect the views of buyers and sellers who are investing their capital.

Investors who attempt to outguess the market are pitting their knowledge against the collective wisdom of all market participants.

So, are investors better off relying on market prices or searching for undervalued opportunities?

New research shows that it’s very unlikely that you will be able to pick a winning investment.

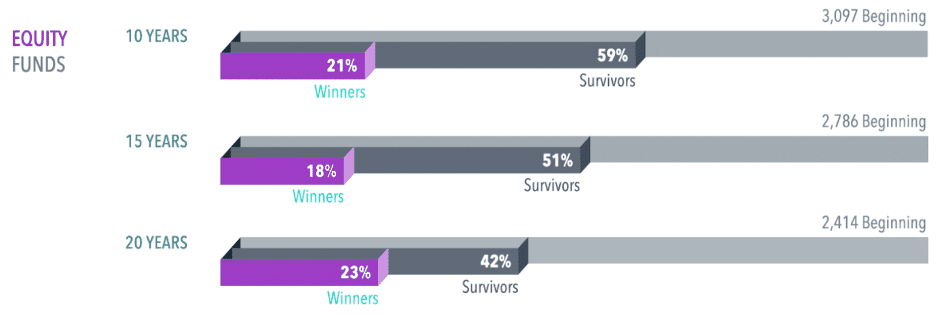

Survivorship and outperformance

When evaluating investment performance, the first thing to take into account is the fact that most investment funds close over time. Over 20 years, more than half of investments close.

Looking at US investment funds, we can see that:

- Only 42% of investment funds remained open 20 years later

- Only 23% of investment funds managed to outperform the market over 20 years

(Source – Dimensional)

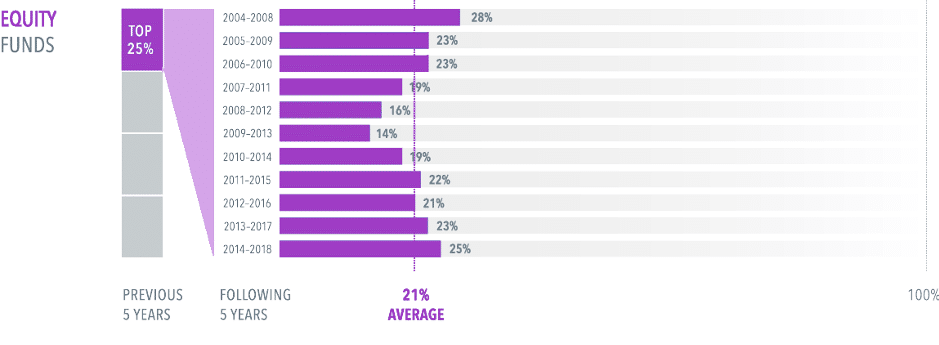

Consistency of market outperformance

But let’s assume that you’ve managed to identify the few investments that have (1) survived and (2) outperformed. The question is then, do they continue to outperform the market?

The answer is no, or at least probably not. If you select yesterdays winner, there is only a 21% chance that it will continue to be a winner in the future.

This lack of persistence is why you shouldn’t pick yesterday’s winners – it’s like driving whilst only looking in the rear-view mirror.

(Source – Dimensional)

You cannot outperform the market

The research is clear:

- The chances of picking a winning investment fund are slim – less than half of funds survived and only a few outperformed

- Even if you do find that elusive outperformer, chances are it will underperform in the future.

Despite the evidence, many investors continue to search for winning funds. That’ a mistake.

Selecting a winning investment strategy requires more than finding yesterday’s winners. As we know, past performance offers no guarantee of a successful investment outcome in the future.

We believe that being a successful investor requires a sound investment philosophy, based on evidence rather than guesswork. That’s why we created the 7 Simple Steps to Investment Success. It provides a proven way to outperform the market, without having to outguess the market.

All the best,

James Mackay, Independent Financial Adviser in Bristol

.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor Bristol, Clifton.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602