Modified on: June 2024

Inflation – how to protect your money from the invisible thief

Inflation – how to protect your money from the invisible thief

Inflation is stealing your money, without you even noticing.

When it comes to money, you have to accept certain inalienable truths:

– Prices will rise

– Politicians will philander

– You too will get old

And when you do… you’ll fantasize that:

– Prices were reasonable

– Politicians were noble

– And you invested in stocks and shares to offset inflation

History shows that investing in stocks and shares is one of the best ways to win the battle against inflation.

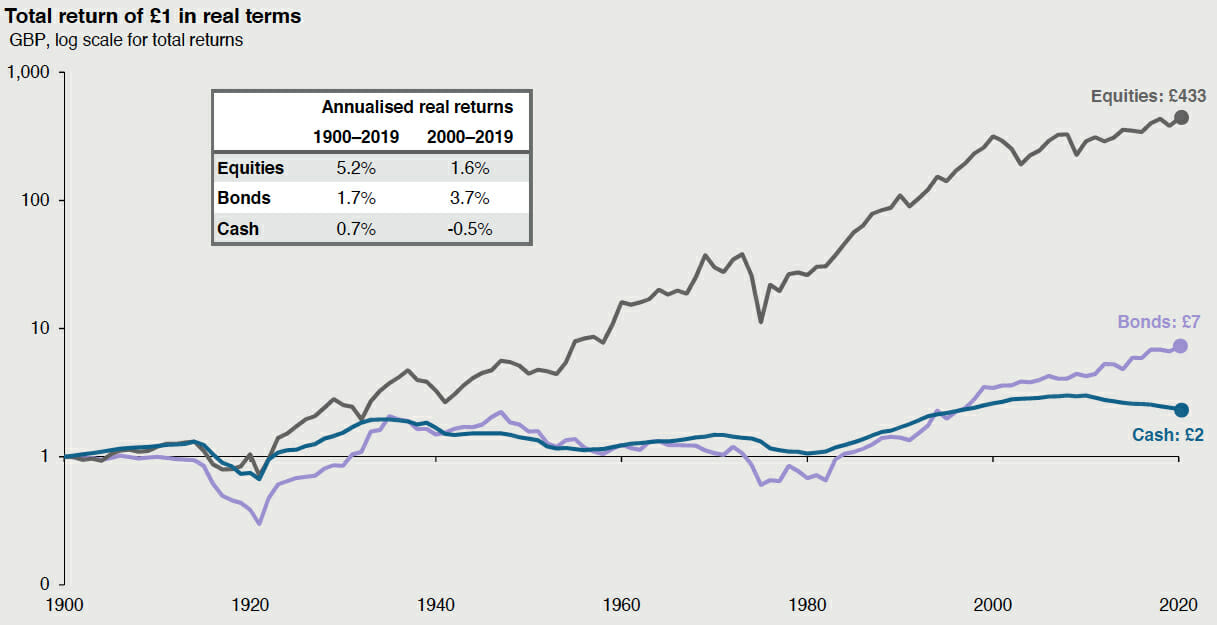

This is shown in the below graph. It shows the real returns (i.e. after inflation) of different investments over the past 120 years.

(Source – JP Morgan)

There’s nothing wrong with keeping some money in cash to cover short-term or unexpected expenses. But there’s no place for cash in your long-term investment strategy.

I would argue that the biggest risk to your retirement is inflation. From 1988 – 2018, the cost of living went up by around 4.2% per year on average. If this holds for the next thirty years, the average retiree could see their cost of living go up by 300%.

This means that if you’re looking to retire on £40,000 per year, you will need £120,000 per year by the end of your retirement just to buy the same things!

Which means if your savings and investments are not growing in line with inflation, you’re going to be financially worse off as a result.

If you want to know more about how to protect your investments from inflation, just drop me a line.

All the best,

James Mackay, Independent Financial Adviser in Bristol

P.s – if you want a little more help with navigating your investments, check out the 7 Simple Steps to Investment Success. It provides you with a proven process to help you avoid costly mistakes and tilt the odds in your favour. You can get a copy by clicking here..

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor Bristol, Clifton.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602