Modified on: June 2024

Is financial advice worth it?

Is financial advice worth it?

It’s an age-old question. Is financial advice worth it?

I’m very aware of the conflict of interest I have in writing this. Financial advisor finds a study that highlights the value of advice! Not exactly groundbreaking stuff, but bear with me, because the findings make for an interesting read.

The International Longevity Centre (ILC) is an independent research organisation that measures the impact that us all living longer is having on society. And because it’s an independent organisation, it doesn’t act as a mouthpiece for the financial advisory profession.

So, when the ILC came out with “powerful research which shows the very real return to obtaining expert financial advice”, naturally I was curious.

The value of a financial advisor

The short answer to is financial advice worth it? is yes.

Let me try and summarise some of the key findings (you can read the full guide about the value of financial advice here).

Those who took financial advice were significantly more likely to save more. Interesting, I would forgive you for thinking that financial advisors are just about getting their clients the best return on their investments.

Well, apparently not, they also seem to be about encouraging good financial habits, like saving some of that spare income for your future.

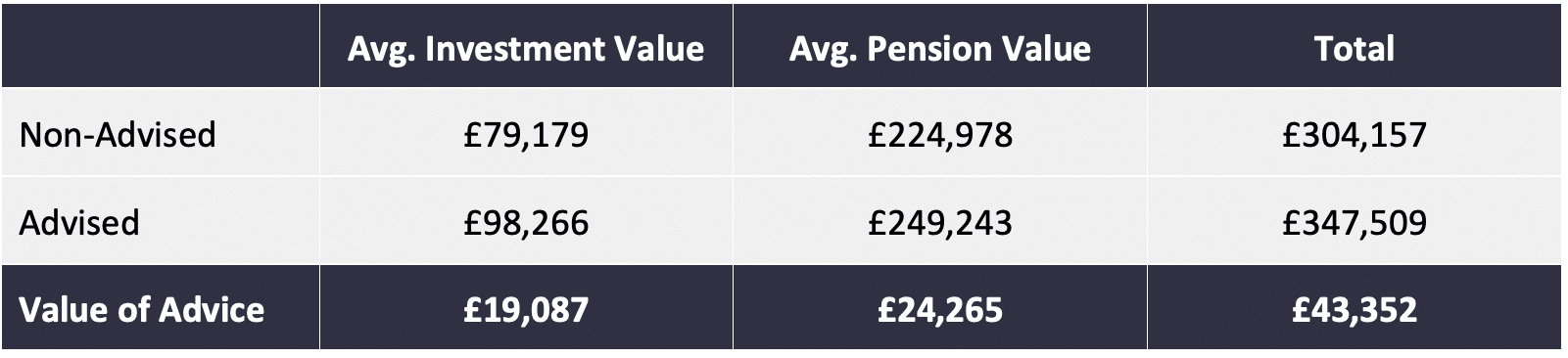

If the last one didn’t surprise you, the next one surely will. Those same individuals who saved more ended up significantly wealthier.

How much wealthier? Around £43,000 by the ILC’s reckoning. And for the cynics amongst you, that’s after all charges!

But go beyond the numbers and there’s something more interesting. Asked whether those who took advice were satisfied, more than 9 in 10 reported being so.

You might expect that having a few extra quid in your pocket would make you happy, but apparently, the source of their satisfaction came from the peace of mind that having a financial advisor provided.

That makes sense, we see time and time again that what clients think they want from a financial advisor (investment returns) is often not what they value most (financial peace of mind).

Is a financial advisor worth it? When you take into account the pounds and pence and peace of mind, we think they are.

Who is financial advice for?

Despite the clear, measurable benefits, only around 17% of the population receive expert financial advice.

What gives? I think one of the many reasons is that there is a mistrust of financial advisors in general, a view that financial advisors cost more than they’re worth.

I can sympathise with that view, but a golden rule of any decent financial advisor is that value provided must exceed cost charged. Otherwise, it just doesn’t make sense to work together.

One of our core principles is that we will only ever work with clients where the value we can add far exceeds the fee we charge.

Quantifying the value of financial advice is never going to be easy and some might say, it will always be open to subjective interpretation. But there is now a growing body of empirical evidence that demonstrates that if you take advice, you are likely to be significantly better off.

Interestingly, the smart money has already worked this out. Generally, the wealthier an individual, the more likely they are to have a financial advisor. My view is that expert financial advice shouldn’t just be the preserve of the wealthy, it should be affordable and accessible to a much wider range of people.

Unlock the full potential of your finances with an initial consultation at Frazer James – see firsthand how expert financial advice can elevate your financial well-being.

Schedule Initial Consultation.

All the best,

James Mackay, Independent Financial Adviser in Bristol

P.s – do you know the difference between a financial advisor and a financial planner?

Financial advisor or financial planner – what’s the difference?

.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor Bristol, Clifton.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602