Modified on: June 2024

New Year, New You – 5 simple steps to freshen up your finances

New Year Finance Resolutions

5 top tips from an independent financial adviser for improving your finances:

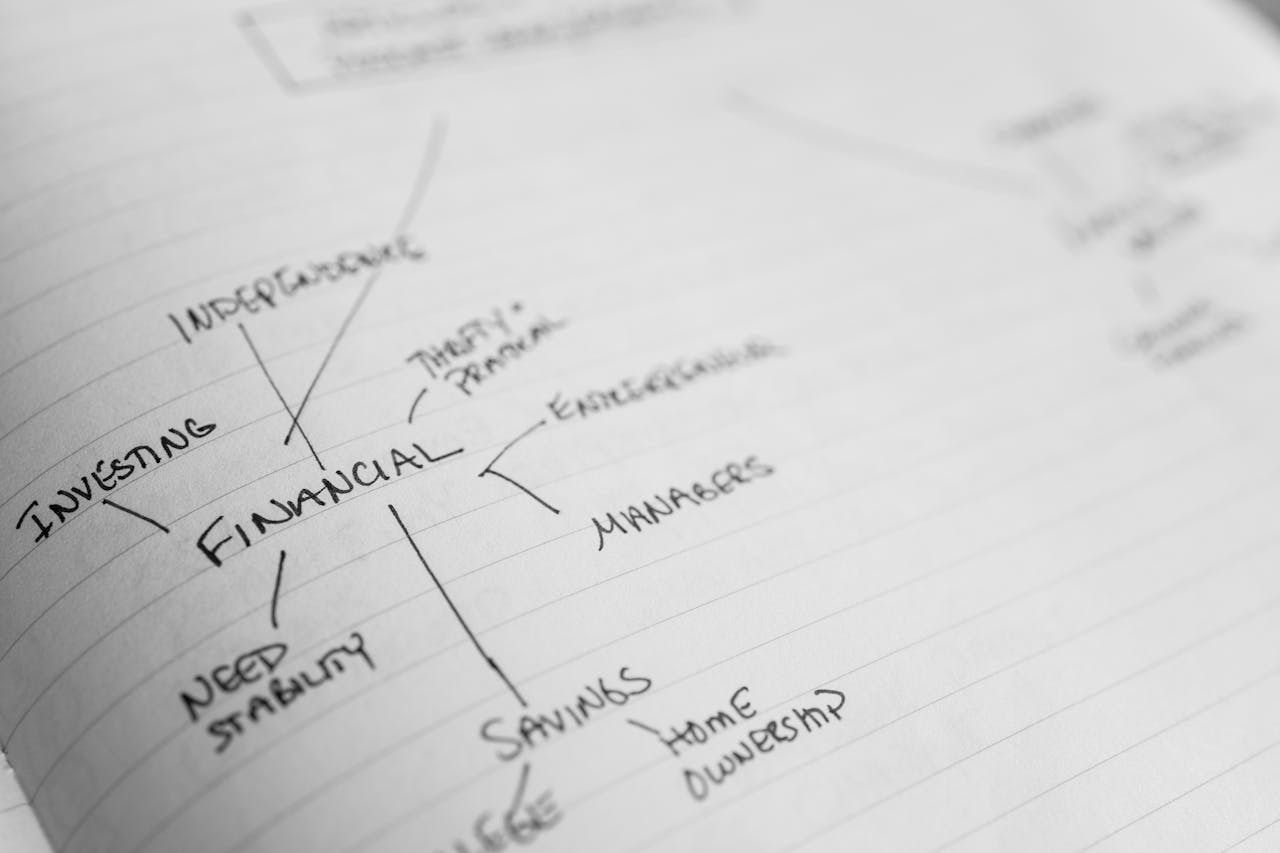

Create a plan for your finances

It doesn’t matter if it’s on the back of a napkin or a 30-page report. Writing things down improves the chances of sticking to them.

What do you want to achieve and by when? Start with the end in mind and work back from there.

Your financial plan should answer three questions:

1. Where are you now?

2. Where do you want to be?

3. How to get there?

If you’re looking for some inspiration, check out our Sample Financial Plan.

Stick to the plan

Sticking to the plan is arguably the hardest part. Your circumstances will change, markets will move against you, life will get in the way.

The key to sticking to the plan is remembering why you’re doing it. This will keep you on track, through the thick and thin.

Start saving

Easy to say, hard to do. With an endless list of things to pay for, but limited funds available, saving can get left by the wayside.

But making small, regular savings can have a big impact over time. Saving just £100 per month could be worth £90,000 in 30 years.*

Einstein described compound interest as “the eighth wonder of the world”.

Get started sooner, you owe it to yourself.

Keep your costs low

In most areas of life, you get what you pay for. If you pay more, you get more. But in the world of investing, you get what you don’t pay for.

Costs matter, because every pound you pay is a pound less in returns. What’s more, just like returns, costs compound over time. Seemingly small differences in costs have a big impact over time.

Keep it simple

Everything should be made as simple as possible, but not simpler.

If you’ve got multiple policies, think about consolidating your pensions and investments together. It will make them much easier to manage and control – not to mention much less paperwork.

If you’re using a complicated investment strategy, think about simplifying it. You don’t need 30 funds to diversify your investment portfolio. A few well-diversified funds will do.

With these 5 steps, your finances will be in far better shape. As always, if you would like a little help, why not book in for a no-cost, no-commitment initial meeting?

All the best,

James Mackay, Independent Financial Adviser in Bristol

P.s – if you want a little more help with navigating your investments, check out the 7 Simple Steps to Investment Success. It provides you with a proven process to help you avoid costly mistakes and tilt the odds in your favour. You can get a copy by clicking here.

* Assumes a net investment return of 5.5% p.a.

.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor Bristol, Clifton.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602