Modified on: June 2024

Top tips to save tax in UK

How to pay less tax

Are you paying more tax than you need to? Could you pay less tax on your UK income and savings?

The answer to both questions is probably yes. Most of us aren’t making full use of our tax allowances and exemptions. As a result, we pay about £12.6bn more than we should in taxes per year.

Why is tax such a big deal?

Tax is likely to be the single biggest expense you’ll ever pay. Reducing your tax bill is the easiest way to make your money go further.

With the top rate of income tax at 45%, making even minor improvements to your tax position is going to save you a lot of money.

What are the tax rates?

There are three main types of taxes, they are:

- Income tax is the tax you pay on income from employment. It ranges from 0% to 45%, depending on how much you earn. You also pay income tax on any dividends you receive and any interest from savings.

- Capital gains tax is the tax you pay when you sell something for a profit, like a second property or an investment. It ranges from 10% – 28%, depending on how much profit you make.

- Inheritance tax is the tax paid by your estate when you die. This is a flat rate of 40%.

How to pay less tax on your income

As of April 2023, every person has a tax-free allowance of £12,570. This is known as your personal allowance. This means that the first £12,570 of income is tax-free. Income includes salary, bonuses, rental income and pension income.

If you’re not already using your personal allowance, check if there are ways to increase your income. For example, if you are married and own a rental property together, could the rental property be held in your name to make full use of your tax-free allowance?

How to avoid the 60% tax trap

If you earn above £100,000, your tax-free personal allowance will be reduced. For every £2 you earn above £100,000, you will lose £1 of your personal allowance. This is known as the ‘60% tax trap’, as you effectively pay tax at the rate of 60% on income between £100,000 – £125,140.

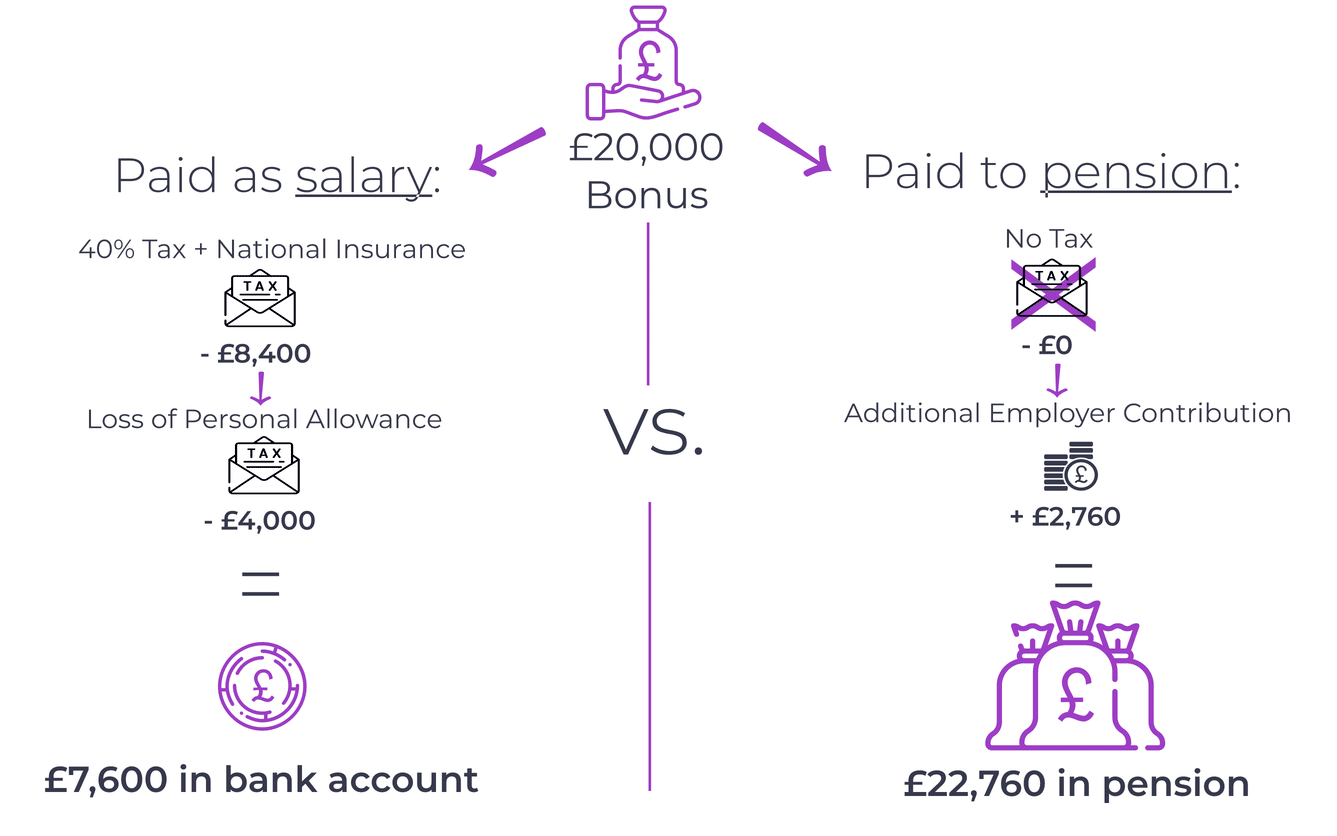

For example, if you earn £100,000 and receive a bonus of £12,000, the bonus will be taxed at 60%. You will also pay national insurance at 2%. You can save tax and national insurance by sacrificing your bonus into your pension.

For more information, check out this article on how to save tax with bonus sacrifice.

How to reduce your capital gains tax bill

If you make a profit when selling an investment or property, you may need to pay capital gains tax. For the 2023/24 tax year, you can make investment/property profits of up to £6,000 per year tax-free (this will reduce to £3,000 per person from 2024/25). This is known as your capital gains tax allowance.

However, any profits you make above £6,000 are taxed at 10 – 20%, depending on your income. There is a ‘special’ rate of tax for properties of 18% – 28%.

There are several ways to reduce your capital gains tax bill:

- If you are married, you can hold investments jointly. This means you will have two sets of capital gains tax allowances (£6,000 x 2).

- If you are married and one of you pays a lower rate of tax, you can hold the asset in their name solely. This can reduce the tax rate from 20% to 10% (or 28% to 18% in the case of property).

- If you have other investments that have made a loss, you can offset the loss against the gain when selling an asset.

How to minimise capital gains tax on RSUs

Some employees receive shares in the company they work for, known as Restricted Stock Units (RSUs). If you continue holding these shares, you may need to pay capital gains tax.

There are two ways to minimise your capital gains tax on RSUs:

1) Immediate sale – you can sell the shares immediately without any further tax liability. If you want to still own the shares, you can buy them back in a stocks and shares ISA so that no capital gains tax is paid in the future.

2) Spousal transfer – you can transfer some of the shares to your spouse tax-free. They can sell the shares, in effect doubling the amount that can be sold tax-free each year.

Want to know more about restricted tax units? Click here to read this article on how to save tax with RSUs.

How to reduce your company tax bill

If you own a business and make a profit, you will need to pay corporation tax. You will pay tax on any profits you make. The rate of tax is between 19% – 25%, depending on your level of profits.

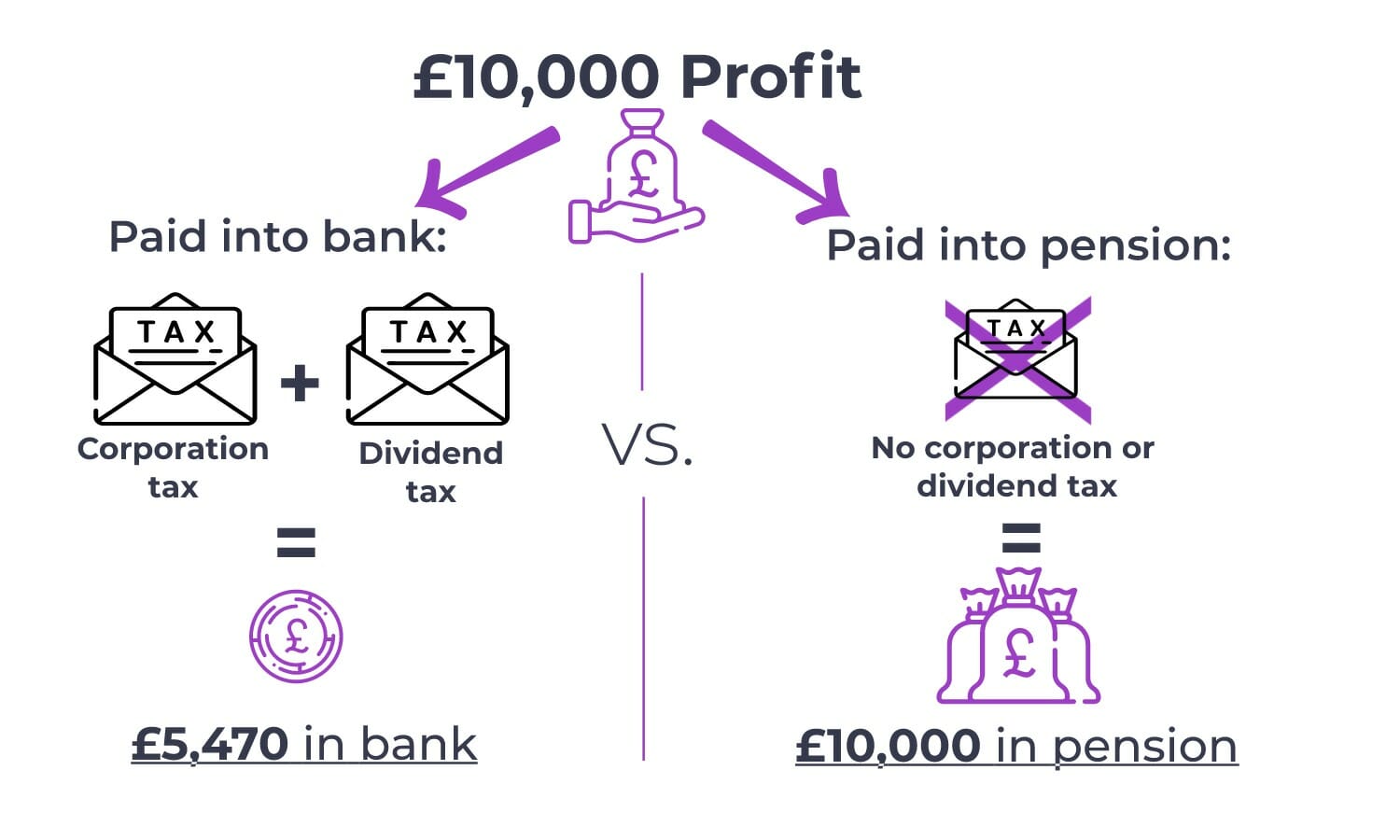

However, employer pension contributions are treated as a deductible expense and therefore can reduce your corporation tax. There’s also no income tax or dividend tax to pay on employer pension contributions.

By making a pension contribution of £10,000, you can save up to £4,530 in tax compared to paying yourself a salary (assuming a company tax rate of 19% and a dividend tax rate of 32.5%).

For more information read this article on reducing corporation tax with employer pension contributions.

How to reduce your income tax bill

.You will pay income tax on any earnings over £12,570. The amount you pay will depend on how much you earn:

- Earning £0 – £12,570 = 0% (0% tax plus 0% national insurance)

- Earning £12,570 – £50,270 = 30% (20% tax plus 10% national insurance

- Earning £50,270 – £100,000 = 42% (40% tax plus 2% national insurance)

- Earning £100,000 – £125,140 = 62% (60% tax plus 2% national insurance)

- Earning £125,140+ = 47% (45% tax plus 2% national insurance)

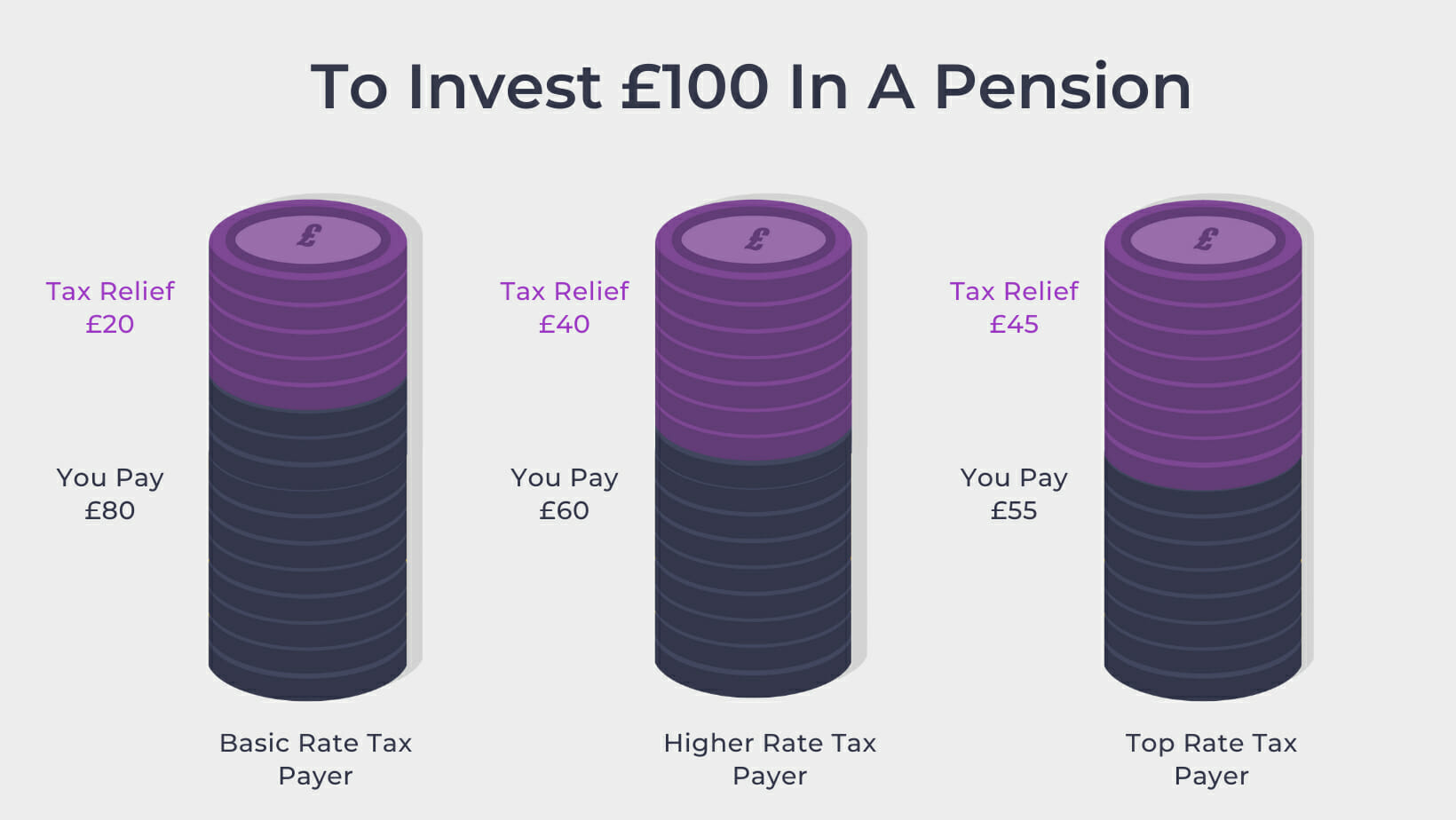

There are various ways to reduce your income, resulting in you paying less tax. The most common way is to pay into a pension, which will reduce your tax bill by the top rate of tax.

So, if you normally earn £60,000 and pay £10,000 into a pension, this will reduce your tax bill by £4,000.

For more information on how to save tax with pensions, check out our pension masterclass.

How to avoid the tapered annual allowance tax charge

.If you’re a high earner, the amount you can pay into pensions will be limited.

Many people are being presented with unexpected tax charges, due to the ‘tapered pension allowance’. The tapered pension allowance reduces the amount you can contribute to a pension to £10,000. If you pay more than this, you may face an unexpected tax charge of 45%.

However, you may be able to carry forward unused pension allowances from previous tax years, this could help you avoid the tapered annual allowance charge.

You can also reduce your pension contributions or ask for your employer to pay you an increased salary instead of pension contributions.

For more information, read this article on how to avoid the tapered annual allowance tax charge.

How can we help?

At Frazer James, we do more than just help you pay less tax. We integrate effective tax strategies into a broader wealth management plan, aligning them with your overall financial goals. Our focus extends beyond individual tax savings to a complete financial picture, including retirement planning, investment strategies, and long-term wealth building.

If you’re looking for a financial partnership that goes beyond one-time tax advice and considers your overall financial picture, feel free to schedule an initial consultation. Discover how our holistic approach to financial planning can create a lasting impact on your wealth and well-being.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor Bristol, Clifton.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Adviser, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602