Modified on: June 2024

Property vs Pension – What’s the Best?

Should I buy a property or invest in my pension?

Property vs Pension? It’s an age-old question that we’re going to settle once and for all.

Whilst property and pensions both offer the potential for good investment returns, under the bonnet, they couldn’t be any more different.

Although most people understand property, few people understand pensions. Property is easy to understand, it’s all around us – we can see it, touch it, live in it. Pensions – not so much.

So, when focusing on property vs pension, let’s look at the return each gives you.

Property vs pension – what gives the best return on investment?

Let’s start with how much your property or pension could have grown over time.

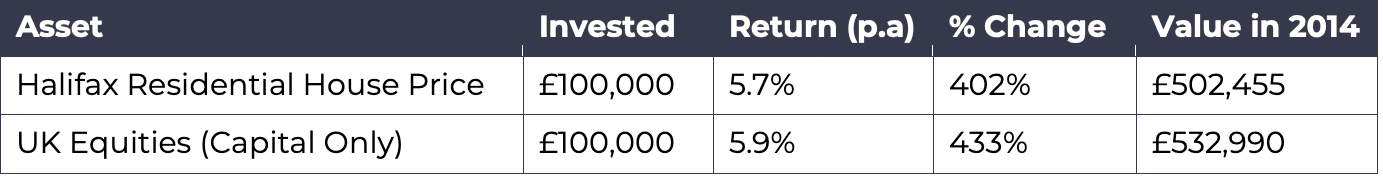

The below table assumes that you invested £100,000 back in 1984.

- For property prices, we’ve used the Halifax Residential House Price index, which represents the average house price nationally. Of course, if you invested in London, you would be laughing. But hindsight is a wonderful thing.

- For pensions, we’ve assumed you invested in the FTSE 100, which represents the largest 100 companies in the UK. Of course, if you invested in Apple/Microsoft/Google, you would be laughing. But hindsight is a wonderful thing.

So, what would you get? The table does the talking.

So, in the battle of property vs pension, there’s not much difference in return. How about income?

Property income vs pension income

Ah yes, income! As anyone self-respecting landlord will tell you, it’s the income you want to focus on, not capital growth.

But don’t forget that investments in a pension also provide an income, in the form of dividends.

Unfortunately, the industry doesn’t track rental income, which makes it hard to compare So we’ll need to make a few assumptions.

Buy to let properties typically produce rental income of between 2 – 6% per year, depending on location. So, let’s go straight down the middle with 4%.

Which kind of makes sense when you think about it. A £200,000 buy to let property will typically produce rental income of around £8,000 per year.

It’s pretty much the same figure for investing, with the average dividend yield being around 4% per annum.

Importantly, these figures are gross, meaning they don’t take into account any costs or taxes.

Still, no clear winner in the property vs pension debate.

Property tax vs pension tax

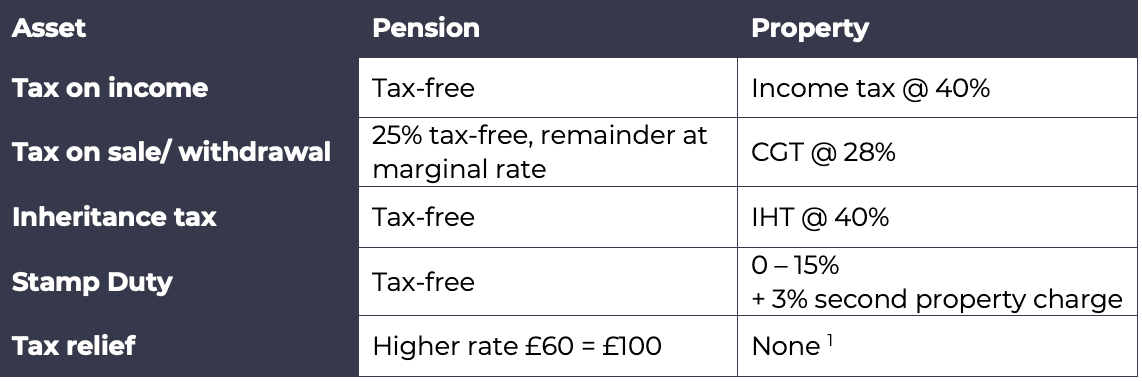

It’s no secret that the Government dislikes buy to let property, but loves pensions.

We know that because they apply an extra high rate of tax on property and provide tax relief on pensions.

The below table summarises the differences for a higher rate taxpayer. Suffice to say, pensions destroy property from a tax standpoint.

1 Mortgage tax relief is being phased out for higher rate taxpayers.

Tax relief is an interesting one and something that very few people understand. It basically means if you put £60 into a pension, the Government puts another £40 in (assuming you’re a higher rate taxpayer).

Tax relief should be renamed ‘free money’, but that’s a subject for another day.

Property vs Pensions from a tax perspective? Pensions are a clear winner.

Property vs pension – other considerations

Aside from tax, there are a couple of other things you need to consider. Things like costs, liquidity and leverage. These are the critical details that most people overlook.

Liquidity – it’s bloody damn hard to sell a property, particularly if you’re in a hurry. Pensions, on the other hand, are fairly easy to sell, you can get your money out in a few weeks at most.

Leverage – investing in property comes with the special privilege that the bank will lend you most of the money. It’s like playing poker and betting with house money. This has the potential to magnify your returns, in a big way – although it can also magnify your losses. Generally speaking, borrowing money to invest is not available in pensions.

Hassle – property is seen as the classic ‘passive income’ but ask anybody who’s rented one out and you’ll hear a different story. You’ll need to maintain it, deal with estate agents, missed rent payments, etc. Pensions are less hassle, but they also need to be maintained, you can’t just set and forget and expect everything to be hunky-dory.

Charges – buying, selling and renting out a property doesn’t come free. Every person in the chain will want their fee, whether that’s the solicitor, mortgage adviser, estate agent, etc. Pensions also come with fees, but they’re generally much lower (typically less than 1% per year).

Again, a clear winner for pensions in the Property vs Pensions debate.

What’s best – property or pension?

Property has delivered fantastic returns over the last 30 years, as have pensions. But when it comes to the critical details, it’s a mixed bag.

Property comes with leverage – which is your friend in a rising market but your enemy in a falling market! Pensions, on the other hand, are more liquid, less hassle and lower cost.

As always, neither is right or wrong, it will depend on your circumstances.

All the best,

James Mackay, Independent Financial Adviser in Bristol

.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor Bristol, Clifton.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, retirement planning advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602