Modified on: July 2024

Retirement Revisited: A Roadmap For High-Net-Worth Individuals

Retirement Revisited: A Roadmap For High-Net-Worth Individuals

Planning for a secure retirement is a key objective for many high-net-worth individuals. Achieving a secure retirement requires a blend of foresight, strategy and careful financial stewardship. This article simplifies the complexities of retirement for high-net-worth individuals, offering a clear, strategic framework to achieve a prosperous and fulfilling retirement.

Assessing Your Financial Landscape

Retirement planning is a journey that starts with a clear understanding of your financial terrain. It’s akin to mapping out a route before embarking on an adventure. For high-net-worth individuals, this journey begins with an assessment of your financial landscape — your assets, liabilities, and income streams.

Your financial picture is far from ordinary. It’s like a tapestry woven with various assets, from investments and properties to business interests. To plan effectively for retirement, you must assess this landscape comprehensively. Take stock of your assets, ensuring you haven’t overlooked any significant holdings. This comprehensive view of your net worth is the foundation of your retirement strategy. It’s the compass that guides your financial decisions.

Understanding Your Financial Goals

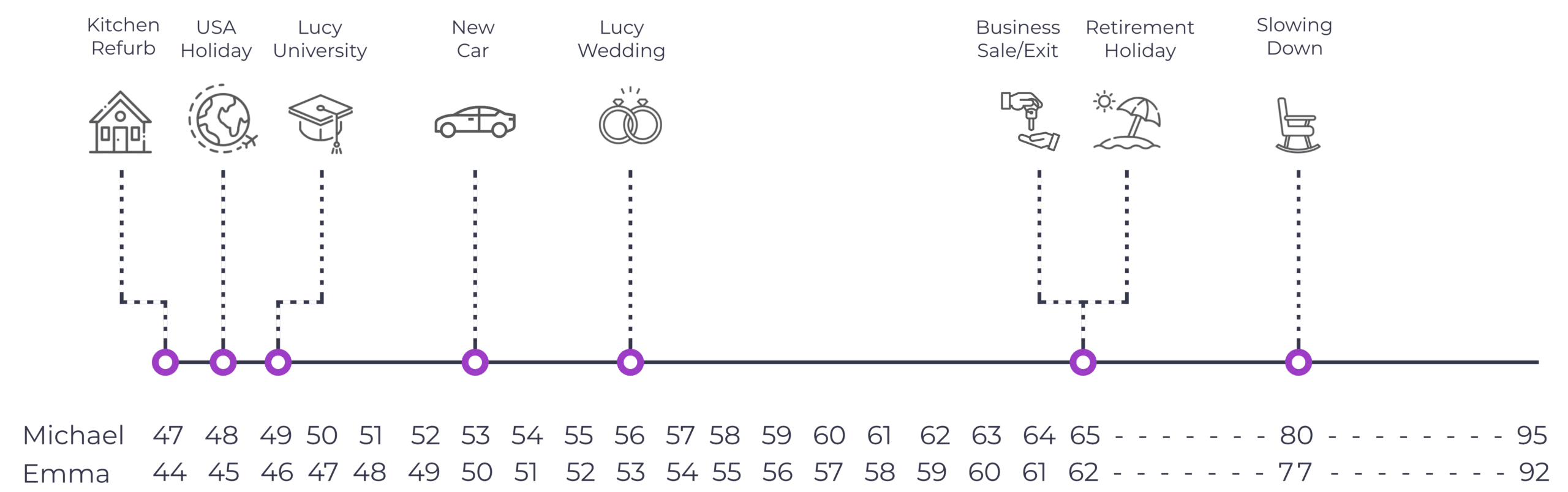

After assessing your financial landscape, the next step is to envision your retirement lifestyle. Whether it’s peaceful countryside living or globe-trotting adventures, your retirement goals shape your financial planning.

Begin by listing your aspirations, like travel, hobbies, or relocating. Place these goals on a timeline to visualise when you wish to achieve them. For instance, specific travel plans might be ideal earlier in retirement, while other goals may be less time-sensitive.

The crucial step is attaching a financial cost to each goal. Estimate the expenses involved in each aspiration. For travel, consider the type of travel and destinations. For relocating, research your desired area’s cost of living, including housing and healthcare.

This exercise helps outline the cost of your retirement and checks if your current savings and investment strategies align with these goals. It’s a chance to see if adjustments are needed in your financial plans. Remember, flexibility in your goals is critical. Life changes, and so might your retirement plans. Building adaptability into your retirement strategy is essential.

Crafting Your Financial Plan

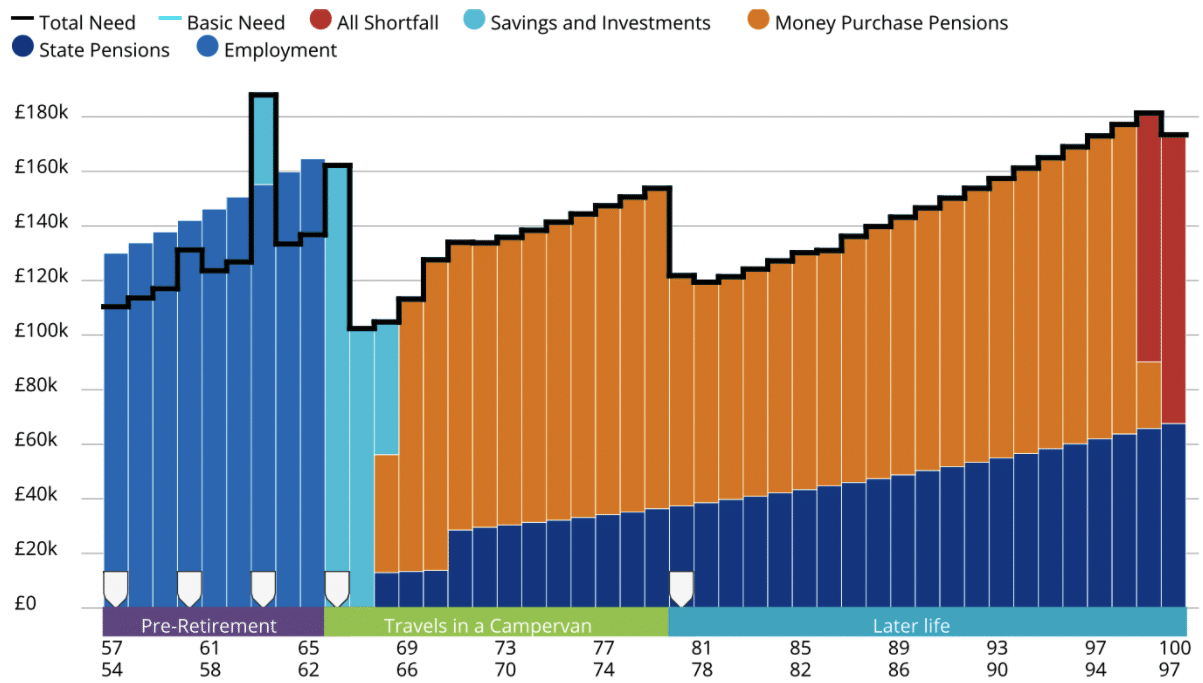

A vital tool in crafting your retirement financial plan is cash flow modelling. This technique involves projecting your future income and expenditures over the course of your retirement, providing a dynamic and detailed picture of your financial future. Cash flow modelling allows you to see the impact of various financial decisions and life events, helping to ensure that your resources are managed effectively to support your lifestyle throughout retirement.

Think of it as taking a 10,000-foot view of your financial situation. Just as a business relies on its income statement and balance sheet to gauge its financial health, you too need a clear view of your cash flows. This overview includes regular income streams from investments, pensions, or other sources juxtaposed against your ongoing and future expenses.

This high-level perspective enables you to see not just the individual components of your wealth but how they interconnect and affect your overall financial health. Understanding the resources available to you is vital, especially in scenarios where your expenses might exceed your income, necessitating a drawdown from your capital over time.

These insights allow you to anticipate and strategically plan for periods where capital drawdown becomes necessary. Maintaining this balanced and comprehensive overview ensures that your retirement strategy is robust, adaptable, and aligned with your long-term financial goals.

Determining Your Risk Tolerance

Armed with a detailed understanding of your financial situation and a comprehensive cash flow plan, you’re now equipped to make informed investment decisions. Your financial plan details the exact level of return required to meet your specific retirement objectives. It maps out your ideal investment risk level and specifies how much risk is manageable without compromising your financial stability.

This crucial insight from your financial plan directly informs your ‘risk need’ – the degree of risk necessary to achieve your retirement goals. It’s a fine line: excessive risk can threaten your financial reserves, while insufficient risk might leave your retirement objectives unfulfilled.

Melding this data-driven risk assessment with your individual risk tolerance is critical to creating a tailored risk profile. This profile then becomes the cornerstone for building your investment portfolio. Everyone’s risk tolerance is unique, shaped by their personal comfort with market ups and downs.

For some, a steady, low-risk approach aligns best with their retirement aims and financial stability. In contrast, others may require a more dynamic, higher-risk strategy to reach their targeted outcomes. Striking this balance between risk and return is essential to maintain a secure retirement. This approach ensures your retirement plan is aligned with your aims and objectives whilst being grounded in reality.

Crafting Your Retirement Investment Portfolio

Once you have calibrated your investment risk profile, the next step is to craft your retirement investment portfolio. Think of your investment portfolio as the fuel that powers the journey outlined in your financial plan. Your financial plan charts the course from where you are now to where you aim to be in retirement, and your investments are what propel you along this path.

Diversification acts like a multi-fuel engine. It involves spreading your investments across various asset classes, such as bonds and equities, and diversifying geographically across different countries. This strategy helps mitigate risks from market fluctuations and economic variances globally, ensuring a smoother ride.

When it comes to investment costs, the rule of thumb is surprisingly straightforward: the less you pay, the more you keep. This is somewhat counterintuitive compared to most industries, where paying more typically equates to getting more. In investments, however, minimising fees means maximising your portfolio’s growth potential.

Rebalancing your portfolio is akin to tuning your engine to ensure optimal performance. It keeps your portfolio’s risk level in check, realigning it with your original investment strategy. As market conditions shift, rebalancing helps maintain the right balance between different types of investments, consistent with your risk tolerance.

Your retirement portfolio, fueled by well-considered investments, is what drives you toward your retirement goals. Ensuring it’s composed of the right mix of diversified assets, managed costs, and evidence-based strategies is essential for a successful financial journey.

Strategic Tax Planning in Retirement

For high-net-worth individuals, effective tax planning is essential in maximising net returns from your retirement portfolio. Strategically structuring your retirement income and investments can significantly reduce any tax drag, enhancing the growth of your wealth.

Consider the impact of drawing income from different types of accounts, each with its own tax implications. For example, you might prioritise withdrawing from tax-advantaged accounts, thereby delaying the taxation of other assets. This approach can optimise the long-term growth of your wealth.

Different accounts have distinct tax treatments that can be leveraged to your benefit. ISAs, for instance, offer tax-free growth and withdrawals, making them an attractive option for early withdrawals. Pensions, while providing tax relief on contributions and tax-free growth, have taxable withdrawals. Considering their unique tax characteristics, a strategic blend of these accounts can significantly improve the tax efficiency of your overall financial plan.

By integrating such tax strategies into your retirement planning, you ensure that every decision contributes to an optimised financial outcome. It’s not just about growing your wealth; it’s about retaining as much of it as possible by navigating the complexities of tax efficiently.

The Art of Adaptive Retirement Planning

Retirement planning is akin to navigating a journey, where continuous adjustments are essential to adapt to changing conditions smoothly. Just like a pilot makes subtle course corrections in response to varying weather patterns or air traffic, your retirement plan needs periodic recalibration in response to personal life shifts and external changes such as market dynamics, tax legislation, and global economic trends.

Regular reviews of your retirement plan are crucial. This process ensures that your strategy remains aligned with your current circumstances and the broader financial landscape. It’s not just about adapting to the present; it’s about preemptively preparing for future changes.

By staying flexible and incorporating expert advice, you can efficiently navigate the complexities of retirement planning. This approach helps you avoid potential setbacks and ensures your financial path is relevant and resilient.

Begin Your Retirement Planning with Frazer James

Effective retirement planning for high-net-worth individuals involves meticulous financial management, strategic investment choices, and savvy tax planning. It’s a journey that starts with understanding your current financial status and devising a plan tailored to your specific retirement goals.

At this critical juncture, making well-informed decisions is crucial. Frazer James specialises in developing bespoke retirement strategies for high-net-worth. Our approach is straightforward and focused on results.

Our Retirement Strategy Consultations are an opportunity to explore if our services align with your needs. This discussion focuses on understanding your financial landscape and how we can bring value to your retirement planning.

Opting for Frazer James means choosing a partner who comprehends the complexities faced by high-net-worth individuals. We invite you to begin this dialogue to discover how our expertise can help you achieve a financially secure retirement.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor based in Clifton, Bristol.

About us: Frazer James Financial Advisers is a financial advisor in Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, retirement planning advice, investment advice, inheritance tax planning and insurance advice.

Need help with pensions advice or wealth management? Frazer James can help with that too.

If you would like to talk to a Financial Adviser, we offer an Initial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing but not personal advice. If you’re not sure which investments are right for you, please request advice. Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602