Modified on: May 2024

Pension Planning Opportunities: Retirement Strategies for High Earners

Introduction to Pension and Retirement Strategies for High Earners

Navigating the complex landscape of pension tax benefits is crucial for high earners. The right pension contribution strategy can offer significant tax benefits for those nearing retirement. Understanding how to leverage these contributions effectively is not just about future savings; it’s a strategic approach to managing current financial obligations.

Increased Pension Allowances for High Earners

The UK pension planning landscape has recently undergone a significant shift, with the annual pension allowance increasing from £40,000 to £60,000. This significant increase in the allowance marks a substantial change with important consequences, particularly for high earners.

Furthermore, the recent changes to the ‘tapered pension allowance’ are especially advantageous for high earners. Previously, individuals earning £312,000 or more had a ‘fully tapered’ reduced pension allowance of £4,000 per year. This has now been raised to £10,000, significantly benefiting those at this income level. In addition, the income threshold at which the tapered pension allowance starts has been increased. The adjusted net income level for the taper to kick in has risen from £240,000 to £260,000. These adjustments are particularly favourable for very high earners, who can now contribute more tax-efficiently to their pensions.

Finally, the recent abolition of the pension lifetime allowance significantly benefits those with pension values of £1m or above. This change means there is no longer a tax charge on the total value of your pension over your lifetime, regardless of how much it’s worth. However, it’s important to note a critical alteration in the tax-free cash you can withdraw from your pension. Previously, you could take up to 25% of your entire pension pot tax-free. Now, this tax-free amount is capped at either 25% of the total value of your pension or £268,275, whichever is lower.

These changes make retirement savings through pensions more tax-efficient for high earners than ever. If you can maximise your contributions, you can now allocate a larger portion of your income to your pension pots. This not only lowers your tax bill right away but also helps you accumulate a larger retirement fund.

Pension Tax Benefits for High Earners

Pension planning is vital for higher and additional rate taxpayers. Individuals falling into these tax brackets often face substantial tax burdens, making efficient pension planning a strategic necessity for a secure and stable retirement.

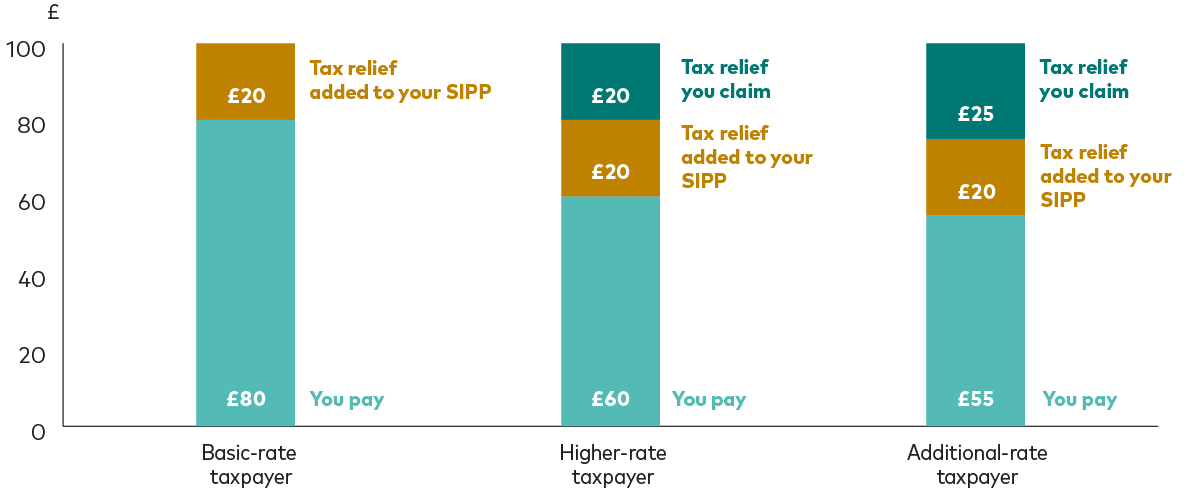

Contributing to a pension scheme means that part of your income that would otherwise be taxed gets redirected into your pension, thereby reducing your taxable income. For an additional rate taxpayer, the ‘net cost’ of contributing £100 to their pension is just £55, given the income tax saving of £45.

Pension Contributions: Relief at Source vs Salary Sacrifice

Regarding pension contributions in the UK, there are two primary methods to consider: Relief at Source and Salary Sacrifice. Both have unique features and tax implications that can significantly impact your take-home pay and future pension benefits. Understanding these differences is critical for high earners looking to optimise their pension strategy.

Relief at Source

In the Relief at Source method, contributions are made from net pay after deducting income tax. The pension provider then claims tax relief at the basic rate (currently 20%) on your behalf and adds it to your pension pot. Higher and additional rate taxpayers need to claim higher/additional rate tax relief via their tax return. Many forget to do so!

The main benefit is that it is simple and easy to understand. The drawback is that higher and additional rate taxpayers need to contact HMRC to claim extra tax relief. It is also slightly less tax-efficient than pension contributions made via salary sacrifice, as you do not save any national insurance.

Salary Sacrifice

Salary Sacrifice involves agreeing to reduce your salary by a certain amount, which is then contributed directly to your pension. This reduction in salary means lower national insurance contributions and income tax.

The main benefit is tax efficiency; your income tax and national insurance liability are reduced immediately by the full amount eligible. Your employer also saves on their national insurance bill and may even split the savings with you. The main drawback is that mortgage applications can be affected, as your official salary appears lower.

Case Study: Pension Tax Benefits for £200,000 Earner

Consider a professional earning £200,000 annually who decides to contribute £50,000 of their salary (potentially from a bonus) into their pension via Salary Sacrifice. Income at this level is taxed at the additional rate (45%).

If they took this £50,000 as income, they would pay taxes of £22,500 (45%) and national insurance of £1,000 (2%), leaving them with just £26,500.

If, instead, they contributed this £50,000 to their pension, the full £50,000 would be invested for their retirement. Any growth their pension achieves will be tax-free if the money remains within the pension.

This strategy exemplifies the power of Salary Sacrifice for high earners. The immediate tax and National Insurance savings, combined with the potential for greater pension growth, make it an attractive option for those looking to maximise their pension contributions and minimise their tax liability.

Advance Tax Planning Strategies for Pensions

Effective tax planning using pensions can significantly enhance financial security, especially with recent regulation changes. Understanding how to leverage pensions can provide substantial benefits, not just for retirement savings but also in terms of estate planning and managing tax liabilities.

Pensions play a crucial role in estate planning, primarily due to their favourable treatment regarding inheritance tax planning. Money left in a pension pot is typically outside of one’s estate for inheritance tax purposes. This means that if you die before 75, your beneficiaries can inherit your pension tax-free. After 75, beneficiaries will pay income tax on the pension at their marginal rate when they draw it, which can still be more favourable than the 40% IHT rate. This makes pensions an effective tool for passing wealth to the next generation while minimising tax implications.

Additionally, there is the ability to ‘carry forward’ unused pension allowances from previous years. This is particularly useful for those who have not maximised their pension allowances each year and wish to make a larger than £60,000 contribution in the current year. Unused pension allowances can be carried forward for up to three years.

Seeking Professional Advice for Tailored Pension Strategies

Personalised advice is key in pension planning, especially for optimising contributions and maximising tax benefits. A financial adviser’s expertise is crucial for effectively navigating various pension strategies and adapting them to your unique financial situation.

Advisers provide more than just help in choosing pension funds or setting contribution levels. They guide you through how much you should contribute to your pension to fit your financial goals and tax situation. This is particularly important for high earners, who may be subject to the tapered pension allowance. Their insights are more valuable than ever with changes in pension rules, such as the end of the lifetime allowance and new tax-free cash limits.

Working with someone who understands your financial picture, including your income, retirement goals, and tax needs, is essential. This personalised approach ensures that your pension plan is effective and aligned with your long-term objectives.

Taking Action

Strategic pension planning is vital for high earners, offering a path to minimise tax liabilities and maximise retirement savings. Understanding the various pension contribution methods and staying abreast of the latest changes in pension regulations are key to making the most of your retirement planning efforts. The recent shifts in pension allowances and the introduction of new tax-free cash limits highlight the importance of staying informed and adaptable.

We encourage you to seek expert guidance to navigate these complexities. A financial adviser can provide tailored advice, ensuring your pension strategy is optimised for your unique circumstances and future goals.

If you want to enhance your pension planning, consider scheduling an initial consultation. With professional advice, you can confidently navigate the pension landscape, making informed decisions that will benefit you now and in your retirement years.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor based in Bristol.

About us: Frazer James Financial Advisers is a financial advisor based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, retirement and pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to talk to a Financial Advisor, we offer an Initial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing but not personal advice. If you’re not sure which investments are right for you, please request advice. Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement masterclass

Retirement masterclass  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602