Modified on: June 2024

Self-employed contractors income protection guide

What is Income Protection for Contractors?

Income protection for contractors is an insurance policy that provides you with a replacement income if you’re unable to work because of injury or illness. It normally pays out until you retire, you die or you return to work.

However, there is also a short-term income protection policy, which pays out for a maximum of one or two years. This shorter-term income protection policy is often cheaper.

Income protection for contractors, otherwise known as contractor sickness insurance, was formerly called permanent health insurance.

Why Should Self-Employed Contractors Consider Income Protection?

If you are an employee, your employer will normally provide some form of sickness insurance. However, as a self-employed contractor, you do not automatically have any form of sickness insurance in place.

This means that if you’re unable to work, due to accident, injury or illness, you will lose income. You may face financial difficulties as a result.

Contractor income protection is a vital insurance policy for all self-employed contractors. It provides you and your family with financial security if you’re unable to work.

Without contractor sickness insurance, you will be reliant on claiming Employment and Support Allowance (ESA). Depending on the type and length of illness, this will provide between £57.90 per week and £111.65 per week, hardly enough to pay the bills!

By contrast, if you set up a contractor income protection policy, you will receive a replacement income of up to 70% of your normal income. Better still, the income you receive will be tax-free. Broadly speaking, you can expect to receive a similar income, after taxes are taken into account.

Do self-employed contractors need income protection?

If you need to earn an income to pay the bills, then you need contractor income protection. This is especially true if you have people who are financially dependent on you, such as a spouse or children.

You need to ask yourself how you would financially copy if you were unable to work for a prolonged period of time. You may have some cash in the bank, but how long will this last?

It’s sensible to keep a couple of months expenses in cash, just in case. But what happens if you suffer an illness that prevents you from working for the next 6 month or even 6 years?

What does self-employed income protection cover?

Self-employed income protection provides you with a regular income if you’re unable to work due to accident, illness or injury.

When you set up the policy, you can choose how much cover you need. You can cover up to 70% of your income, before taxes. This will include salary, dividends and sometimes bonuses.

If you become redundant, you won’t receive any income. Likewise, if your injury is self-inflicted, or the result of misuse of alcohol or drugs, you won’t receive any income.

Apart from that, income protection will pay out in most circumstances, however, make sure to read the key features document first.

What are the additional options for income protection?

Waiting Period

A waiting period, otherwise known as a deferred period, is the amount of time you need to wait between being off work and claiming on your policy. Waiting periods range from 1 day to 12 months.

The longer the deferred period, the cheaper the policy. However, it also means that your policy won’t provide an income until the end of the deferred period.

Occupation Type

There are three types of occupation type:

- ‘Any occupation’ – the policy will pay out if you’re unable to do ‘any’ job whatsoever.

- ‘Suited occupation’ – the policy will pay out if you’re unable to do a job you are ‘suited’ for. So, if you’re an IT contractor, and you can perform the job of an IT analyst, the policy will not payout.

- ‘Own occupation’ – the policy will pay out if you’re unable to do your ‘own’ job. This type of cover is most likely to pay out but it’s also the most expensive type of cover.

When searching online, you will likely find cheap income protection cover. Chances are, it is an ‘any occupation’ policy, which means that it’s unlikely to payout.

Increasing cover

The regular income you receive will either:

- Be the same amount each year (this is known as ‘level cover’)

- Increase by inflation each year (this is known as ‘increasing cover’)

As you know, the cost of food, petrol and bills goes up every year. Therefore it makes sense to have increasing cover, otherwise, you’ll have less income each year (after inflation).

Waiver of Premium

If you select a waiver of premium, you won’t need to pay anything for the policy whilst claiming it.

How much income protection cover do I need?

How much income protection you need will depend on how much you spend each month. If you earn £3,000 per month, but only spend £1,500 per month, then you only need £1,500 of cover (50%).

Make sure to take into account any savings you make on a regular basis. This is important, as otherwise, you will get to retirement and not have enough money set aside.

How much does income protection cost?

The cost of contractor income protection will depend on your individual circumstances.

The cost of income protection will depend on:

- Age

- Health

- Occupation type

- How much cover you need

- Your deferred period

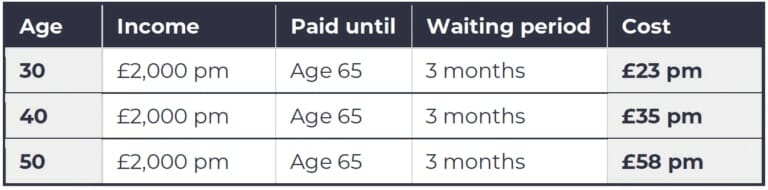

The most important factor is your age, as shown in the below table:

* For illustrative purposes only. Assumes that you are a non-smoker and work in an administrative role.

What’s the best self-employed income protection policy?

The best income protection policy will depend on your personal circumstances. How much income you need, how long you can wait until it’s paid and how long it’s paid for will depend on your personal finances. There are income protection calculators available, however, these don’t take into account all of your personal circumstances.

Alternatively, an independent financial adviser can help you understand what’s the best type of income protection policy. If you want a hand finding the best income protection policy, you can schedule an initial consultation.

What are the other types of insurance for self-employed contractors?

If you need an income to pay the bills, the most important insurance policy is self-employed income protection. However, there are other types of insurance policies which are also important:

- Life insurance – Life insurance pays out a lump sum if you die. It ensures that your family and loved ones are financially safe if you’re no longer around. If you’re a business owner, you can set up life assurance to be paid via your company. The benefit of doing this is that it reduces your corporation tax bill.

- Critical illness cover – Critical illness cover provides a lump sum if you are diagnosed with a serious illness (e.g. cancer, stroke, heart attack, etc). This is especially useful for paying off outstanding debts, such as a mortgage. It can also be useful for paying for large one-off expenses, such as paying for health and medical expenses.

- Private medical insurance – Private medical insurance provides you with fast access to private healthcare when you need it. This policy will pay for certain private medical treatments in addition to that provided by the NHS. Many self-employed people find this type of policy useful as any treatment required can be carried out quickly, allowing them to return to work sooner.

- Keyman insurance – Keyman insurance pays out a lump sum to the business if a ‘key employee’ dies. It provides the business with a tax-free payment, which can be used to help offset the impact of a key employee’s death. As many self-employed people are in partnership with others it is a worthwhile policy to have as part of your protection cover.

How can I get some help?

If you would like a little more help, we provide an Initial Financial Consultation. This meeting will:

.![]() Work out what insurance you already have

Work out what insurance you already have

.![]() Works out what you need

Works out what you need

.![]() Discusses potential solutions

Discusses potential solutions

Book Initial Financial Consultation

As ever, if you want a helping hand, feel free to drop me a line.

All the best,

James Mackay, Independent Financial Adviser in Bristol

.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor Bristol, Clifton.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602