Modified on: June 2024

Retirement Planner UK: The Definitive Guide To Pensions & Retirement Planning

Wondering how much do you need in retirement and how can you get a steady flow of retirement income? After years of working hard and saving prudently, you are about to reach the big day. You have built up a nest egg and are looking to withdraw an income from your pension. This retirement planning guide will give you everything you need to know about how to withdraw an income in retirement.

Retirement Masterclass: Plan Your Retirement Income

You can usually take your pension from age 55 (57 from 2028) and have a range of income options to choose from. You’ll also be able to receive up to 25% as tax-free cash.

Pension Calculator: Ways To Withdraw Money From Your Pension

There are three main ways to withdraw money from your pension:

- Annuity – A guaranteed income for the rest of your life. Not a flexible option, but your income is secure. You can usually take up to 25% tax-free cash when setting up your annuity.

- Income drawdown – Keep your pension invested, taking the income you want, when you want. A flexible option, but it comes with risks. If you take too much income, you could run out of money. You can take up to 25% of your tax-free cash at the start, or take it as you need it.

- Lump-sum – Take your pension as a single lump sum (or series of lump sums). Up to 25% will be tax-free, with the remainder taxed.

This video provides a little bit more information on how you can get your pension income:

For many, a Mix & Match strategy works best. The way this works is that you buy a small annuity to cover your essential needs and keep the remainder of the pension invested, used to fund your leisure discretionary expenses.

Important information – What you do with your pension is an important decision. Before withdrawing an income, you should make sure that you understand all the options. The government’s free and impartial Pension Wise service can help you and we offer an Initial Financial Consultation. The information in this article is not personal advice.

Using Annuities for Retirement Planning in the UK

What is an annuity?

An annuity is one of the only ways of providing a secure income from your pension.

You can exchange some, or all of your pension with an insurance company for an annuity. In return, you’ll receive a guaranteed income for life. The amount of income you receive will depend on the value of your pension, your age, your health and which options you select.

Your annuity will continue to be paid for as long as you live. You don’t have to worry about what happens to the stock market; your income is guaranteed. However once set up, an annuity usually can’t be changed or cancelled, so it’s important to choose your annuity options carefully.

You can buy an annuity anytime from 55 (57 from 2028). Your annuity income will be taxed in the same way as earned income, but you can usually take up to 25% of your pension pot tax-free first.

What annuity options are there?

When you buy an annuity, you will be presented with a range of options. These are important to understand as it will determine how much income you receive and how that might change over time.

Level vs Increasing

Your annuity income will either remain level, meaning that it won’t increase over time, or it can increase over time.

- If you select a level (non-increasing) annuity, you will receive a higher income initially. Over time, the amount that you can buy will reduce, as the cost of living increases.

- If you select an increasing annuity, you will receive a lower income initially. Over time, the amount you receive will increase, broadly in line with the cost of living increases. If you live to old age, you might get more income overall.

There’s no right or wrong option, it will depend on your personal circumstances.

If you have other income that already increases (such as a State Pension or Final Salary pension), then a level annuity may make sense. On the other hand, if this is your main income, and you expect to live to old age, then an increasing annuity may make sense.

Single vs Joint Life

The income from an annuity will be paid for your lifetime. However, if you select a joint-life annuity, on your death, the income will continue to be paid to your spouse (assuming they are still alive).

By selecting a single life annuity, you will receive a higher initial income, although this will stop being paid on your death.

If you have a spouse that is financially dependent on you, you might want to consider purchasing a joint-life annuity. This ensures that they continue to receive an income if you predecease them.

Guarantee Period

When purchasing an annuity, you will need to select a ‘guarantee period’, ranging from 0 – 30 years. The way a guaranteed period works is that if you die before the guarantee period, the annuity will pay a lump sum to your beneficiary, equivalent to the amount of years income you selected, less any payments already made.

For example, assume that your annuity pays £10,000 per year and you select a guarantee period of ten years. After five years, you die. The insurance company would then pay £50,000 (number of years remaining x annual income) to your beneficiary.

If you’re worried about dying early and want your beneficiaries to receive some money, selecting a guarantee period can be useful. The longer the guarantee period you select, the lower the income amount you will receive.

How much income will you receive?

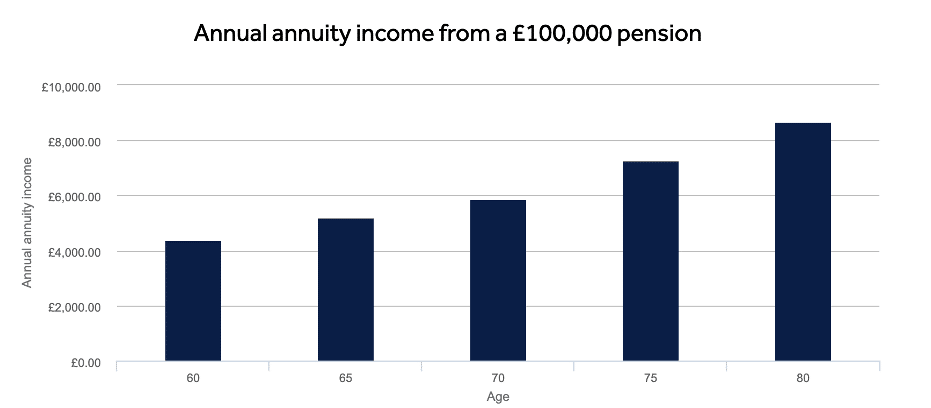

The below chart summarises how much income an annuity might provide based on different ages. It assumes that you select a single life annuity, that doesn’t increase over time and has a five-year guarantee.

The chart shows that the older you are when you purchase an annuity, the more income you’ll receive. This reflects the fact that you have a reduced life expectancy.

Importantly, annuity rates change regularly, so the amount you receive will reflect current market conditions.

How can I get a higher income in retirement?

Your current pension provider is unlikely to offer you the best annuity rate, so it’s vital you shop around and compare quotes.

Another way to increase your annuity income is to make sure you are medically underwritten. If you have any health issues, the insurance company will normally provide you with an enhanced income. This can provide a significant boost to your retirement planning.

Using Income Drawdown for Retirement Planning

What is income drawdown?

Income drawdown is one of the most flexible ways to access your pension. You can usually take up to 25% as a tax-free cash lump sum and keep the rest invested for later. Youre in control of how much income you take and can make withdrawals whenever you want to.

You have the freedom to choose your own investments, and if they perform well you could receive more income than you would from an annuity. If at the end of your life, you haven’t spent your pension, it can be passed on to your loved ones, often tax-free.

How does income drawdown work?

You can move a pension into drawdown either with your current provider (if they offer it) or by transferring your pension to a new drawdown provider. If you have multiple pensions, it’s often possible to transfer them all to one provider if you wish. Before you transfer, make sure to check that you won’t lose any valuable benefits or pay high exit fees.

How much tax-free cash work?

Any tax-free cash will be paid to you at the start. If you’d rather not move your whole pension into a drawdown at once, that’s fine too.

Each time you move part of your pension into drawdown, you can normally take up to 25% tax-free cash from that portion. This is called phased drawdown.

How do I take an income from my pension?

You don’t have to draw an income straight away, or even at all. But if you do want to, you can take as little or as much income as you like. You can choose to take regular withdrawals or make ad hoc withdrawals as required.

Remember to factor in how long you’re going to need your pension to last. Your retirement might last thirty years or even longer. If you withdraw too much too soon, you might run out of money.

How should I invest my pension?

As your pension will still be invested, you’ll need to choose how it is invested. The performance of your investments will determine how much income you can withdraw.

Investment options can include funds, shares, bonds and cash. You can pick your own investments, use ready-made portfolios, or let a financial advisor create an investment portfolio for you.

You’ll need to keep in mind that the value of your investments can go down as well as up, so it is possible to get back less than you invest.

How long will my money last?

Retirement planning is fraught with risks. One of the risks of drawdown is that your investments may fall in value and you’ll run out of money.

If your pension falls in value whilst you’re working, it’s no big deal. You have time for it to recover. But if your pension falls in value whilst you’re withdrawing an income, it can be deadly.

If your investments suffer drastic falls and you find yourself in a situation where you need to sell investments so your income can be paid out, you may deplete your pot rapidly.

Financial markets experience highs and lows. On average 1 in every 4 years is a negative performing year, although predicting market declines is virtually impossible.

Of course, you could leave your pension in cash if you wish, however, this poses its own risks. Whilst cash seems like a low-risk option, your pension won’t grow over time. As the cost of living increases, you may find that the pension isn’t enough to sustain your income needs.

Retirement Income Planner UK: Frazer James Retirement Planning Service

As part of our retirement planning service, we help you work out how to set up, invest and withdraw an income from a drawdown pension:

Best Pension – We will find the best pension for you, taking into account charges, security, investment options, etc.

Investment Advice – We will help you create an investment portfolio, giving you the right balance between risk and return.

Independent – We are not tied to any pension or investment company, so you know we’re on your side, doing what’s best for you.

Pension Management – We will help plan and manage all aspects of your pension, making sure it continues to perform as expected.

Tax Strategy – We will help you build a retirement income plan that aims to minimise income tax.

The Extra Mile – We will also help with all aspects of your retirement planning – such as our State Pension Review, which advises you on how to increase your State Pension.

Our retirement strategy sessions offer you an initial consultation with a Certified Financial Planner to help you better understand your retirement options.

Take advantage of this unique opportunity to gain valuable knowledge and personalised advice from our team of financial experts.

Schedule your retirement strategy session today.

Taking a Lump Sum for Retirement Planning

How does taking a lump sum work?

Taking a lump sum is an additional, flexible way to withdraw money from your pension. It allows you to withdraw your entire pension in one go, or a bit at a time.

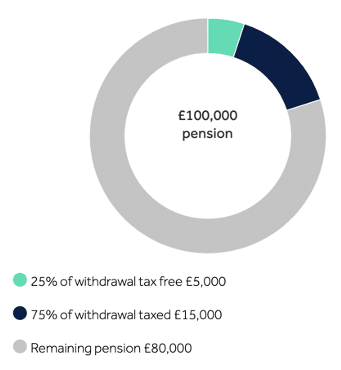

Each time you take a lump sum, usually 25% of that withdrawal will be tax-free. The rest will be taxed as income. Anything you don’t take will be left in your pension and will need to be invested.

For example, assume that you have a £100,000 pension and decide to withdraw £20,000. From the withdrawal, you will receive £5,000 tax-free and £15,000 taxable. You will also be left with a pension pot of £80,000, which will remain invested.

How much lump sum should I take?

In most cases, there’s no limit to the amount you can take as a lump sum. However, it’s important to consider how long you’ll need your pension to last. Usually, 25% of each lump sum you take will be tax-free, and the rest taxed as income.

If you take the full pension in one go, you won’t have any left for later. You will also pay a lot of tax. This is because the income part is taxed at your marginal tax rate, meaning that you may become a higher or even additional rate taxpayer, suffering tax at 40% or 45%.

How should I invest the remaining amount?

Anything you don’t take stays invested. This creates the potential for growth but also means your pension is exposed to the ups and downs of the stock market.

Investment options can include funds, shares, bonds and cash. You can pick your own investments, use ready-made portfolios, or let a financial advisor create an investment portfolio for you.

You’ll need to keep in mind that the value of your investments can go down as well as up, so it is possible to get back less than you invest.

Closing thoughts

Hopefully, by now you are much more clued up about your retirement options.

As I mentioned at the start, how you take an income from your pension is an important decision. There are lots of options and things you need to consider.

If you need a hand with your Retirement Planning, consider scheduling a Retirement Strategy review. These sessions offer you an initial consultation with a Certified Financial Planner to help you better understand your retirement options.

Schedule your retirement strategy session today

All the best,

James Mackay, Independent Financial Adviser in Bristol

.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor Bristol, Clifton.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602