Modified on: June 2024

Time in the market – the best investment strategy

Time in the market – the best investment strategy

Trying to time the market, rather than spending more time in the market is a dangerous thing. Here’s why:

Unfettered access to information can be a dangerous thing. Take, for example, a friend of mine, who was experiencing some troubling medical symptoms. Typing her symptoms into a search engine led to an evening of research and mounting concern. By the end of the night, the vast quantity of unfiltered information led her to conclude that something was seriously wrong.

The difference between experts and amateurs

One of the key characteristics that distinguishes an expert is their ability to filter information and make increasingly refined distinctions about the situation at hand.

For example, you might describe your troubling symptoms to a doctor simply as a pain in the chest. But a trained physician will be able to ask questions and test several hypotheses. They might then conclude that rather than having the cardiac arrest you suspected, you have something completely different.

While many of us may have this capacity – given enough research, reaching this point takes time, dedication, and experience.

My friend, having convinced herself that something was seriously wrong, booked an appointment with a physician. The doctor asked several pertinent questions, performed some straightforward tests, and recommended the following treatment plan: reassurance and education.

Not surgery. Not drugs. But an understanding of why and how she had experienced her condition. The consultative nature of a relationship with a trusted professional—both when a situation arises and as we progress through life—is one of the key benefits that an expert can provide.

The value of working with a financial advisor

There are striking parallels with the work of a professional financial advisor.

The first responsibility of the doctor or advisor is to understand the person they’re serving so that they can fully assess their situation. Once the plan is underway, the role of the professional is to:

- Monitor the situation

- Evaluate if the course of action remains appropriate

- Help to maintain the discipline required for the plan to work as intended

Like my friend’s doctor, an advisor may have experienced conversations with clients that are triggered by news reports or informed by unqualified sources. In some cases, all that is required to help put the client’s mind at ease is a reminder to focus on what is in their control as well as providing reassurance.

The benefits of working with the right advisor are demonstrated through the ability to both help clients pursue their financial goals and to help them have a positive experience along the way.

The risks of self-diagnosis

Trouble might arise when we confuse simple and complex conditions. Probably no harm is done when a person, recognising the onset of a common cold, takes cold medicine, drinks plenty of fluids, and rests. But had my self-diagnosing friend not made an appointment with a specialist, and instead moved from self-diagnosis to self-medication, she may have caused herself real harm. Similarly, thinking that all aspects of your financial situation can be handled through a basic internet search or casual conversation with a friend might result in a less than optimal financial outcome.

Without the guidance of a financial advisor, the self-medicating investor might overreact to short-term market volatility by selling some of their investments. In doing so, they risk missing out on some of the best days since there is no reliable way to predict when positive returns in equity markets will occur.

Time in the market, not timing the market

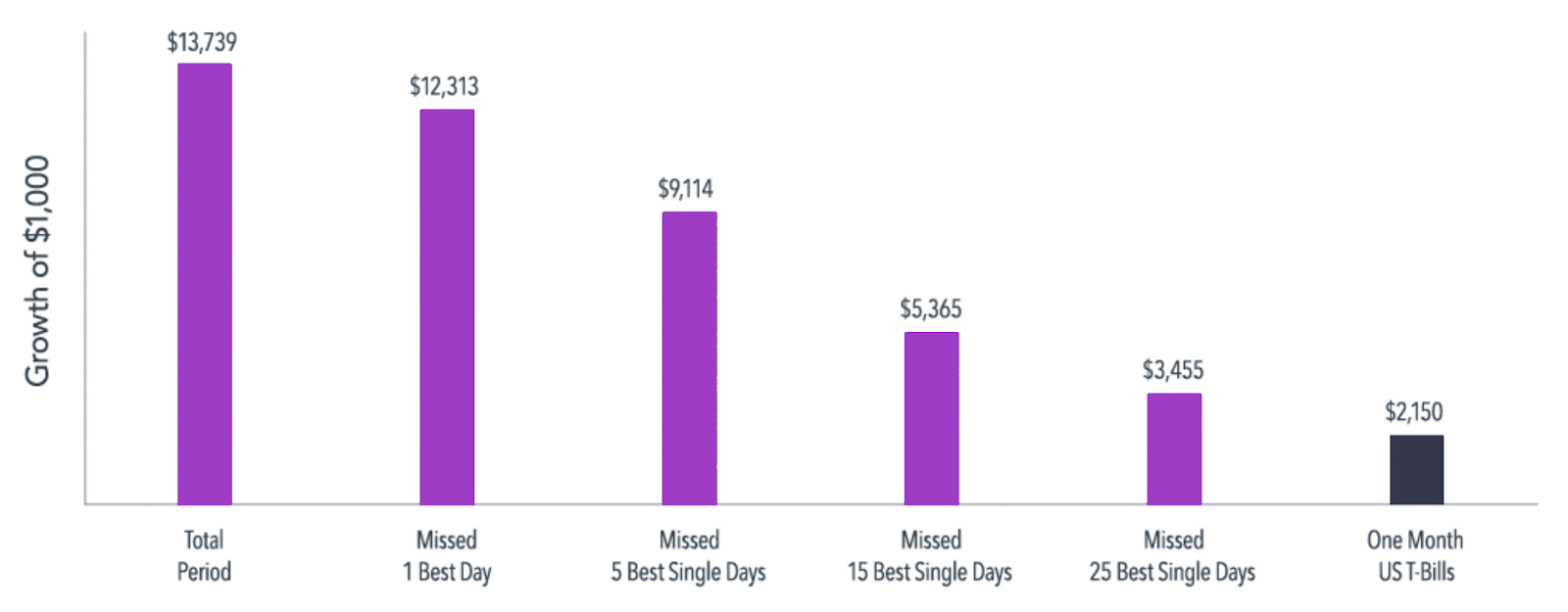

One might think that missing a few days of strong returns would not make much difference over the long term. But, as shown below, had an investor missed the 25 single best days in the world’s biggest equity market, the US, between 1990 and the end of 2017, their annualised return would have dropped from 9.81% to 4.53%.

Such an outcome can have a major impact on an investor’s financial “treatment” plan.

Performance of the S&P 500 Index, 1990-2017

(Source – Dimensional)

Improving someone’s financial health is a lot like improving their physical health. The challenges associated with pursuing a better financial outcome include diagnosis of the current situation, development of the appropriate course of action, and sticking with the treatment plan.

Many financial advisors are trained on the intricacies of complex financial situations. By providing the prescription of reassurance and education over time, we believe the right financial advisor can play a vital and irreplaceable role in investors’ lives.

All the best,

James Mackay, Independent Financial Adviser in Bristol

P.s – if you want to become a better investor, you have to check out our 7 Simple Steps to Investment Success. It provides you with a proven process, based on evidence, not guesswork, to help you avoid the costly mistakes and tilt the odds in your favour.

.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor Bristol, Clifton.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602