Modified on: June 2024

Best retirement advice – how to plan for retirement

Retirement forecaster – the best way to plan for retirement

The best retirement advice I give each of my clients is to get a clear picture of their finances, both now and in the future.

Most of us muddle through life, saving a bit of money here, investing a bit there. We jump from one job to another, leaving a trail of workplace pensions in our wake.

Then one day, we look up and realise that we’re 55. The kids are about to leave home and we don’t feel so young anymore. We’ve been so busy with the here and now that we’ve forgotten to think about the future.

Retirement planning felt like something we should get around to, but somehow never did. We knew its importance, it’s just never felt particularly urgent. Until now.

So, if you’re 50-something, and starting to think about retirement – where do you start? What’s the best retirement advice for somebody fast approaching retirement?

Retirement planning – how much is enough?

Planning for retirement is incredibly difficult. It requires working out how much money you’re going to need for the rest of your life, assuming you never work a day again.

If you’re like most people, you probably have a good idea of how much you have saved up for retirement. This will typically include money in the bank, investments and of course pensions. You’ll also have a reasonable understanding of what income you’ll receive in retirement. This might include buy-to-let income, State Pensions and final salary pensions.

But the one thing you probably don’t know, guessing by the fact that you’re reading this article, is “how much is enough?”

This is a much broader question. It requires you to consider your income, your capital and of course your expenses throughout retirement. It also requires estimating tax, investment returns and life expectancy. Not an easy task!

The only way to answer “how much is enough” is to create a comprehensive view of your finances. This will take into account your income, expenses, taxes and capital available for retirement. This is where cash flow modelling comes in. Cash flow modelling provides a big-picture view of your finances, both now and in the future.

It takes into account all of your financial information, to produce a forecast of your money over time. Ultimately, it helps to answer “how much is enough”, giving you clarity and confidence around your retirement planning.

Using cash flow modelling to visualise your retirement planning

Take John and Jan. They are 55 years old and are looking to retire at 60, with an income of £50,000 per year.

They have a buy-to-let property, which provides £12,000 per year. They will also receive State Pensions, providing a combined £18,000 per year from age 68. This gives them a total retirement income of £30,000 per year.

With a target income of £50,000 per year, they are left with a shortfall of £20,000 per year (more in the early years, as their State Pensions aren’t in payment yet). To fund the shortfall, they have £600,000 of savings. This is held between their workplace pensions and stocks and shares ISAs.

We produced a forecast of their finances, using cash flow modelling. The model was based on their income and expenses, as well as their pensions and investments. It also accounted for tax. We used some prudent assumptions for inflation, investment growth, tax rates and life expectancy.

Retirement forecast – are we on track?

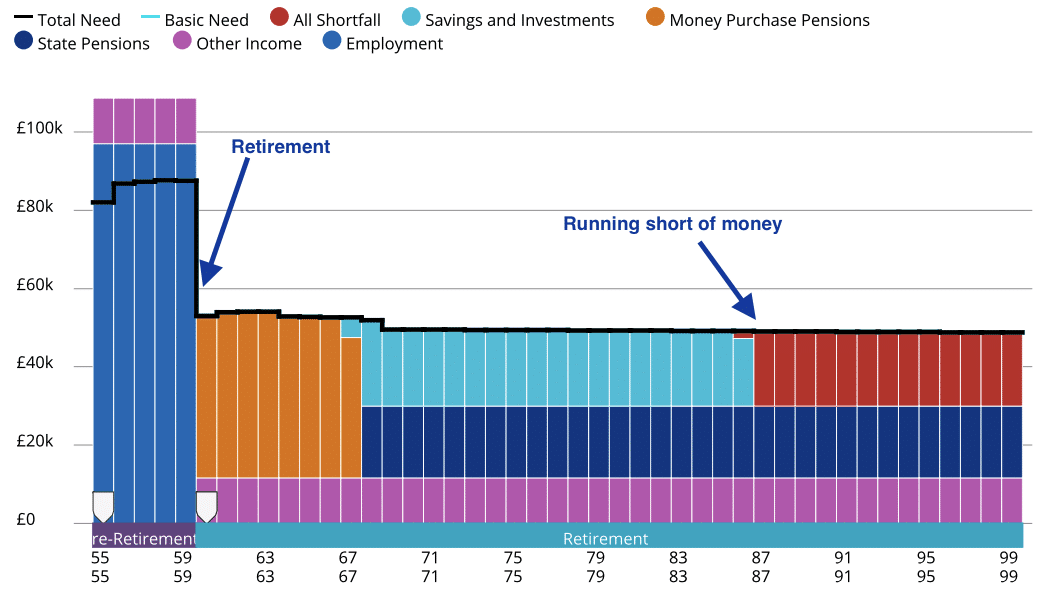

The below chart summarises their cash flow position. It shows that if they retire at 60 and spend £50,000, there is a reasonable chance that they will run short of money in their later years. The early years of retirement, before their State Pensions come into payment, required them to withdraw heavily from their savings (ISAs and pensions), leaving inadequate funds for later life.

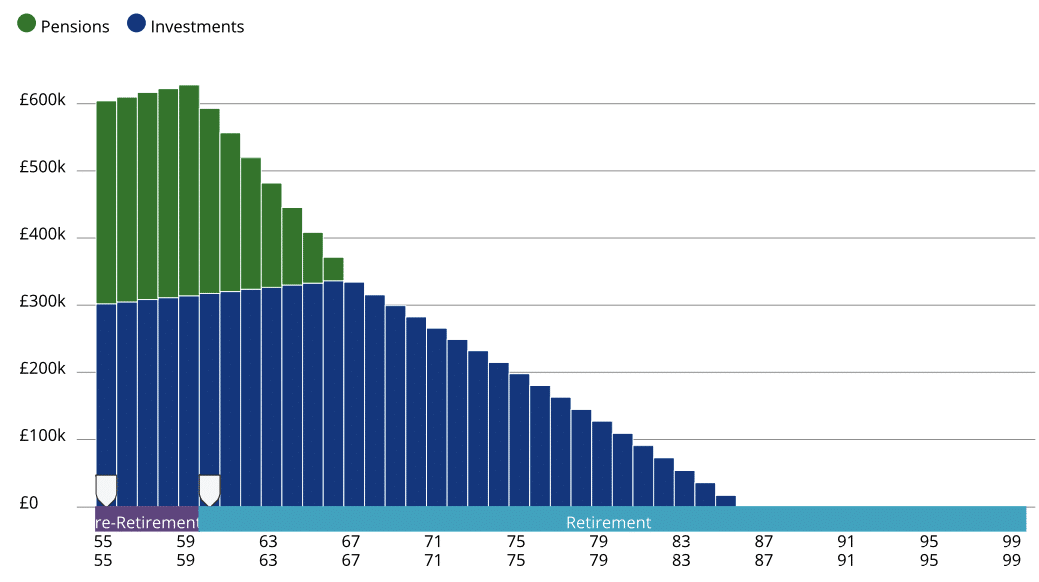

The flip side of their cash flow position is their asset position (i.e. the capital they are spending down to fund their income shortfall). This forecasts the value of their assets over time, taking into account the withdrawals they will need to make to fund the income shortfall.

The chart shows:

- Between the ages of 55 – 60, their assets grow modestly, as they remain employed and do not need to withdraw any money.

- Between the ages of 60 – 68, their assets decline quickly, as they require significant withdrawals to fund their retirement expenses.

- Between the ages of 68 – 87, their assets decline at a slower rate, as their State Pensions are now in payment, reducing how much they need to withdraw.

- From age 87 onwards, their assets are depleted in their entirety, leaving them with a shortfall in their later years.

How cash flow helps you understand your retirement options

Armed with this information, John and Jan were able to make decisions about how best to mitigate the shortfall. Some of the options highlighted from their cash flow forecast included:

- Retiring a couple of years later – for example, the model showed that if they retired a few years later at 63, instead of 60, they would be able to generate an income of £50,000 per year, without running short in their later years.

- Saving a little more – the model showed that if they could an extra £1,500 per month for the next five years, they could afford to retire at 60 with an income of £50,000 per year.

- Spending a little less – for example, if they reduced their spending to £45,000 per year, they could afford to retire at 60, whilst remaining financially secure.

- Paying less tax – by structuring withdrawals from their investments/pensions tax-efficiently. For example, by only withdrawing from their pension up to their tax-free allowance, they could make their money last longer.

- Taking more investment risk – with the aim of increasing their overall investment return. The model demonstrated that for every 1% improvement in their investment return, their money would last an extra five years.

- Reducing their investment costs – by minimising their costs, more of their money remained invested to support their retirement income. By reducing their costs by 0.50% per year, the cash flow showed their money lasting an extra three years.

For the first time in their life, John and Jan had complete clarity around their finances. They understood their current financial position, where they were heading, and the options available to them.

Best retirement advice – getting a clear picture of your finances

Cash flow modelling is like your financial GPS. It shows you where you are today and where you’re heading. It provides a forward-looking forecast of your finances, showing you whether you are on track or not with your retirement planning. It can also act as a gauge, highlighting any shortfalls in your retirement planning and how these can be fixed.

- Here are just some of the questions that cash flow modelling can help you answer:

- How much money do I need to retire?

- How much can I spend each year in retirement?

- How much do my investments need to grow by each year?

- What happens if I spend £x more per year in retirement?

- How much tax will I pay each year in retirement?

- How much risk should I be taking with my investments?

Whilst a cash flow model is no panacea, it’s better than the alternative – which is essentially flying blind.

The bottom line

Retirement is the biggest transition you’re ever going to make. It’s not the sort of thing you do regularly and not the sort of thing you want to get wrong. Cash flow modelling provides a comprehensive view of your finances, helping you make smart decisions around your retirement planning.

If you would like a hand with your retirement planning, feel free to book your Retirement Strategy Session. Our team of retirement planning experts will provide clarity around your retirement options and specialist advice tailored to your unique circumstances.

Frequently Asked Questions

What is risk tolerance?

Risk tolerance in retirement planning pertains to both your capacity and willingness to withstand fluctuations in the value of your investments as you fund your retirement. Recognising your risk tolerance is essential as it enables you to establish a suitable blend of investments in your retirement portfolio.

What is considered an early retirement age?

Early retirement age is subjective and can vary, but it often refers to retiring before the traditional retirement age of 65. Some people may consider retiring early in their 50s or even earlier. The decision depends on factors like financial preparedness, health, and personal goals.

What are the things to consider before you decide to retire early?

Here are the top considerations for retiring early:

- Financial Stability: Ensure you have enough savings and investments to sustain your lifestyle.

- Healthcare: Consider healthcare costs and insurance coverage.

- Longevity: Plan for a potentially longer retirement period.

- Debt: Aim to reduce or eliminate high-interest debts.

- Taxes: Understand the tax implications of early withdrawals and income sources.

What are the biggest financial mistakes that retirees make?

Here are the biggest financial mistakes that retirees make:

- Underestimating Expenses: Failing to accurately estimate post-retirement living expenses, including healthcare costs.

- Ignoring Inflation: Neglecting the impact of inflation on the purchasing power of retirement savings.

- Taking Too Much Risk: Maintaining an overly aggressive investment strategy without considering age and financial goals.

- Not Having a Withdrawal Strategy: Lack of a well-thought-out plan for withdrawing money from retirement accounts.

- Overlooking Tax Implications: Not considering the tax implications of withdrawals and retirement income sources.

Which are the best investment options for retirees?

Here are the top investment options for retirees:

- Pension Drawdown: Allows you to take a tax-free lump sum and receive a regular income from your pension fund. It provides flexibility and control over your pension savings.

- Fixed-Term Annuities: They provide a guaranteed income for a fixed term, allowing retirees to lock in a set income stream for a specific period.

- Government Bonds (Gilts): UK government bonds, known as Gilts, are a low-risk investment. They pay regular interest and are considered relatively stable.

- Corporate Bonds: These are debt securities issued by well-established companies in the United Kingdom. While they provide greater returns than government bonds, they also entail a slightly elevated level of risk.

- Equity Income Funds: You can invest in funds that focus on dividend-paying UK stocks. These funds can provide a regular income stream and potential for capital growth.

- Real Estate Investment Trusts (REITs): You can also invest in REITs listed on the London Stock Exchange to gain exposure to the UK property market. REITs often pay regular dividends.

- Fixed-Term Savings Accounts: Investing in fixed-term savings accounts offered by banks is also a minimal risk option. These accounts provide a fixed interest rate for a set period.

- Investment Funds: Diversify your portfolio with investment funds, such as unit trusts or OEICs, managed by professional fund managers. Choose funds based on your risk tolerance and financial goals.

- Lifetime Annuities: They provide a guaranteed income for life and can be purchased with pension savings. It offers security, but once purchased, the income is generally fixed.

- Cash Savings: Keep a portion of your portfolio in cash for immediate needs and emergencies. Consider high-interest savings accounts for better returns.

- Emerging Market Funds: Diversify globally with funds that invest in emerging markets. While riskier, they may provide opportunities for growth.

- Premium Bonds: Offered by NS&I, Premium Bonds provide the chance to win tax-free prizes in a monthly draw. While returns are not guaranteed, it provides a unique savings option.

What are the best financial tips for retirees?

Here are the top financial tips for retirees:

- Explore Pension Flexibility: Take advantage of the pension freedoms in the UK. Consider flexible drawdown options and understand the tax implications of your pension withdrawals.

- Diversify Tax-Efficient Investments: Utilise tax-efficient investment options, such as ISAs, to diversify your investment portfolio. This can help manage tax liabilities on your retirement income.

- Review Annuity Options: If considering an annuity, explore the different types available, including fixed-term annuities. Some annuities offer flexibility and can be tailored to your specific needs.

- Understand State Pension Entitlement: Be aware of your entitlement to the State Pension and understand how changes in contributions and retirement age may impact your benefits.

- Plan for Long-Term Care Costs: Consider the potential need for long-term care and explore financial options for covering these costs. Long-term care insurance or other savings strategies may be beneficial.

- Stay Informed About Tax Credits: Explore eligibility for pension tax credits and other benefits available to retirees. Staying informed about available credits can optimise your financial situation.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor Bristol.

About us: We, Frazer James Financial Advisers, are financial advisors and retirement planners in Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement masterclass

Retirement masterclass  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602