Modified on: June 2024

Financial stages of life – saving vs spending

Financial stages of life

As a Certified Financial Planner (CFP), the question I get asked the most is “what should I do with my money?”

The answer, as always, is ‘it depends’. That’s not to sound vague, but it depends on where you are in life.

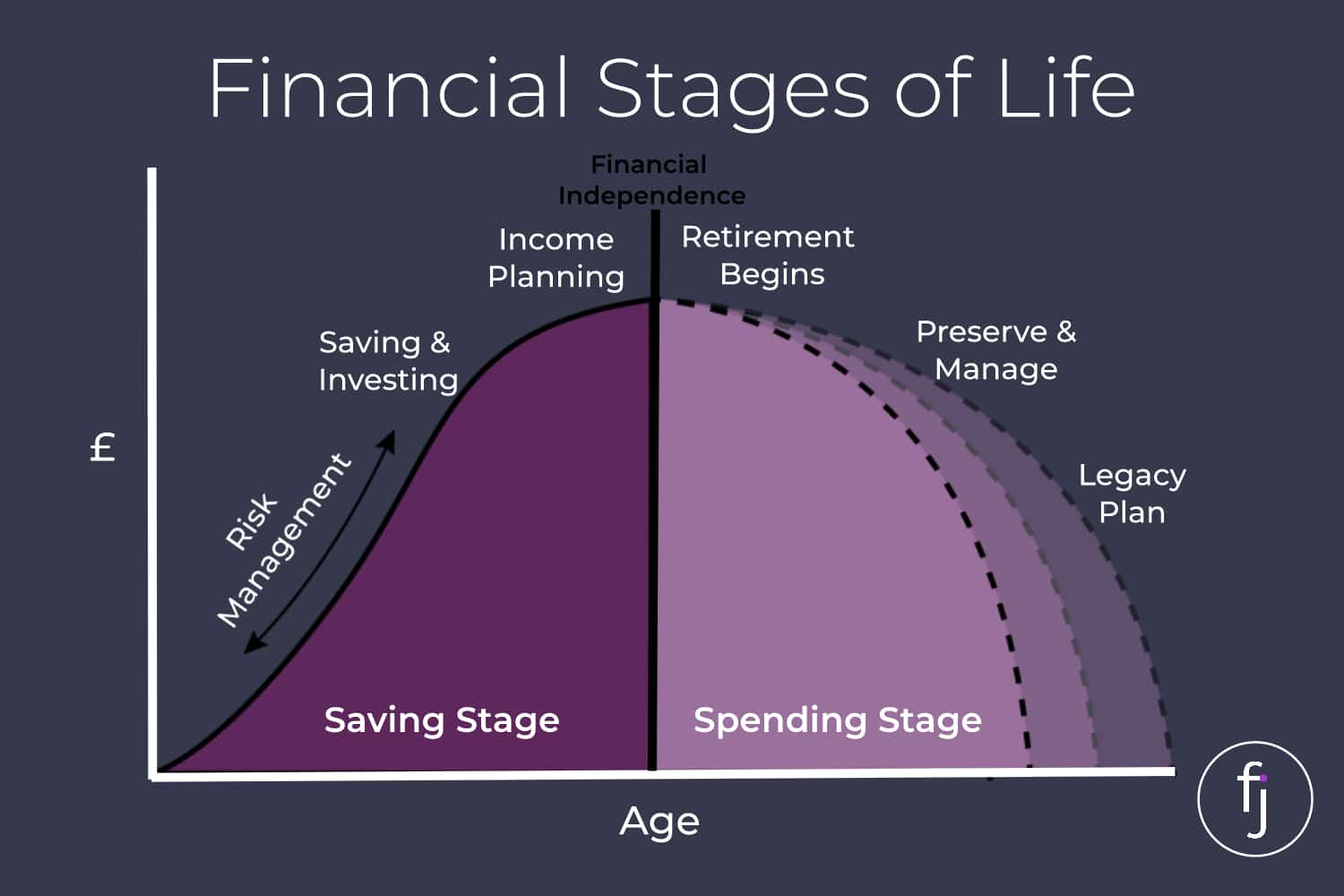

To keep it simple, there are broadly two financial stages to life, the saving stage and the spending stage.

The saving stage

If you’re still working, then you’re probably in the saving stage.

Each month, you save a bit of your income, either into a bank account, an investment, or a pension. You put away money today for the benefit of tomorrow.

How much should you save?

Whilst everyone’s situation is different, you should aim to save about 20% of your net income. This includes money you save into your workplace pension.

If you’re not saving 20%, you’re probably not using my 3 Buckets approach to saving.

It’s about getting the right balance between living for today and saving for tomorrow.

Where should you invest your money?

This is less important than how much you save, but still worth spending a minute on.

Investing seems complicated, but it’s really not. All you need to do is get the right mix of investments, make sure they are well diversified, and then leave them alone.

If you’re fairly early on in the savings stage, you’ll want to take a higher level of risk. This will help your investments to grow at a faster rate, but it will come with more ups and downs.

What’s the biggest risk?

The biggest risk during the savings stage is suffering an illness that prevents you from working. In my work as a Certified Financial Planner, I have seen people’s finances completely derailed because they have fallen ill and are unable to work. Where you invest your money doesn’t matter if you don’t have any money to invest.

This is why income protection is so important. It provides a replacement income if you’re unable to work.

The spending stage

At some point, you’re going to reach financial independence. This is where you have enough money so that work becomes optional.

Moving from the saving stage to the spending stage takes a psychological shift. You move from being a lifetime saver to a lifetime spender. It’s a big shift and takes some getting used to.

How much should you spend?

Many people worry that they will run out of money in retirement. It’s the single biggest thing that keeps people up at night. The problem is, most people won’t know for sure until it’s too late.

Whilst everyone is different, a widely accepted view is that you can spend around 4% of your money each year in retirement. So, if you have a pot of £200,000, you can withdraw £8,000 per year.

The ‘4% rule’ however is just a starting point. It oversimplifies what is an incredibly complex calculation. For example, it doesn’t take into account your other assets, incomes, expenses, and liabilities. It also doesn’t take into account how long you’re likely to live for.

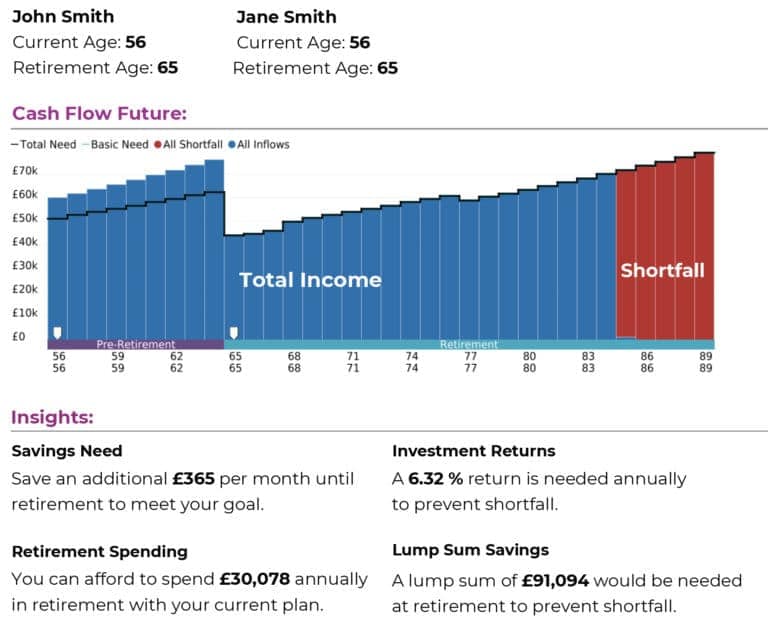

This is where working with a Certified Financial Planner can help. By using some fancy software, we’re able to forecast your future finances and answer the question of ‘will I have enough?’.

If there’s one time that absolutely everybody should get financial advice, it’s when they’re approaching retirement. I know this is self-serving, but it’s far too important to leave to chance. If you’re thinking about retirement, go ahead and schedule your retirement planning consultation.

How to withdraw money in retirement?

After you know how much you can spend, the next question is how to withdraw money in retirement. Chances are, you’ve got a couple of different ‘pots’ – pensions, ISAs, savings, and the like.

For most people, the best way to withdraw their money is to use their savings first, their investments second and then their pensions last. The reason being that this is (generally) the most tax-efficient way, although it will, of course, depend on your personal circumstances.

If you’re approaching retirement and want a hand with your retirement planning, feel free to schedule your retirement planning consultation.

All the best,

James Mackay, Independent Financial Adviser in Bristol

.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor Bristol, Clifton.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602