Modified on: June 2024

How long will a pension last

How long will my pension last?

Easy question, without an easy answer.

Ultimately it comes down to what goals you have and how far you want your pension to stretch. It’s also important to consider what sources your pension will come from and what percentage will be from the state and what will be built up from savings and investments.

With a defined contribution pension the main factors affecting your pension are:

- How much it grows (investment growth)

- How much you withdraw

- How much you pay in charges

How long should you expect the pension to last?

When it comes down to it, the real question is how long do you think you will live? It may sound morbid, but when discussing pensions it really is at the heart of the matter. Surveys indicate that most people underestimate how long they are going to live for, and as such do not accurately calculate their pensions.

The average life expectancy is around 85 years for those in their 40s now, meaning you may have another whole lifetime ahead of you.

When it comes to retirement planning, there are essentially two outcomes:

- You outlive your money.

- Your money outlives you.

The first is a disaster, the second is a tragedy. The first occurs when you spend too much, too soon. The second occurs when you don’t enjoy life as much as you could.

Part of what we do is help you find the right balance between now and the future. We use comprehensive retirement planning software to show you how much you can afford to spend each year, without running the risk of running out of money.

Flexible vs secure Income

When it comes to your retirement there are two main forms of income to consider, your secure income, which includes your state pension, any other defined pension benefits and rental income. This is a reliable form of retirement income that will be paid for as long as you live.

You can fairly easily calculate. However, figuring out exactly how much you will need and how much you intend to use is another matter entirely.

The other form of income is that which can be generated from savings, investments and pensions. This is known as ‘flexible income’ or ‘insecure income’. The key difference here is that you are withdrawing money from a pot. If you withdraw too much, then the pot may be depleted during your lifetime. You can of course grow the pot, by investing the money – although there are no guarantees.

The age factor

When it comes down to it, the fundamental deciding factor on how long your pension will last is at what age you think you will start dipping into it and to what age you think you will live to.

It’s no secret that people are living longer, with people in their 50s now expected to live well into their 80s, and people who were born in the 1970s may expect to live into their 90’s and beyond. While these increasing ages are great in most ways, it does mean that you will need to factor this into your retirement fund. If you are going to retire at 55 but then live for another 30 to 40 years, you’re going to need a lot of money to sustain yourself over that time

Another aspect of living longer is the impact of inflation. Fortunately, the State Pension and most defined benefit pensions are inflation-linked, meaning they will rise each year in line with prices. However, the money you withdraw from savings and investments will not automatically grow by inflation. To ensure it is not eroded over time, you may need to invest the money to help it grow.

Minimising charges

When it comes to investing, you get what you don’t pay for.

Every investment comes with charges. Some more than others. Quite simply, the more you pay in charges, the less you have remaining. Keeping your charges low can significantly extend how long your pension will last.

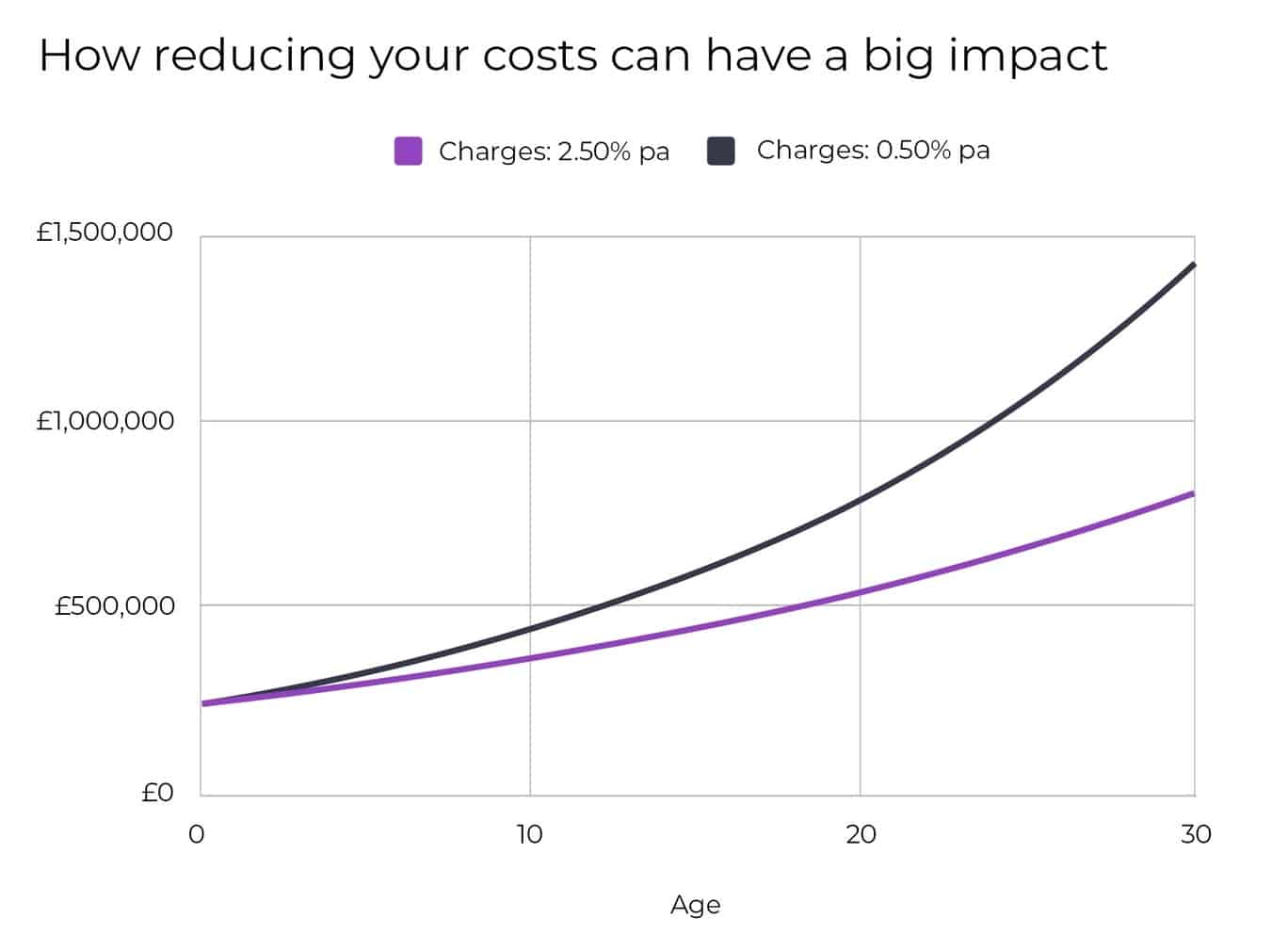

Small differences in charges might not sound like much, but they add up to big differences over time. Consider the below example. Both investments are worth £250,000 today, each growing at 6.00% per year, before charges. However, the investments pay different charges, with the first paying 2.50% per year and the second paying 0.50% per year.

Over the course of 30 years – about the same length as the average retirement – the outcomes are vastly different.

It is important to be very clear on how much you are paying and that you understand what you will be receiving for that fee. By working together, we will help you understand exactly how much you’re paying in charges. We will then compare different options to see if you can reduce how much you pay. Many older-style pensions have high charges, and can likely be reduced.

Where does this put you?

With all this information you may be wondering where that puts in you the picture. If you are concerned or curious about your pension options and you want to investigate, then we at Frazer James are here to help.

We have years of experience in the field and are experts at bespoke finance that are tailored to our client’s needs. Book a meeting with us today to get some perspective on your retirement.

We assist senior executives and business owners in achieving financial stability. We keep our customers on pace to accomplish their financial objectives by building long-term partnerships. If this is something you think you would be interested in, get in touch and we will arrange a meeting as soon as possible.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial and Retirement Advisor Bristol.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As independent financial advisers, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602