Modified on: July 2024

How much do I need to retire at 55?

Do you want to retire at 55?

I’m often asked, “how much do I need to retire at 55?” or “can I retire at 55?”

Retiring at 55 is a real possibility for some people. To retire at 55 is a goal that many people share, it allows you to enjoy life whilst you are still young, fit and healthy. Whilst anyone can retire at 55, early retirement isn’t for everyone.

In the UK there are currently no age restrictions on retirement and generally, you can access your pension pot from as early as 55. How much you need to retire at 55 will depend on how much you plan to spend in retirement. As a general rule of thumb, you’ll need 20x your unfunded retirement expenses in savings/pensions. For example, if your unfunded retirement expenses are £30,000 per year, you will need £600,000 in savings/pensions.

However, the earlier you start saving and investing, the earlier you’ll be able to retire. Working alongside a financial planner will help you work out if retiring at 55 is a possibility for you.

This article will show you how much you need to retire at 55.

What is a good pension pot at 55?

When people think about early retirement, they think about pensions. I’m often asked what is a good pension pot at 55? Or what is the average retirement age in the UK?

There is no such thing as a good pension pot at 55. It will depend on your personal circumstances and what you need from your pension pot.

Is it possible to retire at 55 with £500k pension pot? That depends. How much will you spend in retirement? If you’re spending £50k per year, chances are a £500k pot isn’t going to last very long.

For what it’s worth, the average UK pension pot at 55 is around £80,000. But this doesn’t tell you very much. I would go as far as saying that what someone else has in their pension has no relevance to your individual retirement.

Your retirement plans will be specific to you. How much you spend in retirement, and therefore how much you need in your pension pot, will be unique to you. No two retirements are the same. A good pension pot provides you with enough income to do everything you want.

To understand how to retire at 55, you first need to understand how much income you’ll need in retirement.

This will determine how much money you need to retire – and how much to save for retirement.

How much income do you need in retirement?

If you’re thinking about retiring at 55, the first question you need to ask yourself is “how much will I spend in retirement?”

This is the starting place for any retirement planning. This will determine how much you need in your pension pot to retire at 55, and how much you need to save to retire at 55.

If your answer is “I haven’t got a clue”, then take a look at your current situation.

- What do you currently spend each month?

- How is this likely to change once you retire? For example, will you spend more on travel but less on commuting?

- Are there any ‘one-off’ expenses, like repaying the mortgage or helping the kids?

Where possible, split out the ‘need to haves’ from the ‘nice to haves’. We call these ‘basic expenses’ and ‘leisure expenses.

To help you get started, you can download our one-page retirement expenses sheet.

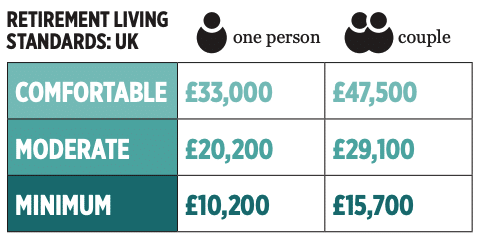

Whilst your retirement expenses will be unique to you, you may find some examples helpful. Research by Retirement Living Standards shows that on average a couple requires an income of £29,100 per year to sustain a moderate standard of living in retirement.

Where will your retirement income come from?

Once you know what you want to spend, the next question is how much income will you receive in retirement?

Broadly speaking, the money you receive in retirement will be made up of two parts, income and capital:

Income

Income is easy to work out. It’s the regular payments you receive into your bank accounts. It will include savings interest, dividends, State Pensions, rental income and any final salary pensions.

If you’re unsure how much State Pension you will receive, you can get an estimate of your state pension here

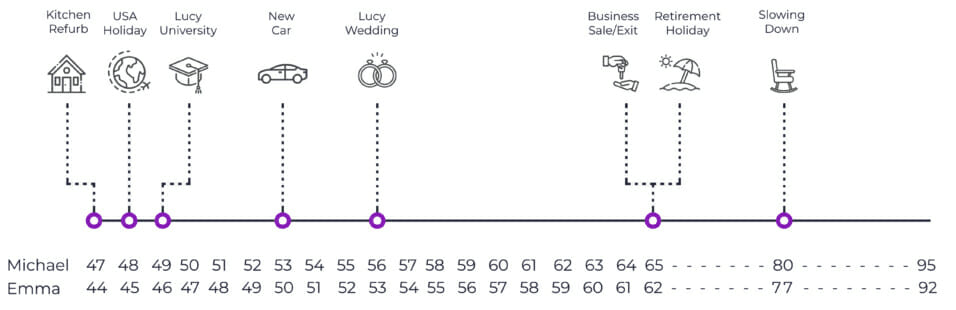

The challenging part is working out when the different incomes start and when they may stop. It will be useful to create a retirement timeline, showing all the different events:

When creating your retirement timeline, make sure to include any final salary pensions, but not any personal/workplace pensions. The former pays a guaranteed income for life, the latter is treated as capital – and should be treated separately. For more information about different types of pensions, check out our pension masterclass.

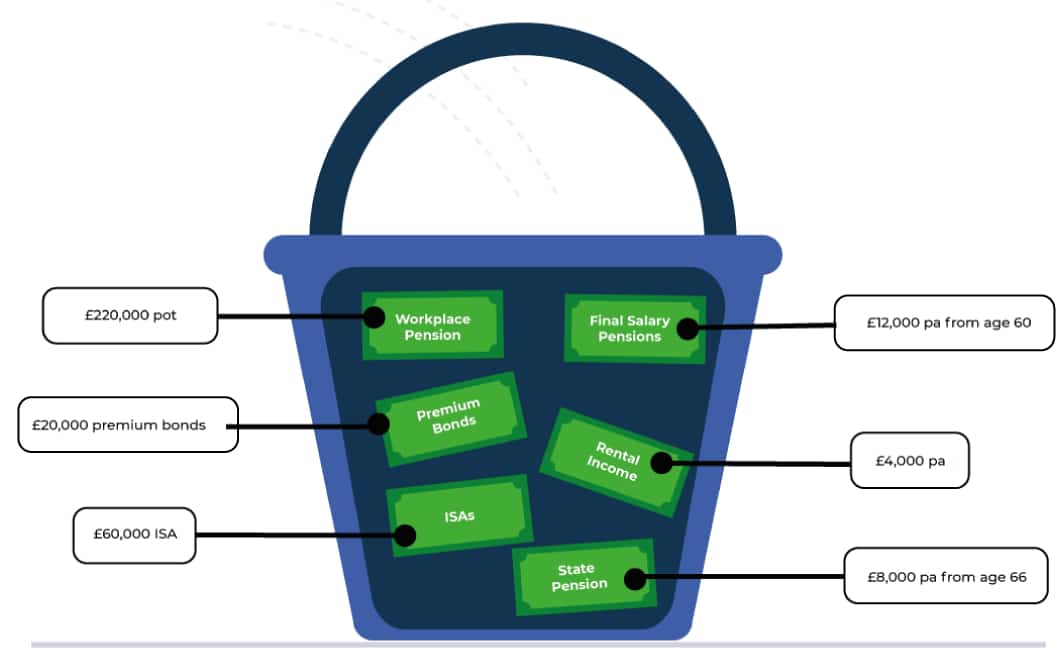

Capital

Capital refers to pots of money. This can include cash savings, ISAs, stocks and shares and pension pots. This is what people often mean when they say how much to retire at 55? They’re referring to how much money they need to have saved up to retire at 55.

Working out how much capital you can withdraw each year isn’t so easy. If you withdraw too much, you risk running out of money. Withdraw too little and you’ll get to the end without living the life you wanted.

Broadly speaking, you can withdraw around 4% of your capital each year without running out of money.

Income & Capital

Although income and capital come in different forms, they serve the same purpose, to provide you with an income in retirement. For the time being, simply get a list of all of your different ‘pots’, as shown below.

How much income will you receive if you retire at 55?

To find out how much income you’ll receive if you retire at 55, you will need to create a retirement income plan.

A retirement income plan is simply your income + capital combined to fund your retirement expenses.

This is where cash flow modelling comes in, it creates a forecast of your finances. It starts by working out how much you spend each year and then overlays this with the income you will receive. Once your income and expenses have been built in, the final step is to add your capital.

Your cash flow report will show you one of two outcomes, either you have enough money to retire at 55, or you don’t.

Do you have enough to retire at 55?

If you have enough to retire at 55, what are you waiting for? I recently met with a client who thought he needed to work for another 10 years.

By creating a retirement cash flow plan, I was able to show him that he can afford to retire at 55, and do all the things he wanted.

If you don’t have enough…

If you don’t have enough money to retire at 55, don’t panic! There are options available so that you can retire early. For example, you can:

1. Save a little more each year

3. Spend a little less in retirement

4. Get a higher investment return*

* By taking more investment risk. There is no guarantee that taking more risk will deliver a higher investment return.

How to retire at 55 without running out of money

To avoid running out of money after retiring at 55, you will need to consider going into an annuity or drawdown.

Annuity

The only way to retire at 55 and guarantee that you won’t run out of money is to purchase a pension annuity. That way, you’re certain that the income will never stop. However, pension annuities provide a pitiful income, and you will need a very large pension pot to do this. The alternative is to use a drawdown pension

Drawdown

A drawdown pension allows you to access your money more flexibly. You choose when to take it and how much you take. You’re in control, but if you spend too much too soon, you risk running out of money.

Regular reviews of your pension with an independent financial adviser can help eliminate that risk and ensure you stay on track.

Annuity vs Drawdown?

An annuity is a guaranteed income for life. The amount is usually fixed, though you can purchase one that rises with inflation.

The main advantage of using your pension to purchase an annuity is that you will receive a pension income for as long as you live.

The main disadvantage of using your pension to purchase an annuity is the low level of income you receive. For example, if you use your £100,000 pension to purchase an annuity at 55, you will receive just £1,722 per year. This assumes that the annuity increases each year and pays your spouse an income if you die.

A drawdown pension is very different. Your pension pot remains invested, and you draw on it as needed.

The main advantage of a drawdown pension is that you have complete flexibility over how much you withdraw. You can withdraw as little or as much as you like when you like.

The main disadvantage of a drawdown pension is that you can run out of money if you withdraw too much. Think of a drawdown pension like a bank account, if you withdraw too much, your balance will eventually hit £0.

What else do you need to think about?

Pensions and inflation: how much will prices rise?

For a while now, we have experienced low interest and low inflation rates. But those of you looking to retire at 55 will likely remember the high inflation of the 1980s. One of the biggest risks to your retirement income is that it won’t rise with inflation (the cost of living). As a result, your money will be worth less and less.

It’s difficult to appreciate the small but corrosive effect of inflation. Over a 30+ year retirement, a 2.5% pa inflation rate can have a huge impact.

For example, £5,000 of income in 1995 will need to have grown to around £10,000 in 2021 in order to keep pace with inflation.

So if your income doesn’t increase with inflation, it could mean living a low budget lifestyle in the future.

Some investments, such as inflation-linked bonds, are specifically designed to protect against inflation.

When creating your retirement income plan, an independent financial adviser will take these risks into account. They will help you work out the right balance between maximising income today whilst ensuring it is not eroded by inflation over time.

They will also create a withdrawal policy statement, which maximises how much income you can spend in retirement without the risk of running out of money. Click here to learn more about retirement income planning strategies.

How can we help you retire at 55?

Retiring at 55 is more than a date; it’s a milestone that requires careful, holistic planning. As award-winning independent financial advisers, we excel in creating retirement strategies that encompass more than just your pension. Our expertise lies in integrating your retirement goals with your overall financial picture, including investments, tax planning, and long-term wealth management.

At Frazer James, we don’t just focus on the ‘when’ of retirement; we dive deep into the ‘how’. Our clients have found peace of mind and confidence in their retirement plans, thanks to our bespoke approach and continuous support. Planning to retire at 55 is a journey, and we’re here to guide you through each step, ensuring your plan evolves with your life.

If you’re considering retirement at 55 and looking for a partner to help build and maintain a comprehensive retirement strategy, schedule your retirement consultation with us today. Let’s discuss how we can help you achieve a fulfilling retirement, ensuring every aspect of your financial life is aligned with your retirement plans.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Adviser Bristol.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602