Modified on: June 2024

The Impact of Investing Ethically

Investing ethically – the new normal?

Recent social outcry has brought millions to the streets, demanding changes to the way society is governed. Protests have erupted throughout America and much of Europe, with Edward Colston’s statue being pulled down in Bristol. The calls are for a fairer, more equal and more just world. Governments are being held to account and rightly so.

Whilst Governments set policies, it’s companies and institutions that make them happen. Regulation and legislation only get us so far, implementation is what drives change and makes the difference.

Which got me thinking, could ethical investing be the answer to some of the biggest challenges we face today?

What is investing ethically?

If you haven’t come across the term ethical investing before, you may have heard of impact investing or sustainable investing.

These are investment styles that incorporate environmental, social and governance (ESG) values into the investment process. They seek to make a positive impact on the world whilst balancing the objective of making an investment return.

The rise of ethical investing

What used to be a fringe activity is now a significant and growing part of the industry. There is now more than $31tn committed to sustainable investing, with that figure growing every day.

Driving this trend has been a change in consumer attitudes. In 2015, just 19% of people stated that they were “very interested” in sustainable investing. By 2019, that figure had jumped to 49%.

With more and more people ‘voting with their money’, companies have taken notice. Many have signed up to the UN Sustainable Development Goals and are committing resources to issues such as clean water and clean energy.

Even traditionally polluting industries, such as oil, gas and energy are taking notice. For example, energy supplier SSE is a leading provider of renewable energy and aims to reduce its carbon footprint by half by 2030.

The benefits of investing ethically

Aligning your money with your values is one of the key benefits of investing ethically. By investing money in causes that you care deeply about, you are creating positive change.

You are also acting as a catalyst for change. As more money is invested in companies with sustainable business practices, less money goes to the traditional polluters.

It’s reasonable to assume that over the long-term, socially responsible companies are likely to perform better than their traditional counterparts. A company that looks after its customers and treats its staff well is more likely to be around in ten years than one with sharp business practices.

Does investing ethically result in lower investment returns?

Whilst ‘doing good’ is an important part of ethical investing, it’s only part of the picture. Most people invest their money with the aim of growing it. There are some concerns that by investing ethically, you will get a lower investment return.

However, there’s no evidence that investing ethically results in lower investment returns. In fact, there is a growing body of evidence that investing ethically may actually improve your investment returns.

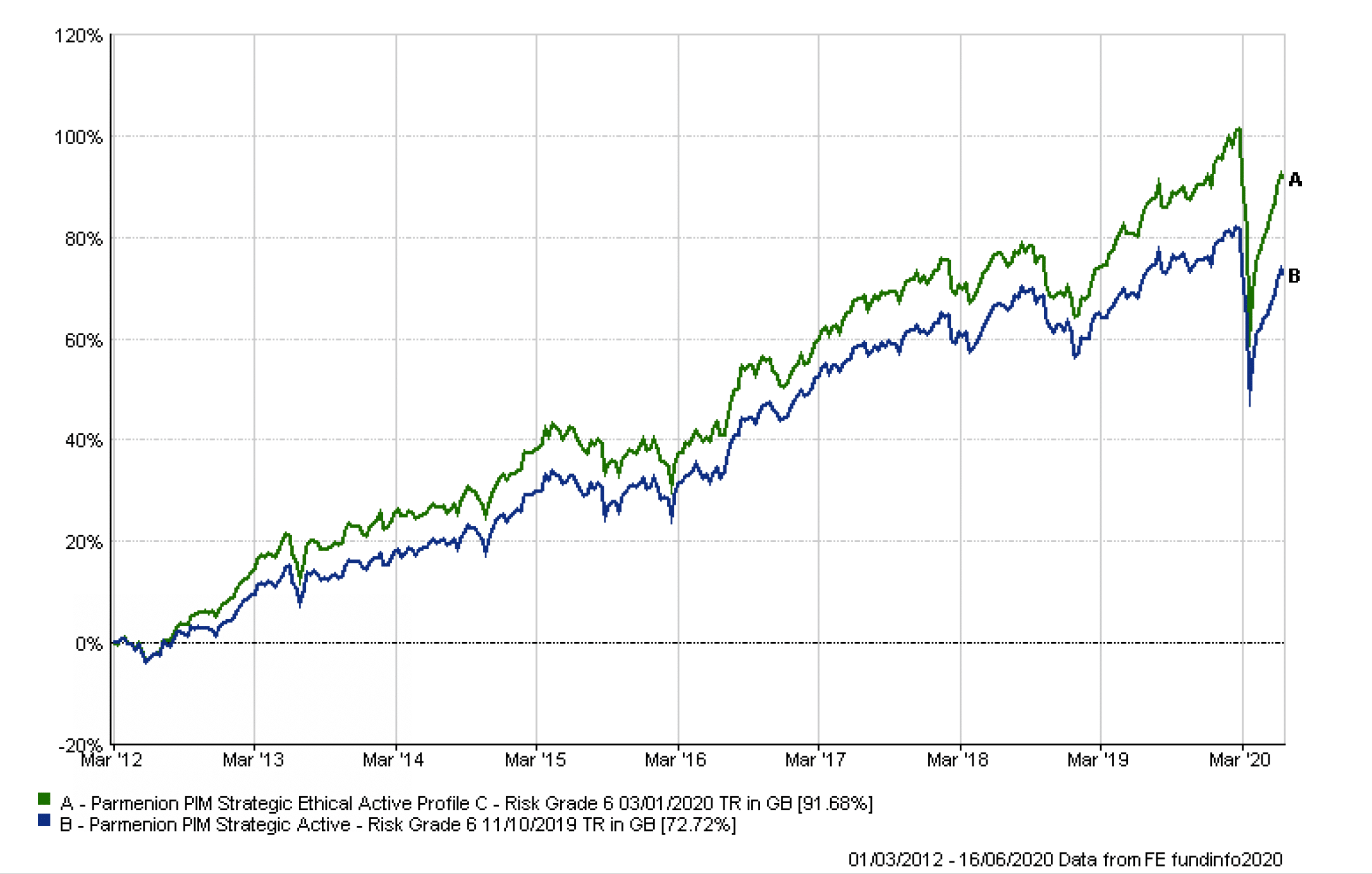

The below chart compares to investment portfolios that take the same level of risk. It shows that the ethical portfolio has delivered a higher investment return over time.

Of course, this is just a snapshot in time, comparing one portfolio with another. However, there is a growing body of research showing that there is no evidence that ethical investments underperform more conventional investments.

How to invest ethically

If you’re interested in investing ethically, there are a range of options available. The problem may be that there are too many options!

To narrow down the list, you want to start with asking yourself what’s important to you. Ask yourself, what are your hopes and fears for the world? What change do you want to see in your lifetime?

There’s no right or wrong answer. For one person, achieving net-zero carbon may be the most important thing, for someone else it could be stopping forced child labour.

Once you identify what’s most important to you, the next step is to find investments that support these areas.

How to find ethical investments

Broadly speaking, there are two approaches, you can either invest only in businesses that support your chosen area, or you can specifically avoid businesses that are damaging to these areas. This is what the investment industry calls ‘positive screening’ and ‘negative screening’.

You can use research tools like FundEcoMarket to identify funds which meet your ethical criteria. Alternatively, you can work with a financial advisor to help you identify which investments are suitable.

Just make sure to do your research before investing. Some companies have been accused of ‘greenwashing’, giving the impression that they are more ethical than they really are.

You will, of course, need to check to make sure the investment meets your risk profile and has delivered good investment performance.

Free ethical investment guide

If you want to know more, download our free ethical investment guide

It shows you how to invest your money to make a positive impact in the world whilst generating an investment return.

Initial consultation

If you would like a little more help, you are welcome to schedule an initial consultation with an experienced, ethical investment adviser.

All the best,

James Mackay, Independent Financial Adviser in Bristol

.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor Bristol, Clifton.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602