Modified on: July 2024

Maximising Retirement Wealth – A Guide for Business Owners

Maximising Retirement Wealth – A Guide for Business Owners

As business owners in the United Kingdom approach retirement, the complexities of financial planning become increasingly paramount. Retirement is not merely a transition; it’s a new phase of life that demands meticulous planning and strategic foresight. At Frazer James, we provide business owners with their own Personal Wealth Plan.

This article aims to guide you, a business owner on the cusp of retirement, through the nuances of strategic tax planning, thoughtful retirement planning, and intelligent investment management.

The Unique Financial Landscape of Business Owners

Every business is different. So, it is no surprise that every business owner’s financial landscape is different. It comes with a unique set of challenges and opportunities. Here are a few:

- Fluctuating income – unlike a salaried employee, your income will depend on company profits, which are not guaranteed. This makes long-term financial planning difficult, even at the most stable of times.

- Retirement planning – unlike a salaried employee, no generous company pension contribution is paid on your behalf. It’s your responsibility to provide for retirement.

- Concentration risk – chances are, the majority of your wealth is tied up in one asset: your business. You’re “all in”, financially and emotionally. When things are good, they’re great. When they’re bad, they’re awful.

However, having control over your destiny provides opportunities for intelligent tax planning and thoughtful retirement planning.

Strategic Tax Planning for Retirement

As you begin retirement, your financial focus shifts from building wealth to managing it. Unless managed carefully, your single largest expense will be your tax bill. By structuring your income and assets tax efficiently, you can reduce how much you pay in tax and increase how much you receive in retirement.

- Income Tax: One critical aspect of this planning involves tax-efficient withdrawal strategies. How you withdraw funds from your pensions and investments isn’t just a matter of timing; it’s a deliberate decision that influences your annual tax liability. In the UK, understanding the thresholds of various tax bands is essential.

- Capital Gains Tax: If your retirement strategy includes the disposal of assets like property or stocks, careful timing and planning can leverage the annual capital gains tax allowance, minimising or even nullifying your liability.

- Inheritance Tax: Strategies like gifting assets during your lifetime or setting up trusts can significantly reduce the inheritance tax burden on your estate, ensuring more of your wealth is passed on to your heirs as intended.

In summary, the intricacies of tax planning in retirement are multifaceted. They require a comprehensive understanding of tax laws and a keen eye on how they apply to your unique financial situation. A nuanced approach to retirement income withdrawal strategies and asset management can lead to substantial tax savings, making the most of your retirement funds.

Comprehensive Retirement Planning for Business Owners

Every aspect of your strategy should encapsulate every facet of your financial life – from pensions and investments to the proceeds from the potential sale of your business. The key is to create a holistic plan that reflects your current financial status and anticipates future needs and goals.

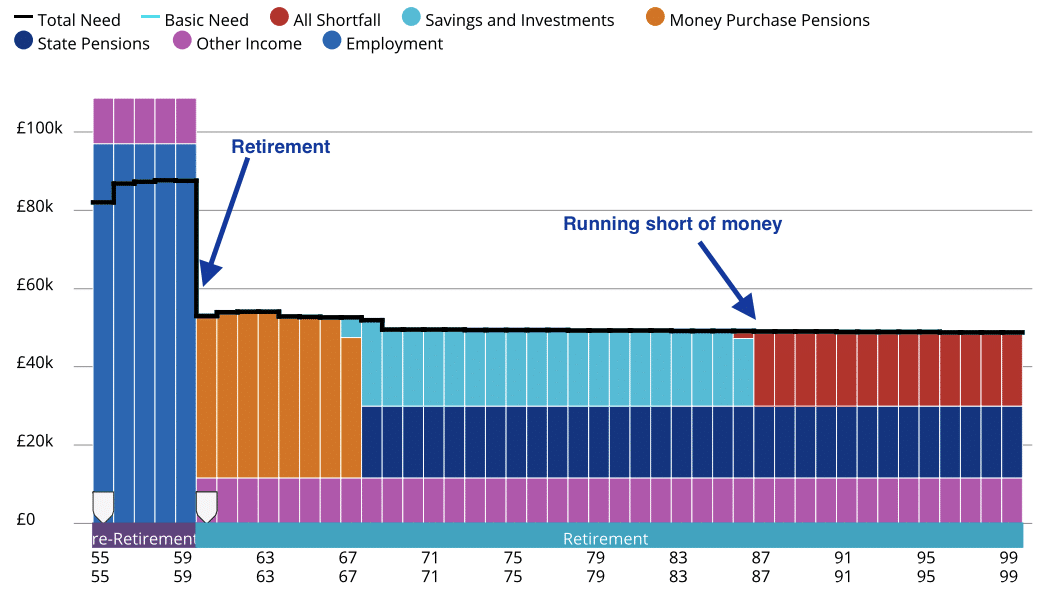

Central to this process is cash flow planning. By mapping out your expected income streams and expenditures over time, you can visualise the trajectory of your finances in retirement. This includes regular pension withdrawals, potential investment income, and lump-sum payments from selling business assets.

Cash flow planning offers a realistic view of your financial future, highlighting periods of surplus and potential shortfalls. It’s like a financial roadmap, guiding you through each retirement phase and helping you make informed decisions about spending, saving, and investing.

Cash flow planning provides your finances with a dynamic framework that can adapt to changing circumstances and market conditions. The economic landscape can shift, as can personal circumstances such as health, lifestyle choices, and family needs. Your retirement plan should be robust enough to withstand market volatility and personal changes. This adaptability is crucial in ensuring that your financial security remains intact, no matter what life throws your way.

A thorough retirement plan is more than a set of financial strategies; it’s a living document that evolves with you. It’s about preparing for the expected while being agile enough to navigate the unexpected. By encompassing all aspects of your financial life and allowing for adjustments, you can ensure a financially secure retirement aligned with your personal aspirations and lifestyle choices.

Investment Management in Retirement

As you transition into retirement, managing your investments becomes pivotal to ensuring a stable and prosperous future. It’s not just about having wealth; it’s about sustaining and utilising it effectively throughout your retirement years. This stage calls for a strategic shift in your investment approach, aligning it with the new priorities and risks of retirement.

Traditionally, the focus during your earning years might have been on growth-oriented investments — stocks, high-yield bonds, or business ventures — aimed at building your wealth. However, as you retire, the emphasis gradually shifts towards income-generating investments. The goal here is to create a steady stream of income that can support your lifestyle without eroding the principal. Investments in dividend-paying stocks, bonds, annuities, or even rental properties can provide this consistent income, balancing the need for immediate returns with long-term security.

Another critical aspect to consider is the change in your risk tolerance. As a retiree, your capacity to recover from significant market downturns diminishes. This reality necessitates a more conservative investment strategy compared to your earlier years. It’s about finding the right balance between risk and return — ensuring enough growth to combat inflation and maintain your lifestyle while minimising the risk of substantial losses.

Effective investment management in retirement involves regular portfolio reviews and adjustments. As market conditions fluctuate and personal circumstances evolve, so should your investment strategy. This approach helps preserve your capital and capitalise on opportunities that align with your changing risk appetite and income needs.

Ultimately, successful investment management in retirement is about creating a balance — ensuring a steady income to support your lifestyle while preserving enough capital to keep up with inflation and unforeseen expenses. This balanced approach paves the way for a financially secure and fulfilling retirement.

Case Study – John’s Retirement

Consider the case of John, a former business owner who effectively transitioned into retirement. John’s financial plan involved a phased sale of his business, which not only provided him with a substantial lump sum but also allowed him to reduce his working hours gradually. His investments were strategically rebalanced to focus more on income generation and less on aggressive growth. This shift ensured a steady income stream while protecting his capital. John’s retirement plan also included a tax-efficient withdrawal strategy that maximised his pension benefits while keeping his tax liabilities to a minimum.

John’s situation underscores the value of personalised, well-thought-out financial planning. It highlights how different strategies — from business exit planning to investment rebalancing and tax efficiency — can combine to create a successful and secure retirement.

Choosing the Right Financial Planner

Selecting a financial planner adept in business owner retirement planning is crucial. Seek a professional who specialises in working with business owners and understands their unique financial challenges. Their expertise in these areas ensures more informed, specialised strategies.

Personalised service is vital. Your financial situation is distinct, requiring customised financial advice rather than generic solutions. To offer tailored guidance, a planner should understand your goals, risk tolerance, and financial background.

Qualifications are important. Look for credentials like Chartered Financial Planner or Certified Financial Planner (CFP), which signify expertise and dedication to the field.

Verify their effectiveness through references or reviews, especially from other business owners. This will give you insight into their track record and client satisfaction.

The Personal Wealth Plan for Business Owners

Our “Personal Wealth Plan” service is tailored to meet business owners’ unique financial situations. Here’s a brief overview of how it can benefit you:

- Comprehensive Financial Assessment: We conduct a thorough evaluation of your financial situation, taking into account your business equity, income, and assets.

- Individualised Strategy: Based on your assessment, we craft a personalised financial strategy to optimise your wealth, including income diversification, tax planning, and asset management.

- Retirement Readiness: We ensure you’re well-prepared for retirement, aligning your strategy with your retirement goals, whether it’s a smooth exit, family succession, or selling to a third party.

- Regular Updates: Our service provides ongoing support, with regular reviews and adjustments to adapt to changing circumstances and market conditions.

- Peace of Mind: With the “Personal Wealth Plan,” you can face retirement with confidence, knowing your financial future is secure and tailored to your unique circumstances.

Schedule an initial consultation with one of our expert retirement planners to see if the Personal Wealth Plan is right for you.

Secure Your Financial Future

Effective retirement planning for business owners is a multifaceted process that demands careful consideration and strategic planning. From understanding the unique financial landscape of business ownership to implementing tax-efficient withdrawal strategies and adapting investment approaches, each step is crucial in securing a financially stable retirement. The importance of personalised, adaptable financial planning cannot be overstated, especially in navigating the complexities that come with transitioning from a business owner to a retiree.

As you approach this significant milestone, remember that the right guidance can make all the difference. We encourage you to reach out for a personalised financial planning session. Our team specialises in helping business owners like you create a retirement plan tailored to your needs and adaptable to the ever-changing financial landscape. To start your journey towards a secure and fulfilling retirement, schedule your Retirement Strategy Session today.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Adviser based in Clifton, Bristol.

About us: Frazer James Financial Advisers is a financial advisor in Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, retirement advice, investment advice, inheritance tax planning and insurance advice.

If you would like to talk to a Financial Adviser, we offer an Initial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing but not personal advice. If you’re not sure which investments are right for you, please request advice. Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602