Modified on: August 2024

How much do I need to retire at 50?

How much do I need to retire at 50?

Retiring at 50 is an ambitious and exciting goal, but it raises a critical question: How much do you need to retire at 50? This blog post will walk you through the essential steps to achieving a comfortable early retirement in the UK, allowing you to enjoy life on your own terms.

Retiring at 50 opens up a world of possibilities while you’re still in good health. Common reasons for early retirement include the desire to travel, pursue personal interests, or spend more time with family and friends. It gives you the freedom to live the life you’ve always imagined, but how do you make it happen?

The key questions are: How much money do you need to retire at 50? How much should you save for retirement? What is a good pension pot at 50, and how much income will you require? This article will provide you with practical advice on how to retire early in the UK.

How much money do you need to retire at 50?

A general rule of thumb for retirement savings is to aim for 25 to 30 times your annual expenses. If you expect to spend £40,000 a year in retirement, you’ll need between £1,000,000 and £1,200,000 saved across pensions, investments, and other assets.

However, this amount will vary depending on additional income sources like rental income, investments, or part-time work. For instance, if you expect to receive £10,000 annually from other sources, you would need to fund £30,000 from your retirement savings, requiring a pot of £750,000 to £900,000.

Curious about your specific retirement needs? Schedule a consultation with a retirement planning specialist to get a tailored plan for your early retirement.

How much income do you need to retire?

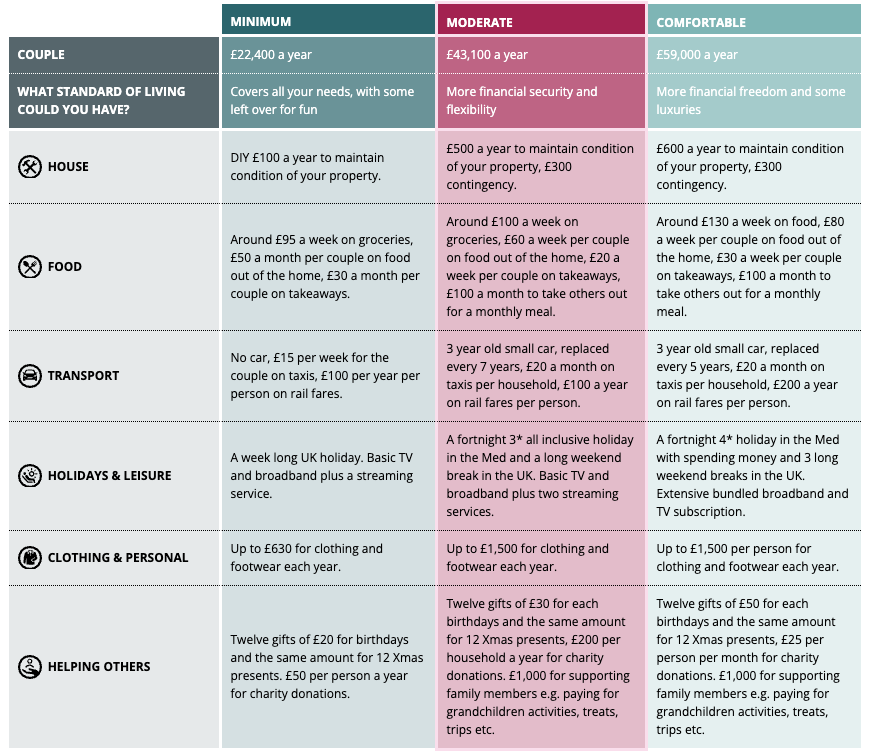

The amount of income you need to retire at 50 depends on your lifestyle choices. The Retirement Living Standards suggest that a couple needs at least £22,400 annually for a basic retirement, £43,100 for a moderate retirement, and £59,000 for a comfortable retirement. However, these figures are just guidelines—your actual expenses will likely differ.

Your personal retirement costs

It’s crucial to personalise your retirement budget. While benchmarks are helpful, they don’t account for your unique situation. Start by assessing your current expenses. For example, if you currently spend £3,000 a month, this figure might change in retirement depending on factors like travel, hobbies, or downsizing your home.

Consider the following:

- Will you spend more on travel or hobbies?

- Will commuting costs decrease?

- Do you plan to relocate or downsize?

To help you plan, we’ve created a free one-page retirement expenses sheet. This tool will give you a clear overview of your expected retirement spending.

Download one-page retirement expenses sheet.

Where will your retirement income come from?

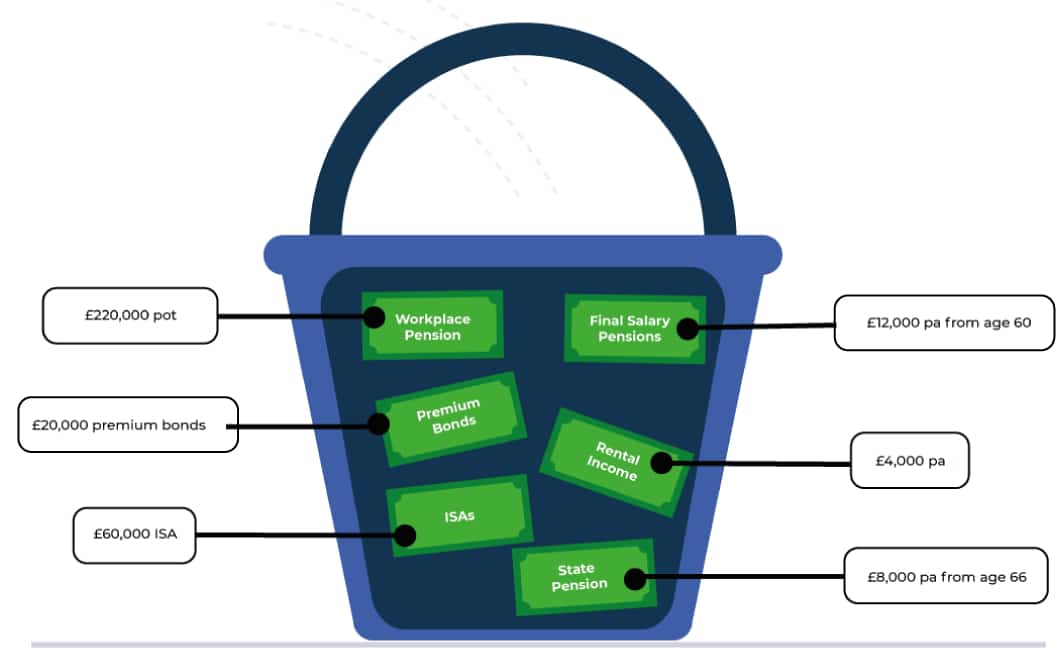

Once you understand your retirement expenses, the next step is identifying your income sources. Your income in retirement typically comes from two sources: income and capital.

Income

Your retirement income might include savings interest, dividends, rental income, and any pensions. For those retiring at 50, it’s important to remember that you won’t have access to your State Pension until later, so your savings will need to bridge the gap.

Capital

Your capital includes pensions, savings, and investments. You can withdraw a portion each year to supplement your income, but be cautious—overdrawing can lead to running out of money. If you’re retiring at 50, you might aim to withdraw 3-4% of your capital annually to ensure it lasts.

How to create a retirement income plan?

Creating a solid retirement income plan involves combining your income and capital to meet your financial needs.

Income + Capital = Your Retirement Plan

While you can create a basic retirement plan in Excel, it might not account for all variables like taxes or one-off expenses. Ideally, you should use cash flow modelling software, which provides a comprehensive view of your finances over time, helping you determine if your savings will last through retirement.

To see an example of a personal retirement report, click here.

Need help working out whether you have enough money to retire? Book in for a retirement review today.

What if you already have enough to retire at 50?

If you’re ready to retire at 50, congratulations! You’ve worked hard, saved diligently, and are now in a position to enjoy the fruits of your labour. However, even if you have enough to retire, it’s worth getting a second opinion to ensure your plan is solid. A retirement review can confirm that your assets will sustain your desired lifestyle.

What if you don’t have enough to retire at 50?

If your current savings aren’t sufficient, don’t worry—there are strategies to help you reach your goal:

- Increase your savings rate: Boost your contributions to your pension or other savings.

- Delay retirement: Working for a few more years can make a significant difference.

- Reduce spending: Cut back on non-essential expenses to increase your savings.

- Seek better investment returns: Consider taking more investment risk for potentially higher returns, though this comes with no guarantees.

How to avoid running out of money?

To avoid running out of money, consider purchasing an annuity, which provides a guaranteed income for life. While annuities offer security, they often provide lower returns, so you’ll need a large pension pot to generate sufficient income.

Alternatively, you can opt for flexible drawdown, allowing you to control how much you withdraw each year. However, this approach requires careful management to avoid depleting your funds too quickly. Regular reviews with an independent financial adviser can help ensure your retirement savings last.

Annuity vs Drawdown – which is better?

Choosing between an annuity and a flexible drawdown depends on your circumstances:

- Annuity: Provides a guaranteed, stable income but may offer lower returns.

- Drawdown: Offers flexibility and control over your withdrawals but carries the risk of running out of money.

Many people find that a combination of both options works best. An independent financial adviser can help you determine the right balance for your retirement needs.

How can we help you retire at 50?

At Frazer James, we specialise in retirement planning, helping clients achieve their goals with confidence. Our award-winning team will work closely with you to assess your readiness to retire at 50 and create a personalised plan to suit your aspirations.

Interested in learning more? Watch our client testimonials to see how we’ve helped others achieve their retirement dreams.

Schedule your retirement consultation

If you’re considering retiring at 50, schedule a personalised consultation with us today. This one-on-one session will help you understand your retirement options and ensure you’re on track to meet your goals.

Click here to schedule your retirement consultation.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor in Bristol, Clifton. About us: Frazer James Financial Advisers is a financial adviser in Bristol. As an independent financial adviser, we can provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice. If you want to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602. Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB. This article provides information about investing but not personal advice. If you’re not sure which investments are right for you, please request advice. Remember that investments can go up and down in value; you may get back less than you put in.

About The Author

Frequently Asked Questions

1. How much money do I need to retire at 50?

2. How much income will I need to retire comfortably at 50?

3. What is a good pension pot at 50?

4. How do I calculate my retirement expenses?

5. What are my income sources in early retirement?

6. How do I create a retirement income plan?

7. What if I already have enough to retire at 50?

8. What if I don’t have enough to retire at 50?

9. How can I avoid running out of money in retirement?

10. Which is better: annuity or drawdown?

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602