Modified on: June 2024

RSUs – A tech employee’s guide to restricted stock units

What are Restricted Stock Units (RSUs)?

Restricted stock units (RSUs) are a form of employee equity compensation. It is a promise from your employer to give you shares in the company in the future. RSUs are a popular form of compensation at large technology companies, including Microsoft, Amazon, Intel and Google.

Over time, RSUs can become a significant part of your overall income and net worth. So, it’s critical to understand how they work, how they are taxed and have a strategy for managing them.

How do RSUs work?

RSUs are awarded to employees at critical events. Many large technology companies, including Microsoft and Google, provide new employees with RSUs when joining the company. They may also be awarded annually or depending on company performance. They are similar but distinctly different to Company Share Schemes.

With RSUs, there are two key dates to remember: the grant date and the vesting date. The grant date is when the RSU is awarded. The vest date is when the RSU becomes available and can be sold. Typically, RSUs vest in tranches rather than all at once.

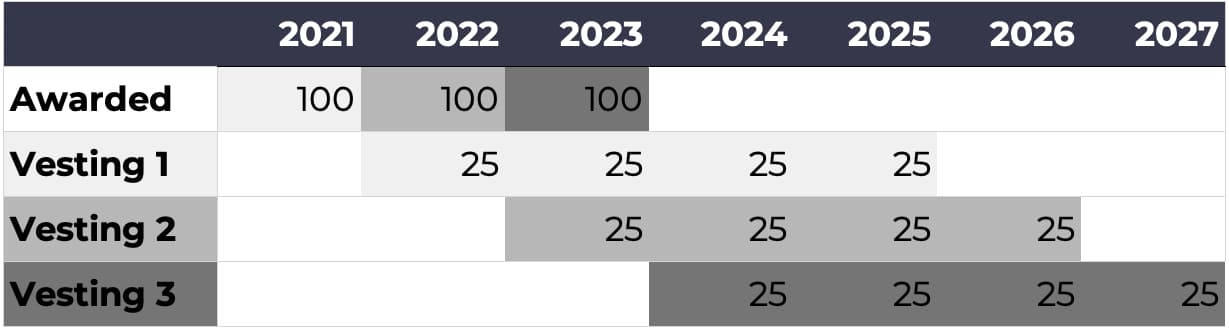

For example, assume that you start working at Microsoft in January 2021. You are provided 100 restricted stock units with a four-year vesting period when you join the company. Each year, 25% of the RSUs are vested. You are awarded an additional 100 restricted stock units every year after that.

In this example, 25 shares will vest after one year, 25 after the second year and so on.

For each additional year you work for the company, you are awarded 100 restricted stock units. This creates a ‘vesting cliff’, meaning a year contains multiple vesting periods.

How are RSUs taxed?

If you’re looking for an RSU tax calculator for the UK, I’m afraid there isn’t one. There are too many variables to create a ‘one-size-fits-all’ RSU tax calculator for UK employees. The exact tax treatment will depend on your financial circumstances, how your employer has set up the RSUs, and the vesting schedule.

In all cases, there is no tax to pay when RSUs are granted. You only pay tax on RSUs when they vest. The UK tax treatment for RSUs is similar to how your salary is taxed. When your RSUs vest, you will pay income tax and employee national insurance. You may also need to pay for employers’ national insurance. Employers can pay this themselves or transfer the liability to you.

If you are liable for employer national insurance, you must deduct this from the RSU vest value when working out your income tax. Confusingly, you don’t deduct the employer’s national insurance when working out your employee’s national insurance (reference).

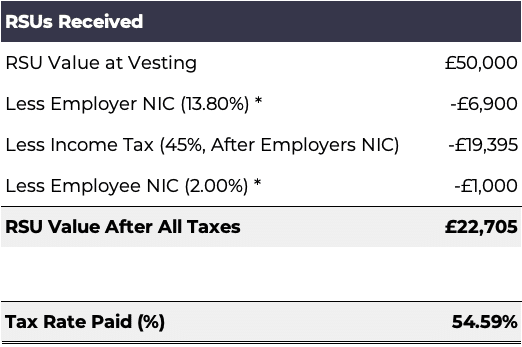

The below example calculates the tax you will pay when your RSUs vest. It assumes that you earn a salary of £150,000, receive RSUs of £50,000 and are liable for paying employers’ national insurance.

It shows that after paying all taxes, you will be left with just £22,705 from RSUs worth £50,000.

In most circumstances, the tax will be paid before you receive the shares (i.e. you will receive the net amount after withholding taxes).

* Income tax/national insurance rates correct as of tax year 2023/24.

How can I reduce tax on RSUs?

One way to reduce how much tax you pay on RSUs is by making pension contributions. This is because paying into a pension reduces your ‘adjusted net income’, reducing your tax bill and potentially your overall tax rate.

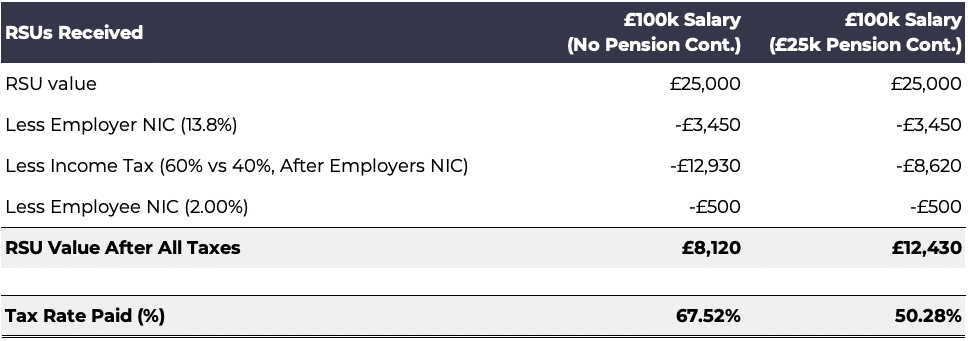

For example, assume you earn £100,000 and receive RSUs of £25,000. This gives you a total income of £125,000. Because the RSUs push your total income above £100,000, you will pay 60% income tax on the RSUs.

This is known as the 60% tax trap. For every £2 you earn above £100,000, your Allowance is reduced by £1. This means that in addition to paying the normal 40% tax, you also pay an additional 20% tax on income that was previously tax-free, resulting in a total tax rate of 60%

You can avoid paying this 60% tax charge by making a pension contribution. If you pay £25,000 into a pension, for tax purposes, you will have earned £75,000 and receive RSUs of £25,000. This gives you a total income of £100,000 and means you will avoid paying the 60% tax charge.

The below table shows that by paying £25,000 into a pension, you will save £4,310 in taxes/NI.

Do I pay capital gains tax on RSUs?

Once RSUs vest, you can sell the shares immediately. There will be no additional taxes to pay if you do this. However, if you decide to hold onto the shares, you may pay capital gains on RSUs.

If the value of the shares increases between when they vest and when you sell them, you will have made a capital gain. Depending on how significant the gain is, you may need to pay capital gains tax.

Everyone has an annual capital gains tax allowance. Up until 2022/23, the capital gains allowance was £12,300. However, from 2023/24, it will be reduced to £6,000 and will reduce again in 2024/25 to £3,000 per person. If the gain exceeds this, you will pay capital gains tax at 20% if you’re a higher rate taxpayer (10% for basic rate taxpayers).

Side note: capital gains receive very favourable tax treatment under current legislation. The top rate for capital gains is 20%, compared to 45% for income (or 60% if caught in the tax trap). The Chancellor is considering increasing the capital gains tax rate, potentially aligning it with income tax.

How can I minimise capital gains tax on my RSUs?

There are two ways to minimise capital gains tax.

- Sell the shares immediately upon vesting. This ensures that there is no gain to tax. If you still want to hold the shares, you could buy them back in a stocks and shares ISA. This ensures that future growth is tax-free (although you may still pay withholding taxes, mainly if the shares are held in a US company). If you hold the shares within a SIPP, any future growth is tax-free, and no withholding tax will apply (assuming that your pension administrator has set it up correctly!).

- Transfer some of your RSUs to your spouse. This is particularly useful if you have accrued large gains on the shares since vesting. Thanks to the inter-spousal transfer exemption, there is no tax to pay when transferring shares to your spouse. Your spouse can then sell the shares using their capital gains tax allowance.

This enables you to sell double the shares before capital gains tax becomes payable.

What should I do with my RSUs?

For most people, the best thing to do is to sell their RSUs immediately upon vesting. At a minimum, this ensures they don’t build up a future capital gains tax bill.

But more importantly, it reduces the risk if things go wrong. By owning shares in your company, you are effectively doubling down on your employer. Think about it this way: if you were paid a cash bonus, would you invest it in your company shares? If the answer is no, you should probably sell your shares and invest elsewhere.

How can we help?

RSUs are just one piece of your financial puzzle, albeit an important one. At Frazer James, we recognise the importance of RSUs in your wealth strategy and offer expert guidance tailored to your unique situation.

Our approach goes beyond just managing RSUs; we consider how they fit into your overall financial landscape, including retirement planning, tax efficiency, and investment management.

Interested in understanding the full potential of your RSUs within a bigger financial picture? Feel free to schedule an initial consultation to discuss how we can align your RSUs with your wider financial goals, creating a cohesive strategy for your future.

All the best,

James Mackay, Independent Financial Adviser in Bristol

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Adviser Bristol, Clifton.

About us: Frazer James Financial Advisers is a financial advisor based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602