Modified on: June 2024

3 Steps to Financial Success (Part 1 – Budgeting)

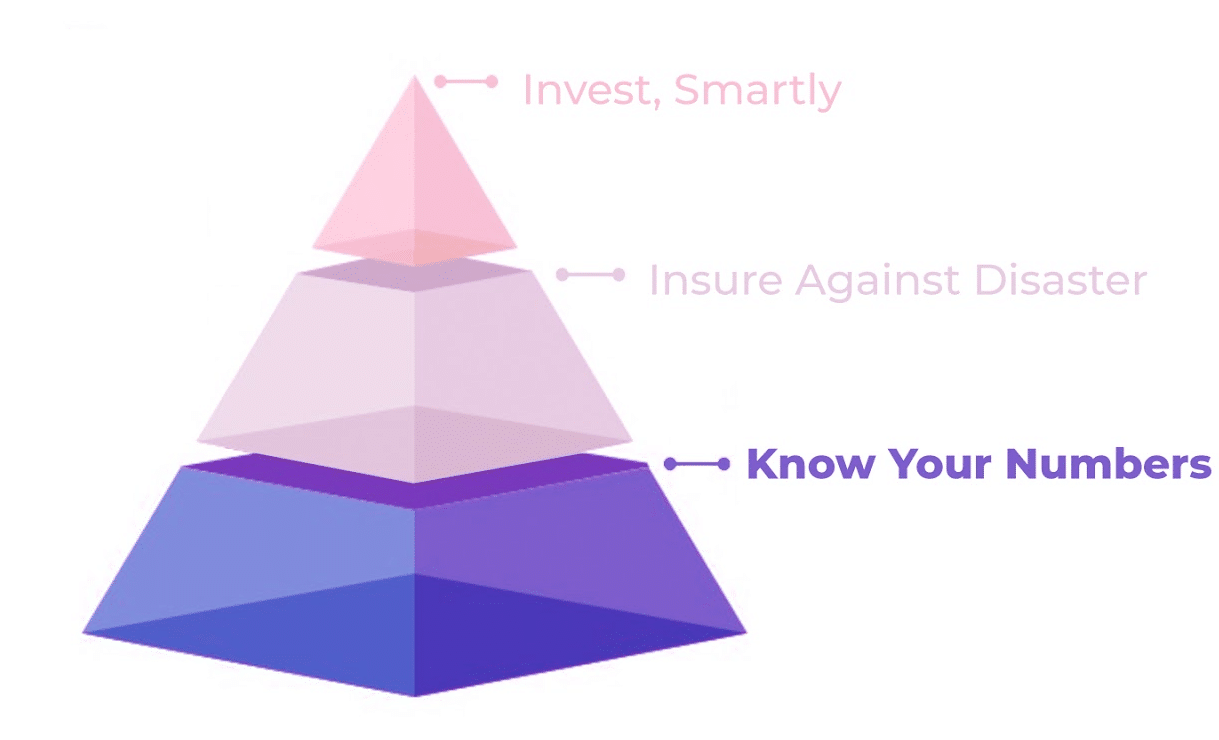

Knowing Your Numbers (otherwise known as budgeting), is part 1 of a 3 part series on how to achieve financial success.

For many, finances can be complicated. But they don’t need to be.

When we really break it down, financial success requires just three things:

…1. Knowing your numbers

…2. Insuring against disaster

…3. Investing wisely

These three simple steps provide a proven process for taking control of your finances and achieving financial success.

Knowing Your Numbers (aka budgeting)

Knowing your numbers is the first step to taking control of your finances.

It’s about understanding what’s coming in (income) and what’s going out (expenses).

I am of course talking about budgeting – the intentional act of telling your money where to go rather than wondering where it went.

It doesn’t matter how much you earn or how much you spend. What matters is how much is leftover and what you do with it.

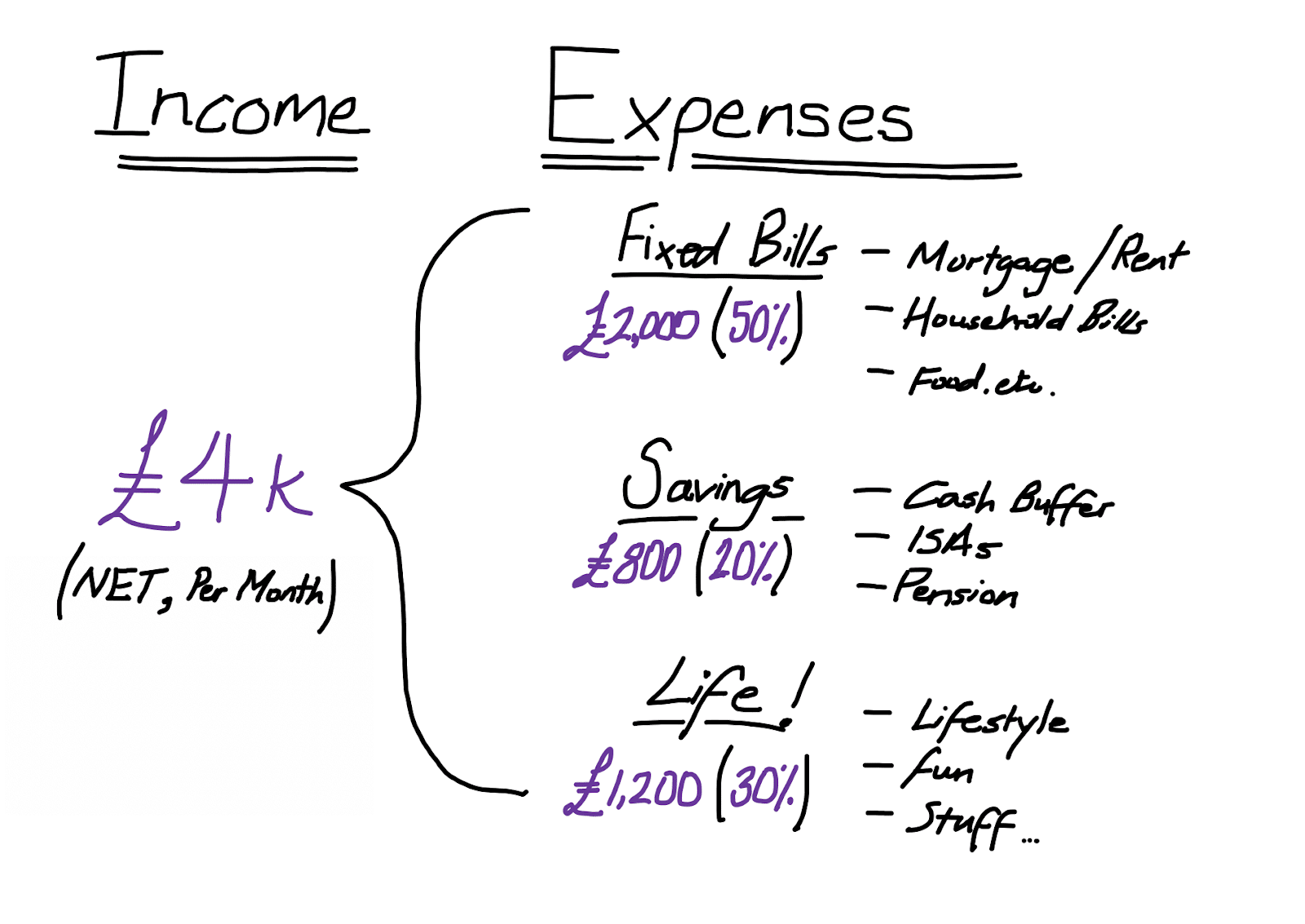

The “3 Buckets” Spending System

I’ve created the simplest (and only) budgeting system you will ever need.

To get started, grab a sheet of A4 paper and divide it into two.

…..On the left-hand side, write down how much money you make each month (don’t forget to take off tax).

…..On the right-hand side; write down how much your fixed bills are, how much you save and how much you spend.

How Much Should You Save?

The only number that’s important here is how much you save.

This isn’t an exact science, but 20% is considered to be the approximate amount you need to save to achieve financial success.

You might be looking at this and thinking “there’s no way I can save 20% of my income each month”.

Most people spend first and save whatever is leftover. By the end of the month, they’re lucky if they have anything leftover, nevermind 20%.

Smart spenders save first and spend whatever is leftover. They automate their savings by setting up standing orders at the start of each month. Whatever is leftover is spent.

Don’t get hung up if you can’t save 20%. When getting started, the habit of how you save is more important than what you save.

Your savings rate should be as high as possible, but life should be enjoyed in the present as well as the future, so finding a balance is important.

What Happens Next?

Knowing your numbers is the first step to achieving financial success. Keep it simple – take an A4 piece of paper and use the “3 Bucket” Spending System.

In a future article, I will cover step 2 of 3 – insuring against disaster.

As ever, if you want a helping hand, feel free to drop me a line.

All the best,

James Mackay, Independent Financial Adviser in Bristol

.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor Bristol, Clifton.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602