Modified on: June 2024

The benefits of getting financially organised

The benefits of getting financially organised

A lifetime of working hard and saving carefully often results in one thing, a filing cabinet full of paperwork and no real idea of what it all means.

After three months in lockdown, most of us have completed the ‘to do’ lists around the house. But very few of us have tackled that dreaded drawer of paperwork.

While there are plenty of companies that want to help you manage your investments, few are interested in helping you get financially organised and managing the paperwork.

I believe that getting and staying financially organised is an important but overlooked part of financial planning.

We do this both at the “macro” level (investment, pensions, insurances etc.) and at the “micro” level (budgeting, cash flow, statements).

To start with, we help clients understand what they’ve got and whether it can be improved. We then organise and simplify their finances, making them easier to manage and maintain

Clients come to us with a drawer full of statements and leave with a clear and concise picture of their financial lives. One piece of paper with all their important financial information.

Clients’ often tell us that this is the thing they value most. It brings order to their financial lives, giving them peace of mind.

How to get financially organised

The first thing to do is to write everything down. And by everything, I mean everything; current accounts, saving accounts, investments, pensions, property details, mortgages, insurance. The goal is to have a complete list of everything you own and everything you owe.

Once you have everything written down, the next step is to organise and simplify your finances. Ask yourself, what purpose are these accounts serving me? If you have several bank accounts, consider transferring them all to one provider, or reducing the number of accounts you have.

The same goes for pensions. If you’re like most people, you will have collected several different pensions along the way. You may want to consolidate your pensions, making them easier to manage.

How to stay financially organised

With your finances organised, the next step is to keep on top of them.

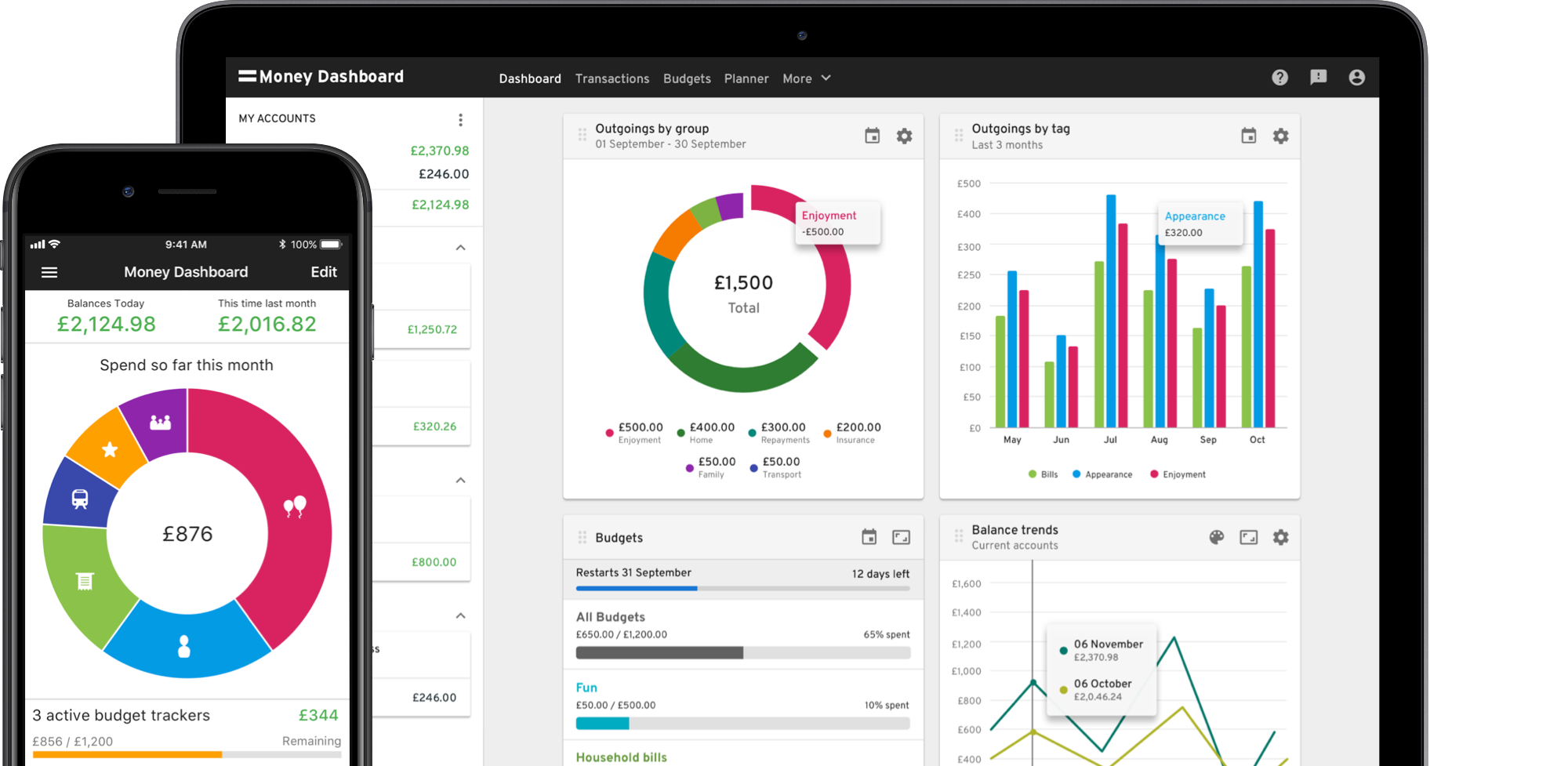

Fortunately, the days of manually logging into each savings/investment/pension account are long gone. New ‘account aggregator’ applications make the process of checking and reviewing your finances simple and easy.

For example, MoneyHub and MoneyDashboad allow you to see all of your finances in one place, making it easy to keep on top of your money. They provide an online website as well as an app for your phone, aggregating all of your accounts into one simple interface.

You’ll want to check your accounts on a regular basis. I suggest completing a monthly ‘check-in’ meeting to make sure everything stays up to date. You don’t need to do a full audit, you just need to make sure everything remains up to date.

Check when your mortgage is coming up for renewal, check when your insurance policies mature and make sure the beneficiaries for your pension remain up to date.

If you have taken out any new financial accounts, make sure to add these to the list and to remove any accounts that have either been closed or are transferred.

Make this year the year to get financially organised. Make it your New Years Financial Resolution if you have to. I promise it will be worth it.

If you want a hand getting financially organised, feel free to drop me a line.

All the best,

James Mackay, Independent Financial Adviser in Bristol

.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor Bristol, Clifton.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602