Modified on: July 2024

How much do I need to retire at 60?

Do you want to retire at 60?

I frequently get asked, “how much do I need to retire at 60?”, or “how much do I need to save to retire at 60?”

To retire at 60 is a goal that many people share, it allows you to enjoy life whilst you still have your health and fitness.

Some of the most common reasons for early retirement include going travelling and spending more time with family and friends. Early retirement means you can do the things you’ve always wanted to do, but never had the time before.

But how much do you need to retire at 60? How much should you save for retirement? What is a good pension pot at 60 and how much income will you receive in retirement?

If you’re thinking about retiring at 60, this article is for you. It will show you how to retire early in the UK. Not everybody wants to retire early, but anybody can do it. In this article, I will show you how.

What is a good pension pot at 60?

When people think about early retirement, they think about pensions. I’m often asked what is a good pension pot at 60? Or what is the average retirement age?

The average UK pension pot is £50,000, and the average pension income in the UK is £511 per week. But simply know what the average UK pension pot value is, or the average UK pension income doesn’t help you to retire early. It may sound trite, but what the average person has in their pension pot has no bearing on your individual retirement plans. At best, it’s irrelevant. At worst, it’s a distraction allowing you to retire early.

Ultimately, a good pension pot is one that allows you to retire early, and provides enough income for the rest of your life. Clearly, this depends on how much income you need. Likewise, how much to save for retirement is a function of how much you will spend in retirement. It’s situational – there’s no such thing as a good pension pot.

Instead of asking “what is a good pension pot?”, the question you should be asking is “how much do I need to retire?” This is a broader question that takes into account not only your pensions but your savings and investments too. It considers how much income you’ll need and whether you have enough saved up.

You will also need to consider any other income you will receive like the State Pension or any final salary pensions. Deciding what retirement lifestyle you wish to lead, will help you work out how much income you need.

How much money do you need to retire at 60?

As a general rule of thumb, you need 20 – 25 times your retirement expenses. So, if you spend £30,000 per year, you’ll need £600,000 – £750,000 in pensions, investments and savings to be able to retire.

However, most people will receive some form of income in retirement, whether that’s a State Pension, final salary pension, rental income or something else entirely.

Therefore, you’ll need to deduct this from any income you receive.

So if you spend £30,000 per year and receive a State Pension of £8,000 and a final salary pension of £2,000, the actual amount you need per year is only £20,000.

How much income do you need to retire?

How much you need to retire will depend on how much you want to spend in retirement. Clearly, the more you spend, the more you need to have saved up for retirement.

The ‘average’ retirement

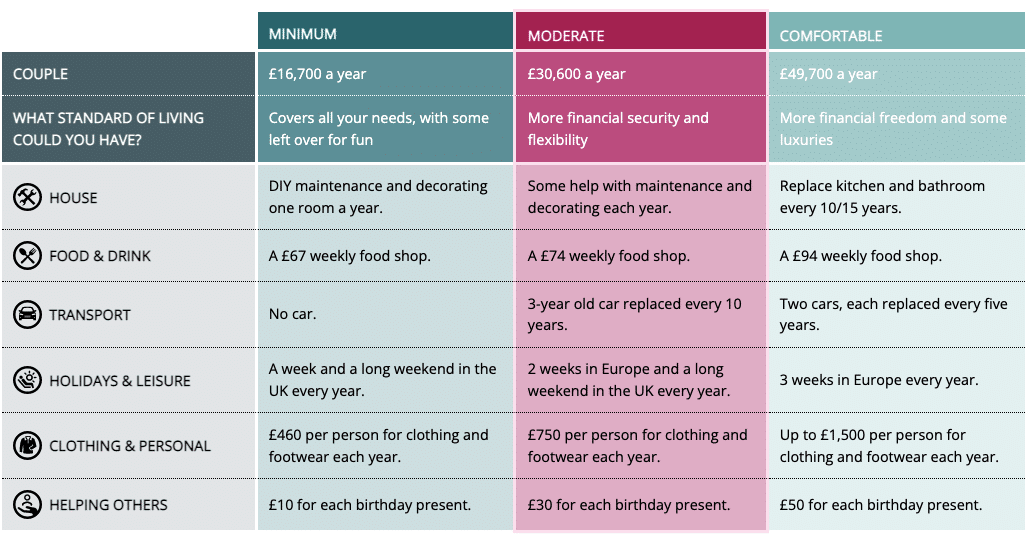

Research by the Retirement Living Standards provides three different examples. They find that for a couple, the minimum income needed to meet basic needs is £16,700 per year. As the quality of your retirement increases, so does the cost – with a comfortable retirement costing £49,700 per year.

Your individual retirement

Whilst the above example is helpful, it doesn’t necessarily reflect the cost of your individual retirement. You are not a statistical average. You are unique and the cost of your retirement will be unique to you.

You should instead calculate what your personalised retirement expenditure is likely to be. If you’re unsure where to start, then work out what you currently spend.

For example, if you earn £5,000 per month and have about £2,000 per month leftover, your expenses are probably around £3,000 per month. Once you know what you spend today, you need to ask yourself how this is likely to change once you are retired.

- Will you be spending more on travel and holidays?

- Will you be spending less on commuting?

- Will you buy a new car?

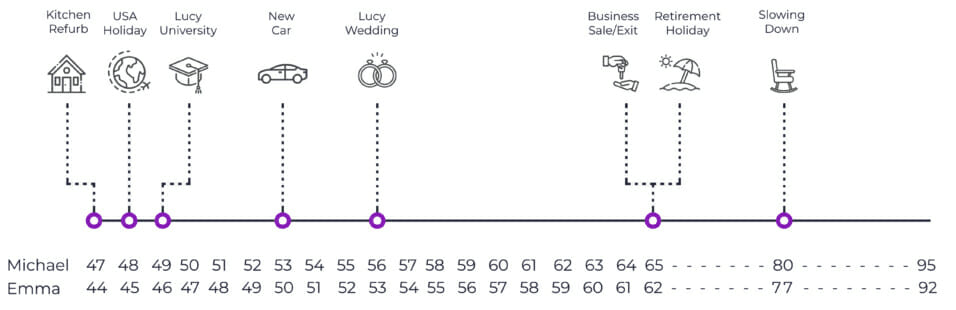

It will be useful to create a retirement timeline, showing all the different events:

Free retirement expenditure form

To help you get started, I’ve created a free one-page retirement expenses sheet. Completing this will give you an overview of how much you will spend in retirement.

Where will your retirement income come from?

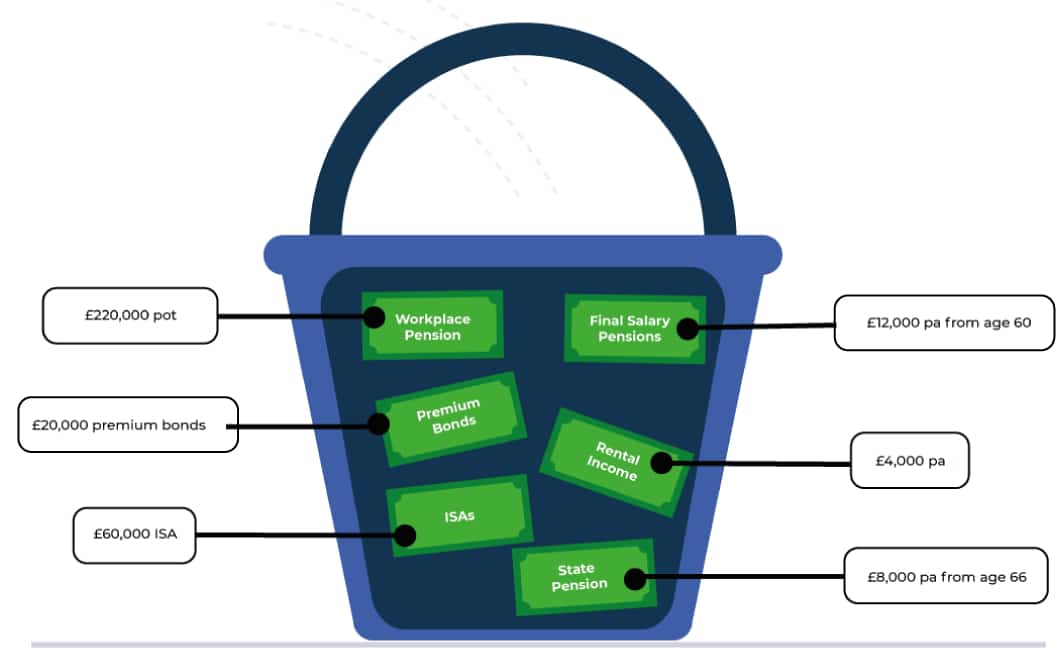

Now that you know what you will spend in retirement, the next question is where will the money come from? Your income in retirement will come from two places, income and capital:

Income

Your retirement income is the money paid into your bank account every month. It will include savings interest, dividends, State Pensions, rental income and any final salary pensions.

If you’re unsure how much State Pension you will receive, you can get an estimate of your State Pension online.

Bear in mind that different incomes will start at different times. If you’re looking to retire at 60, your State Pension may not be paid until 66 (or 67). Likewise, any final salary pensions may not be payable until 65. This is where the retirement timeline discussed above becomes helpful.

Capital

This is money that you have saved up. It will include savings, investments and pensions. You can withdraw some of your capital each month/year to top up your retirement income.

But you need to be careful. If you withdraw too much, you risk running out of money. If you’re looking to retire at 60, in most cases you can withdraw around 4% of your capital each year. If you withdraw more than this, then you may find that you run out too soon.

Income & Capital

Whilst income and capital look different, they serve the same purpose – to provide you with an income in retirement. For now, just get a list of all of your different pots, as shown below.

Need help working out whether you have enough money to retire? Book in for a retirement review today.

How to create a retirement income plan?

Now that you know what funds you have available, you will need to create an income plan for your retirement.

Quite simply, income + capital = your retirement plan

You can create a basic retirement plan using excel, however, this is likely to be limited. For example, it won’t take into account tax, or any one-off expenses, such as replacing the car or home renovations.

Ideally, you will want to cash flow modelling software. This will provide a big picture view of your finances, both now and in the future. It takes into account all of your financial information, to produce a forecast of your money over time.

Ultimately, it helps to answer “how much is enough”, giving you clarity and confidence around your retirement planning. It will provide a personalised retirement report, showing whether you have enough to retire.

What if I already have enough to retire?

If you already have enough to retire, what are you waiting for?

You’ve worked hard, saved prudently and spent modestly. You’ve now got enough income and capital to retire at 60.

Don’t be like the couple I recently met, who carried on working until they were 65. By completing a cash flow report, I showed them not only could they afford to retire now, but they could have retired at 60 (5 years ago!).

Book a retirement review now to see if you could retire at 60.

What if I don’t have enough to retire?

Don’t worry if you haven’t got enough money to retire; there are several ways you can increase your retirement pot.

- Saving a bit more each year

- Retiring a few years later

- Spending a little less each year

- Getting a better investment return*

- Taking your final salary pensions early

* By taking more investment risk. There is no guarantee that taking more risk will produce a higher investment return.

Schedule a retirement consultation today to discuss your retirement options

How to retire at 60 without running out of money?

If you want to retire at 60 with the guarantee of never running out of money, you need to purchase an annuity. An annuity provides you with a guaranteed income for life. It’s the only way you can be certain that the income will continue forever.

But the problem is, pension annuities provide very little income. You will need a big pension pot to do this.

Alternatively, you can flexibly drawdown an income from your pension pot. This allows you to take as much or as little money as you want when you want. But it’s not without risk, if you withdraw too much you will deplete your pension.

This is where working with an independent financial adviser can help. Regular reviews of your pension can help make sure you don’t run out of money.

Schedule your retirement planning consultation today

Annuity vs drawdown – what’s the best option?

Since 2015, people have been free to either purchase an annuity or go into drawdown, but what’s the best option?

Annuity

An annuity provides a guaranteed income for life. The income you receive either remains the same or can increase over time in line with inflation.

The main benefit of purchasing an annuity is the certainty and security it provides. You will receive an income for as long as you live.

The main drawback of purchasing an annuity is the pitiful income it provides. For example, if you use your £200,000 pension to purchase an annuity at 60, you will receive just £4,848 per year. This assumes that the annuity increases each year and pays your spouse an income if you die.

Drawdown

The other option is to go into income drawdown. This is where you keep your pension pot invested and withdraw money as and when you need it.

The main benefit of a drawdown pension is that you have complete control and flexibility. You can choose to withdraw as little or as much as you like, whenever you like.

The main drawback of a drawdown pension is that if you withdraw too much, you will run out of money. Think of your drawdown pension like your bank account. If you withdraw too much, you will eventually have nothing left.

What’s the best option?

The best option will depend on your circumstances.

If you already have enough income to meet your basic needs (food, bills and utilities), you may find that a drawdown pension works well. It can top up your income, providing extra spending money for holidays and leisure. If you spend your drawdown pension, you’ll still have enough to cover the basics.

If you don’t have enough income to meet the basics, you may want to purchase an annuity. This way, you always know that you have enough to cover the essentials.

For many people, a mix-and-match approach works well. As independent financial advisers, we can help you work out what the best option is for your personal circumstances.

Your drawdown can be used to top up your pension pot in small amounts as and when you need it, whilst leaving the majority still invested.

How can we help you retire at 60?

We are award-winning independent financial advisers and expert retirement planners. We’re experts in retirement planning with specialist retirement qualifications, and most recently have been awarded Independent Financial Adviser of the year 2021 for the South West.

Working together, we can show you whether you are on track to retire at 60 and build a retirement income plan.

“As I’m approaching the latter part of my career I decided I needed some support with my retirement strategy. Frazer James has been first class in providing advice and a clear deliverable plan. The team at FJL have shown a real understanding of my priorities and needs, and have provided a truly bespoke service with excellent communications and support. I now feel in control of my retirement plan. Big thanks to James, Chris and the team.” – JC

Schedule your retirement consultation

If you’re ready to retire at 60 or want to find out more about retiring, you can schedule your retirement planning consultation today.

We will use this meeting to discuss your plans for retirement and how we can help you to achieve them.

If you decide that we’re right for you, we charge a fixed flat for our retirement planning service.

.All the best,

James Mackay, Independent Financial Adviser in Bristol

.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor Bristol, Clifton.

About us: Frazer James Financial Advisers is a financial adviser in Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602