Modified on: June 2024

How much do I need to retire at 65?

Planning to retire at 65

How much money do you need to retire at 65? And how much do you need in your pension to retire at 65? The answer to both of these questions will depend on how much you plan to spend each year in retirement.

I’m often asked, “what is the average UK pension pot?” The answer is both simple and misleading. The simple part is that the average UK pension pot is £73,568 – according to Aegon. The misleading part is that what somebody else has in their pension has no bearing on your individual retirement.

A similar question I often get asked is, “What is a good pension pot at 65?” This assumes that there is some magical number that will provide every person with just the right amount of money in retirement (there isn’t). Or it assumes that every person spends exactly the same amount throughout their retirement (they don’t).

Whilst these questions are superficially helpful, as they provide a target to work towards, they are irrelevant. Knowing what the average pension pot is will lead you towards an average retirement. You are not a statistical average. You are unique, and so is your retirement planning.

The real question is how much do you need to retire at 65?

This takes into not just your pensions, but other forms of retirement savings, such as cash, investments and property. It also factors in any retirement income you will receive, such as the State Pension, final salary pensions and any rental income.

Most importantly, it’s personalised to you. It calculates how much money you need to retire at 65 based on your personalised retirement expenditure.

How to save for retirement in the UK?

If you’re still working and saving, the final years leading up to retirement are the most crucial. This is where you can maximise your chances of a successful retirement.

For most people, the best way to save for retirement is to contribute to their workplace pension. The benefit of this is that they will receive pension tax relief (also known as free money). They will also benefit from matched employer pension contributions (more free money).

However, for some people, contributing to a pension may not be the best option. For example, if they are affected by the pension lifetime allowance or limited by the pension tapered annual allowance, then alternatives may need to be considered.

You will also need to consider how your money is invested. If you take too much risk, you may find that your pension pot falls in value just as you reach retirement age, requiring you to continue working to make up the difference. Equally, if you take too little risk, you may find that your pension doesn’t grow enough, requiring you to either pay more in or delay your retirement plans.

Getting the right balance can be the difference between retiring on time and being forced to work a few more years.

What is a good pension pot at 65?

As you approach retirement, a natural question is “what is a good pension pot at 65?” Or what is the average retirement age?

After a lifetime of working hard and saving prudently, you want to make sure you have enough put away for a reasonable retirement.

According to Aegon, the average pension pot in the UK is £73,568. Whilst this information is interesting, it’s also irrelevant. What somebody else has in their pension has no bearing on your individual retirement.

Ultimately, a good pension pot is one that allows you to retire early and provides enough income for the rest of your life. Clearly, this depends on how much income you need.

Basing your retirement on averages is likely to be a misleading distraction. You should never cross a river that’s on average four feet deep, and you should never base your retirement planning on the average pension fund value.

What you want from retirement and how much it will cost will be specific to you. No two retirements are the same. A good pension pot is one that provides you with enough income to do everything you want.

Understanding how much you need to retire at 65 requires first working out how much you will spend each year in retirement. This will determine how much money you need and whether you have a good pension pot or not.

How much do you need to retire at 65?

If you’re planning to retire at 65, the first question you should ask yourself is “how much will I spend each year in retirement?” This is the starting place for any retirement planning and will determine how much you need in your pensions and other savings to retire at 65.

Some people will have a specific retirement income target. However, for many, this can be a difficult question. According to Retirement Living Standards (RLS), 77% of people surveyed do not know how much they need in retirement.

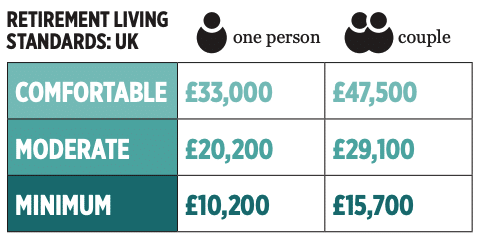

Whilst your retirement expenses will be unique to you, you may find some examples helpful. Research by RLS shows that on average a couple requires an income of £29,100 per year to sustain a moderate standard of living in retirement.

There will inevitably be some changes in your expenditure once you retire. Whilst you may spend less on commuting and housing costs, you will likely spend more on travel and leisure. To work out your own retirement income needs, you can download our one-page retirement expenses sheet.

Retirement planning is all about how to fund your retirement expenditure. It’s not really about pensions and investments – these are just the fuel for the plan. So take time to think through your retirement expenses – ultimately it will be the most important part of your retirement planning.

Until we clarify how much retirement is likely to cost, there is no way to know how much money you need to retire.

How to withdraw an income at retirement?

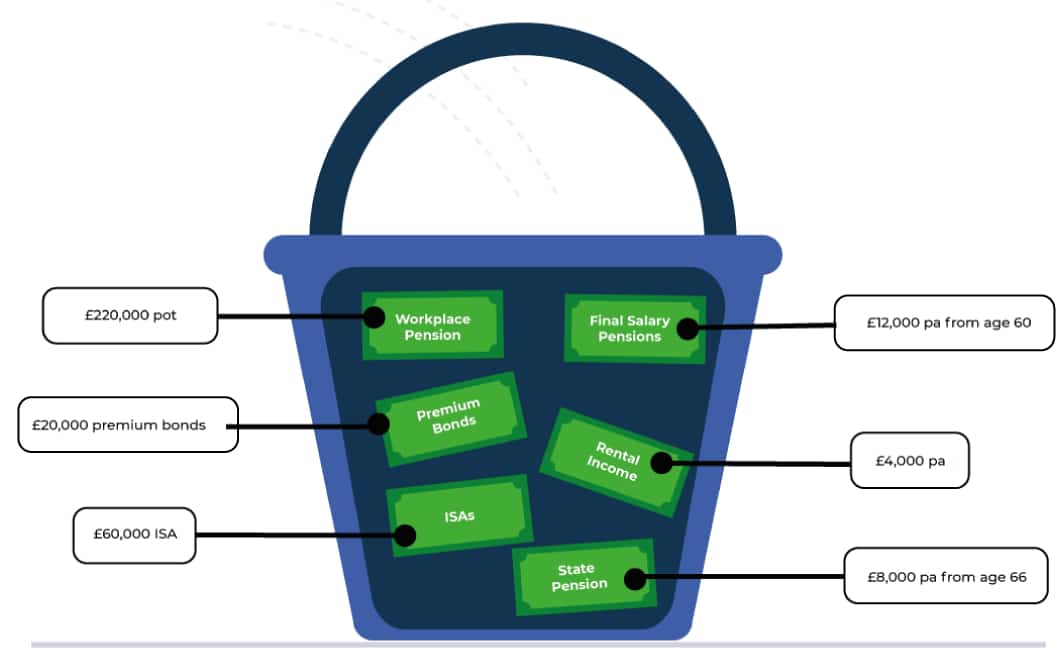

Once you know how much you are likely to spend in retirement, you will then need to factor in your retirement savings. Broadly speaking, your retirement savings are made up of two parts, income and capital:

Income

Income is easy to work out. It’s the regular payments you receive in your bank account. It will include savings interest, dividends, State Pension, rental income and any final salary pensions.

You will then need to create a retirement timeline, summarising the different incomes and when they start. For example, you may have a final salary pension that starts at age 65, whereas your State Pension may not start until age 67.

Capital

Capital refers to pots of money. This can include cash savings, ISAs, stocks and shares and pension pots.

Unlike income, capital doesn’t necessarily provide regular payments to your bank account. You will typically withdraw money each year, topping up your income as needed.

Working out how much capital you can withdraw each year isn’t easy. If you withdraw too much, you risk running short of money in later life. If you withdraw too little, you’ll get to the end of your life with money remaining unspent.

At the risk of oversimplifying things, you can typically withdraw 4% of your capital each year, without risking your long-term financial security. This is known as the 4% withdrawal rule.

Income & Capital

Although income and capital come in different forms, they serve the same purpose, to provide you with an income in retirement. For the time being, simply get a list of all of your different ‘pots’, as shown below.

.

.

How much income will you receive if you retire at 65?

To find out how much income you’ll receive if you retire at 65, you will need to create a retirement income plan. This is a document that summarises the income you will receive in retirement, as well as the capital you have available to fund any shortfalls.

You can do this in a spreadsheet yourself, however, it’s likely to be rather complicated. You’ll need to account for inflation, taxes, investment growth and capital withdrawals.

At Frazer James, we use comprehensive retirement planning software. It starts by working out how much you spend each year and then overlays this with the income you will receive. Once your income and expenses have been built in, the final step is to add your capital.

Your retirement plan is then stress-tested under different circumstances to ensure that it’s robust. For example, what if your investments grow by less than expected? What if inflation is higher than expected? What if you live to a very old age – will you still have enough?

We then produce a retirement planning report which shows one of two outcomes, either you have enough money to retire at 65, or you don’t.

Do you have enough money to retire at 65?

If you have enough…

If you have enough to retire at 65, what are you waiting for?

I recently met with a client who thought they needed to work for another 5 years. After creating their individual retirement plan, I was able to show them that they can afford to retire at 65, and do the things they always wanted to. Spoiler, they are now happily retired.

If you don’t have enough…

If you don’t have enough money to retire at 65, don’t panic! There are options available to help bring forward the date that you can retire. For example, you can:

- Save a little more each year

- Retire a few years later

- Spend a little less in retirement

- Get a higher investment return*

* By taking more investment risk. There is no guarantee that taking more risk will deliver a higher investment return.

Need help increasing your retirement fund? Speak to one of our retirement planning experts to see how they can help you plan for retirement.

How to retire at 65 and not run out of money?

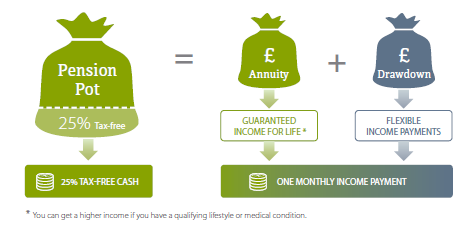

The only way you can make sure you never run out of money in retirement is if you use your pension fund to purchase an annuity. The alternative is to use flexible drawdown, although this comes with risks.

Annuity

If you purchase an annuity, you will be paid a guaranteed income for life. That’s the good news.

The bad news is that annuities provide a pitiful income. For example, if you use your £100,000 pension to purchase an annuity at 65, you will receive just £3,422 per year. To get a reasonable income, you will need a very large pension pot.

The alternative is to use a flexible drawdown pension.

Drawdown

With drawdown, your pension pot remains invested, and you withdraw money from it as and when you need it.

Drawdown provides you with a more flexible retirement income. You choose when to take the money and how much you take. You’re in control, but if you spend too much too soon, you risk running out of money.

The main advantage of flexible drawdown is that you have complete flexibility over how much you withdraw. You can withdraw as little or as much as you like, when you like.

The main disadvantage of flexible drawdown is that you can run out of money if you withdraw too much. Think of a drawdown pension like a bank account, if you withdraw too much, your balance will eventually hit £0.

Regular reviews of your pension with an independent financial adviser can help eliminate that risk and ensure you stay on track with your retirement planning.

What’s the right mix?

Whether to select an annuity or go for flexible drawdown will depend on your individual circumstances.

Annuities work well if you’re risk-averse and are dependent on the income to meet your basic needs. However, if you’re comfortable taking a risk, and have other income to help meet the basics, you may be better suited to flexible drawdown.

If you’re looking for advice on the best way to withdraw an income from your pensions, you can schedule a call with a retirement expert. They will help you understand your options and provide personalised advice on what’s right for you.

How to maintain your standard of living in retirement?

For a while now we have experienced low-interest rates and low inflation rates. But those of you looking to retire at 65 will likely remember the high inflation of the 1980s.

Over time, the cost of things becomes more expensive. One of the biggest risks to your retirement is that the income you receive doesn’t match the increases in living costs. If this happens, you’ll be able to buy less and less each year, resulting in declining living standards.

It’s difficult to appreciate the small but corrosive effect of inflation. Over a 30+ year retirement, an increase in prices of just 2.5% per year can have a big impact. For example, £5,000 of income in 1995 will need to have grown to around £10,000 in 2021 in order to keep pace with inflation.

So if your income doesn’t increase with inflation, it could mean living a low-budget lifestyle in the future. When creating your retirement income plan, an independent financial adviser will take these risks into account. They will help you work out the right balance between maximising income today and ensuring it is not eroded by inflation over time.

They will create a strategy for your retirement designed to maximise how much income you can spend in retirement without risking your long-term financial security.

How can we help you retire at 65?

“Frazer James has been first class in providing advice and a clear deliverable plan. The team at FJL have shown a real understanding of my priorities and needs, and have provided a truly bespoke service with excellent communications and support. I now feel in control of my retirement plan.” (JC, Bristol)

We are a team of chartered independent financial advisers who specialising in retirement planning. In recognition of our work, we were recently awarded Independent Financial Adviser of the Year.

At the heart of what we do, we help you make smart decisions with your finances and avoid making expensive mistakes. By working together, we can show you whether you are on track to retire at 65 and build a retirement income plan.

Our retirement strategy sessions offer you an initial consultation with a Certified Financial Planner to help you better understand your retirement options.

Take advantage of this unique opportunity to gain valuable knowledge and personalised financial advice from our team of financial experts.

Schedule your retirement strategy session today.

All the best,

James Mackay, Independent Financial Adviser in Bristol

.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers Bristol is an Independent Financial Advisor based in Clifton, Bristol.

About us: Frazer James Financial Advisers is a financial adviser in Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602