Modified on: June 2024

How to invest like Warren Buffett

Warren Buffett

Iconic billionaire investor, chairman & CEO of Berkshire Hathaway (the 5th largest company in America).

Hundreds of books have been written about him:

… – How Warren Buffett achieved his success

… – How to invest like Warren Buffett

… – How Warren Buffett thinks about investments

But when you really boil it all down, there’s just one thing that separates Buffett from the rest…

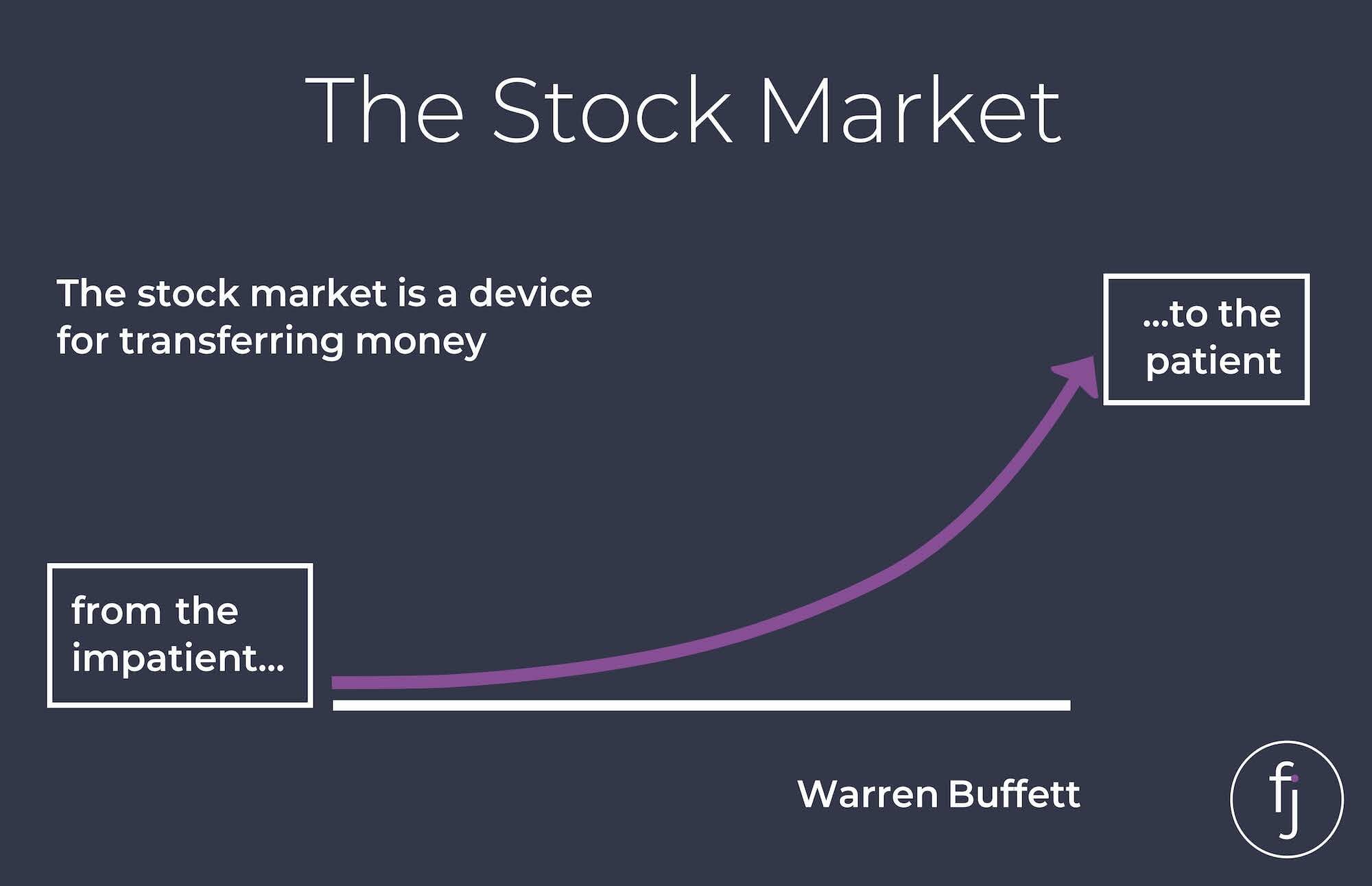

Patience

“The years ahead will occasionally deliver major market declines — even panics — that will affect virtually all stock markets. No one can tell you when these traumas will occur” (September 2017)

and when this does happen…

“Patience and good temperament are of the highest importance”

He doesn’t have any special insight into where the market is going in the short term. The value of his investments goes up and down just like everyone else.

But what separates Buffett from the rest is that when his investments decline in value, he does nothing. He sits patiently, having faith they will recover.

No day trading, no opportunistic selling, just sitting on his hands doing absolutely nothing.

History has shown that investments regularly fall in value, but over the long-term, they’ve always recovered and advanced to new highs.

When it comes to investing, patience is your friend. It’s what separates the amateurs from the experts – and it’s entirely in your control.

All the best,

James Mackay, Independent Financial Adviser in Bristol

P.s if you want to know how best to invest your money, check out my 3 top tips to improve your investments.

.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor Bristol, Clifton.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602