Modified on: June 2024

When can I afford to retire?

When can I afford to retire?

It’s the most common question I hear from new clients.

Clients that end up in our offices often have a question in mind. It might be a pension question; it could be an investment question or something entirely different. But often the question being asked isn’t the real question.

When someone comes in, they often want an immediate answer to an immediate problem. Like, “I’ve got these pensions, what shall I do with them?”

But often what they mean is “when can I afford to retire?”

Lots of people have got to the point where they’ve had enough of work. They want to swap Monday morning meetings for Monday morning musings. They want the freedom to do what they want, when they want.

And that’s what ‘retirement planning’ is all about. It’s not about this pension or that pension, this investment or that investment.

It’s about starting with the end in mind.

Design it – what does my retirement look like?

Starting with the end in mind is about figuring out what you want your life to look like after work.

There are a couple of parts to this:

- What does the day-to-day look like?

- What are the big things you want to do?

- When do you want to achieve this?

It’s simple, but ain’t easy. It’s part thinking, part calculating. That’s where a good financial advisor comes in.

Cost it – what does my retirement cost?

A good financial advisor will help you with two things:

- Work out what you want from life

- Work out what that costs

They’ll work out the day-to-day stuff and then put together a timeline for the big stuff.

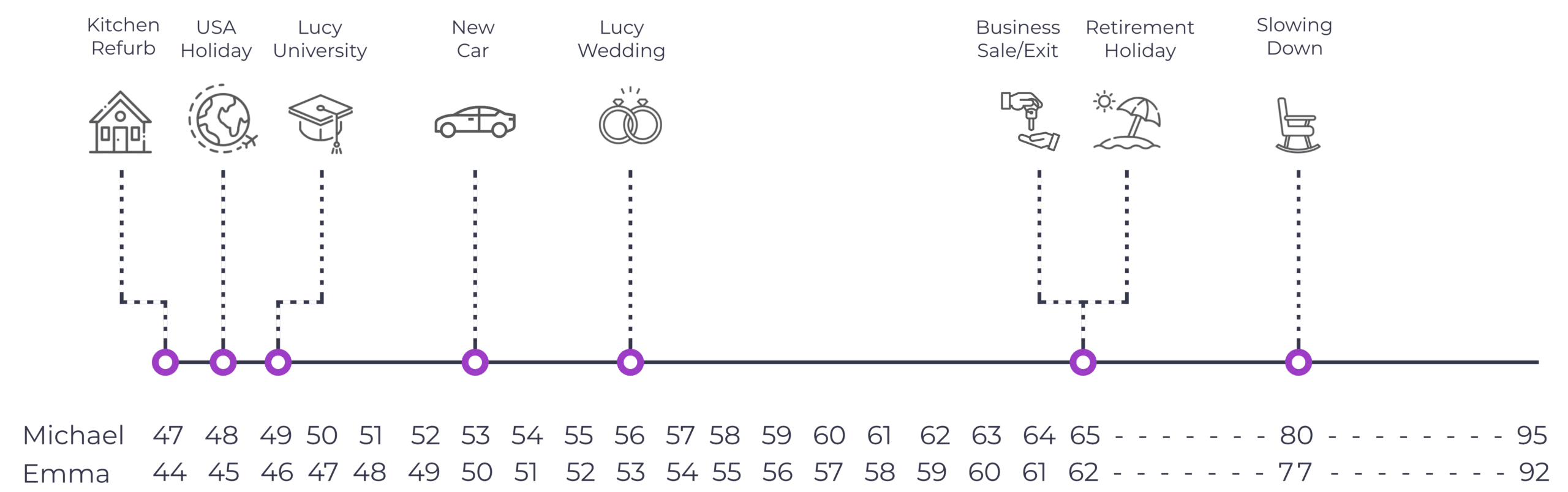

Take a recent example. Michael and Emma came in, wanting to retire in 4 years. They told us they need around £2,000 per month to cover the basics and a bit more for the extras.

They also had a few things in mind they wanted to do, things like refurbishing the kitchen, going on a big holiday and helping their daughter purchase her first home (with the bank of Mum and Dad becoming more and more common!).

We put together a timeline of events for them, working out the cost of each one. Then we worked back from there to work out if they had enough money.

And then it’s about working out whether you have enough!

Fund it – when can I afford to retire?

This is the fun part. It’s about working out how much you’re going to have coming in and what the gaps are.

So, in Michael & Emma’s case, they needed £2,000 a month for their day-to-day, plus their big-ticket items (kitchen refurb etc.). They’ll both get full State Pensions, that’ll give them £16,000 per year from age 67. Michael’s old final salary pension scheme that he’d forgotten about will give him another £6,000 per year from age 65.

Long story short, they had a big gap from age 60-67, but then a small gap once their State Pensions were in payment. They had built up private pensions, investments & savings of around £200,000 and wanted to know if this was enough. We showed them that they had enough to do everything they wanted and didn’t need to work for 4 more years.

Music to their ears! They came in with a pension problem and walked out with financial freedom.

Spoiler alert, Michael and Emma are both retired and thoroughly enjoying life after work!

Your retirement plan

Retirement planning isn’t about flogging your guts and saving as much as you can. It’s about looking at the big picture, working out what you want from life and working back from there. It’s about working out how much life will cost and answering “when can I afford to retire”.

Maybe you’ve already got enough; maybe you need a little bit more. Either way, it’s worth finding out.

Let me know how you get on.

All the best,

James Mackay, Independent Financial Adviser in Bristol

.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor Bristol, Clifton.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602