Modified on: June 2024

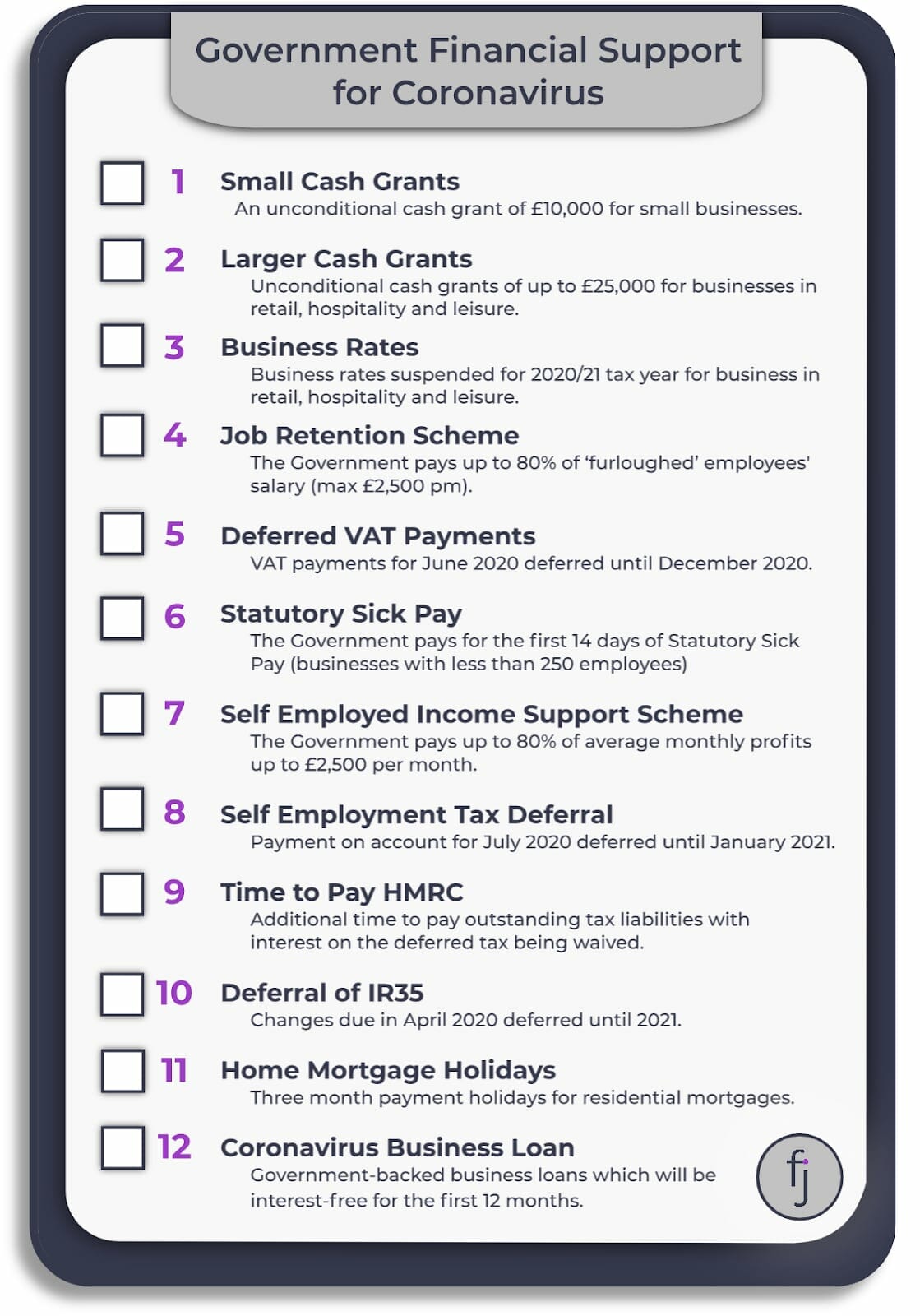

Coronavirus Government Financial Support

Whilst the impact of Coronavirus are devastating, fortunately, Government Financial Support is at hand.

The coronavirus, or COVID-19 as it has become to be known, is impacting the lives and livelihoods of businesses and individuals alike.

You know this, I know this, but more importantly, the Government knows this.

As ‘lender of the last resort’, the Government has stepped in, providing support for businesses and individuals. In March, the Chancellor of the Exchequer announced a £350bn stimulus package, promising to do “whatever it takes” to support the UK economy.

For many, this will provide a lifeline during these challenging times. Make sure to also check out my article on how to get your finances back on track after COVID-19.

Coronavirus Government Financial Support

Here’s a rundown of what’s available and whether you’re eligible:

1. Small Cash Grants

Businesses which pay minimal or no business rates and are eligible for small business rate relief (SBBR) or rural rate relief will be eligible for a one-off grant of up to £10,000 from April 2020 onwards. These grants will be provided by Local Authorities and it is understood that small businesses will be contacted by their Local Authority shortly (rather than having to proactively approach their Local Authority) with information on exactly how to access these grants.

To check whether you qualify for this relief, you can contact your local council directly to claim it. Before you do, check your business’ rateable value.

Update May 2020 – additional Coronavirus Government Financial Support announced for businesses who don’t pay business rates. Find out more about the small business top-up grant.

2. Larger Cash Grants

A further grant of £10,000 to £25,000 is being made available to businesses operating from smaller premises in the retail, hospitality and leisure sectors, which have a rateable value of £15,000 to £51,000.

To check whether you qualify for this relief, you can contact your local council directly to claim it. Before you do, check your business’ rateable value.

3. Business Rates

Businesses in the retail, hospitality and leisure sectors will have their business rates suspended for the 2020/21 tax year. This is designed to assist the payment of rent in particular.

To check whether you qualify for this relief, you can contact your local council directly to claim it. Before you do, check your business’ rateable value.

4. Job Retention Scheme

For all employees who remain on the payroll but would otherwise be laid off, the Government will pay 80% of their basic salary up to a cap of £2,500 per month. Employers will have the ability to top-up the salary to 100% of salary if they choose.

All businesses are eligible for this scheme but in order to access it they need to:

- Designate affected employees as ‘furloughed workers’ (which just means they are being retained but would normally be laid off) and notify those employees of this change. Changing the status of employees remains subject to existing employment law and, depending on the employment contract, may be subject to negotiation, so you should obtain employee law advice where necessary.

- Submit information to HMRC about the employees that have been furloughed and their earnings through a new online portal. HMRC will provide more information soon on exactly what they need.

Businesses can apply from Monday 23rd March. It will be in place for three months and then reviewed every month. The money will be available from the end of April but will take effect from 1st March.

HMRC are now working to set up a system for reimbursement as existing systems are not set up to facilitate payments to employers and will publish further guidance here once available.

Update May 2020 – additional Coronavirus Government Financial Support announced, with the scheme being extended until October. Find out more about the small business top-up grant.

5. Deferred VAT Payments

If you’re a UK VAT registered business and have a VAT payment due between 20 March 2020 and 30 June 2020, you have the option to:

- defer the payment until a later date (latest being the end of the year).

- pay the VAT due as normal

Find out more about how to defer your VAT payment.

6. Statutory Sick Pay

For businesses with fewer than 250 employees the cost of providing 14 days of Statutory Sick Pay per employee would be funded by the Government in full. This will also apply to those who are in self-isolation.

The three day waiting period for statutory sick pay will also be removed, but legislation will be needed to implement this so we await more information.

7. Self Employed Income Support Scheme

The Self-employment Income Support Scheme (SEISS) will support self-employed individuals (including members of partnerships) who have lost income due to coronavirus (COVID-19).

This scheme will allow you to claim a taxable grant worth 80% of your trading profits up to a maximum of £2,500 per month for the next 3 months. This may be extended if needed.

The scheme will be open to those with a trading profit of less than £50,000 in 2018-19 or an average trading profit of less than £50,000 from 2016-17, 2017-18 and 2018-19.

Claim self-employed income support scheme.

Update May 2020 – additional Coronavirus Government Financial Support announced, with the self-employed scheme being extended until October. Extension to self-employed income relief scheme until October.

8.Self Employment Tax Deferral

If you’re due to pay a self-assessment payment on account by 31 July 2020 but the impact of the coronavirus causes you difficulty in making payment by that date, then you may defer payment until January 2021.

You are eligible if you are due to pay your second self-assessment payment on account on 31 July. You do not need to be self-employed to be eligible for the deferment.

If you’re looking for even more ways to save tax, check out my article on 10 ways to reduce your tax bill.

9. Time to Pay HMRC

All businesses and self-employed people in financial distress, and with outstanding tax liabilities, may be eligible to receive support with their tax affairs through HMRC’s Time To Pay service.

These arrangements are agreed on a case-by-case basis and are tailored to individual circumstances and liabilities.

This is an automatic offer with no applications required. No penalties or interest for late payment will be charged if you defer payment until 31 January 2021.

10. Deferral of IR35

The changes surround IR35 that were due to come into effect on 6 April 2020 has been deferred.

This has now been delayed until April 2021 because of the spread of the coronavirus (COVID-19) pandemic.

The delay is to help businesses and individuals deal with the economic impact of COVID-19.

11. Home Mortgage Holidays

Anyone struggling as a result of the coronavirus outbreak will be able to take a three-month mortgage repayment holiday. The Government’s announcement means all lenders will now have to honour the three-month time frame.

Remember to bear in mind that while you are not making mortgage payments, you’re still racking up interest on your remaining mortgage balance. This means that when mortgage payments resume, you will pay a higher amount (assuming you don’t change the term of the mortgage).

If you’re still paying your mortgage, check out the 4 things you need to consider before overpaying the mortgage.

12. Coronavirus Business Loan

For small and medium-sized businesses, the new Coronavirus Business Interruption Loan Scheme is now available for applications.

This scheme will help any viable business with a turnover of up to £45m to access government-backed finance of up to £5 million.

Interest payments and any lender-levied fees for businesses will be covered by the Government for an initial period of up to twelve months.

The government will provide lenders with a guarantee of 80% on each facility to give lenders further confidence in continuing to provide finance to SMEs.

Check eligibility for Coronavirus Business Loan Interruption Scheme (CBILS).

Second opinion service

If you or any of your friends, family or colleagues wish to speak to a financial professional, I’m here to help.

I have a professional obligation to help as many people as I can and am offering an initial consultation free of charge.

Book free financial planning meeting.

P.s – if you’re wondering how to invest during these challenging times, check out our article: Panic Pandemic.

All the best,

James Mackay, Independent Financial Adviser in Bristol

P.s – here are 6 things you can do to survive lockdown during the Coronavirus.

.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor Bristol, Clifton.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602