Modified on: June 2024

Financial advisor or financial planner – what’s the difference?

Financial adviser vs financial planner

What’s the difference between a financial advisor and a financial planner?

In many countries, the use of the title “financial planner” is tightly controlled and regulated. However, that’s not the case here in the UK.

In the UK, any financial advisor can call themselves a financial planner, regardless of whether they actually deliver a financial planning service.

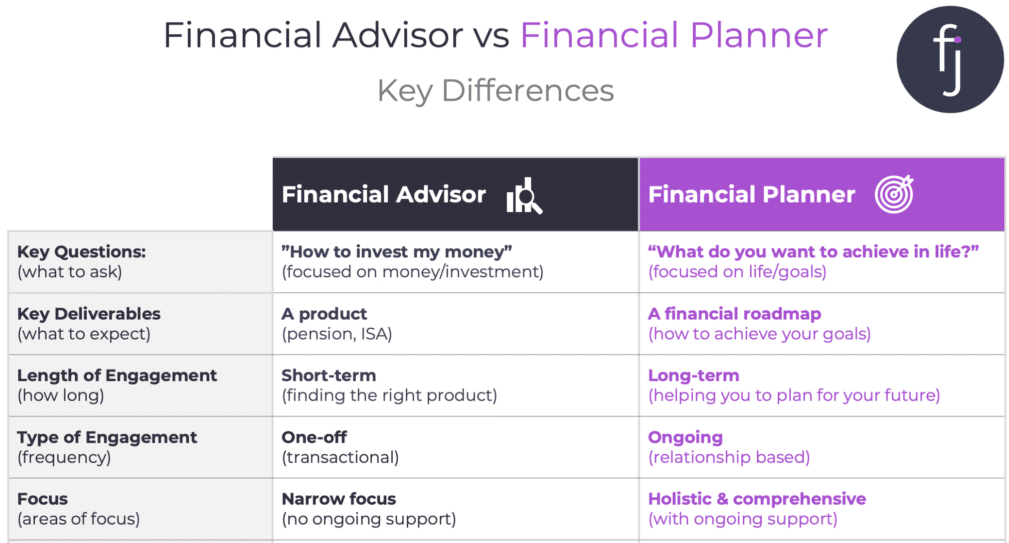

What does a financial advisor do, and what does a financial planner do? The key differences between a financial advisor and a financial planner are summarised below.

Want to know more? Read on to find out the difference between a financial advisor and a financial planner.

What does a financial advisor do?

The main things a financial advisor does is set up a pension, pick an investment or select an insurance provider.

A financial advisor, even an independent financial adviser, tends to focus on a single problem. They don’t take into account the big picture. Instead, they look at the question narrowly, only advising you on what you have asked for.

For example, you may want advice on how best to invest a lump sum for the long term. A financial advisor will consider the options and recommend the best investment strategy. The risk with this approach is that without looking at the big picture of your finances, they may miss something important. Perhaps investing a lump sum isn’t the best idea. What if you need to use it for other reasons?

Financial advisors are important, but they don’t really answer the big questions. Things like “Will I be okay?”, “When can I afford to retire?” and “How much can I spend in retirement?”.

The other problem with financial advice is the focus on financial products. Many advisers only get paid if they recommend a particular product, whether that’s an ISA, a pension or some other investment.

How much does a financial advisor cost? Typically they will charge you 2 – 3% of your investments. So if you have £500,000, they are likely to charge you between £10,000 – £15,000. Our charges are much less than this, read on to find out.

What does a financial planner do?

An independent financial planner will look at the ‘big picture’ of your finances, taking a holistic approach to financial planning. A financial planner will help you work out what you want from life and then create a financial plan to make it happen.

The key difference between a financial planner and a financial advisor is that a financial planner focuses on you and your goals, whereas a financial advisor focuses on your money and your investments. Financial planners use their expertise in taxes, budgeting, pensions and investments to create an overarching strategy for your finances.

Working with an independent financial planner puts you in control of your finances, providing you with clarity and confidence in your financial future. A financial planner will create a financial plan, which provides a roadmap for your financial future. The financial plan will show you three things:

- Where you are today

- Where you want to be

- A strategy to get you there

The financial strategy may include financial products, such as an ISA or a pension; however, these are simply tools to get the job done.

How much does a financial planner cost for the initial financial plan?

For the initial advice, most independent financial planners work on a fixed fee. The exact cost will vary, depending on how complex your circumstances are. For reference, our fees are £2,000 – £3,000 for the initial financial plan and review. This will include:

- Financial Plan – a forecast of your finances (income, expenses, assets and liabilities). This will show you the best way to achieve your objectives, both now and in the future.

- Financial Review – an overall review of your finances (pensions, investments, insurance, and taxes). Creating an overarching strategy for your finances.

After their financial plan has been created, they may go on to take detailed financial advice. The typical fee for advice will be between £2,000 – £3,000, depending on complexity. This will include:

- Financial Advice – a detailed report which clearly lays out our advice on what you should do to improve your financial situation.

- Implementation – we will set up your new accounts and arrange the transfer of any existing accounts as required.

In most cases, hiring a financial planner is better value for money. This is because by working with a financial planner, you will receive a full review of all areas of your finances. In addition to receiving a personalised financial plan, you will receive a full review of your tax position, pensions and investments and advice on how these can be improved.

How much does a financial planner cost for ongoing advice and management?

When you engage with a financial adviser, you’re not just paying for investment management; you’re investing in a relationship that offers proactive, ongoing guidance to navigate the financial landscape. In exchange for a charge of up to 0.90% of your investments annually, the services provided are comprehensive and tailored to your unique situation, including:

- Proactive Planning: We continuously anticipate potential changes in the market and your life, adjusting your financial plan proactively to keep you on the path to your goals.

- 24/7 Accessibility: Your financial wellbeing doesn’t adhere to office hours, which is why we offer around-the-clock access to your adviser, ensuring you have support whenever you need it.

- Unlimited Support: Whether you have big decisions to ponder or just need reassurance, you have unlimited access to your adviser for advice and guidance.

- Regular Reviews: We frequently review your financial plan to ensure you’re on track, making adjustments as your life and goals evolve.

- Tax Optimisation: Strategic advice to improve your tax position, keeping more of your hard-earned money in your pocket.

- Insurance Adequacy: Ensuring sufficient coverage is in place to protect you and your family, whatever life throws your way.

- Retirement Planning: Reviewing your retirement income strategy to reduce the risk of running short of funds in your later years.

- Investment Oversight: Constantly monitoring your investments to confirm they are performing as expected, with adjustments made when necessary.

- Hassle-Free Administration: Handling all the administrative tasks associated with managing your finances, giving you one less thing to worry about.

At Frazer James, we believe that a small investment in expert advice can yield significant returns, both in financial terms and peace of mind. Our goal is to ensure that every aspect of your financial life is carefully managed and monitored, so you can focus on living the life you want, secure in the knowledge that your financial health is in expert hands.

What’s right for you?

If you just want to set up an ISA & don’t want to consider ‘the bigger picture’, then you’re probably best working with a financial advisor. But if you want to take control of your finances and have a plan for your future, then financial planning is the way to go.

Our experience is that most people think they want a financial advisor, but what they need is a financial planner. Nobody is looking to invest money for the sake of it, there’s normally a reason there. Working with a financial planner will provide clarity on where you are today and where you want to be, ensuring that any advice is in your best interests.

If you want someone who really understands financial advice & planning, then you should consider hiring a Certified Financial Planner (CFP). This is the hallmark of global standards in financial planning.

At Frazer James, we provide financial planning and advice. If you would like to know more, feel free to schedule an initial financial consultation.

All the best,

James Mackay, Independent Financial Adviser in Bristol

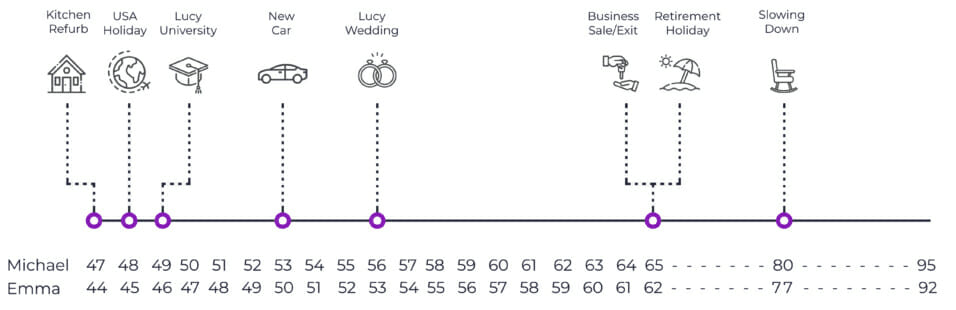

P.s – here is a short client story about the differences between a financial planner and a financial adviser.

.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor Bristol, Clifton.

About us: Frazer James Financial Advisers is a financial adviser in Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement masterclass

Retirement masterclass  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602