Modified on: June 2024

Top 3 Investment Myths – and how to avoid these costly mistakes

Top 3 Investment Myths – and how you can avoid these costly mistakes

Don’t fool for these 3 investment myths!

When it comes to investing, it ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.

#1 Investment Myth – Stocks & shares are risky

If I had £1 for every time someone told me that stocks are too risky, I would be retired!

Yes, stocks and shares go up and down, sometimes by a lot. But over time, stocks and shares are more likely to go up.

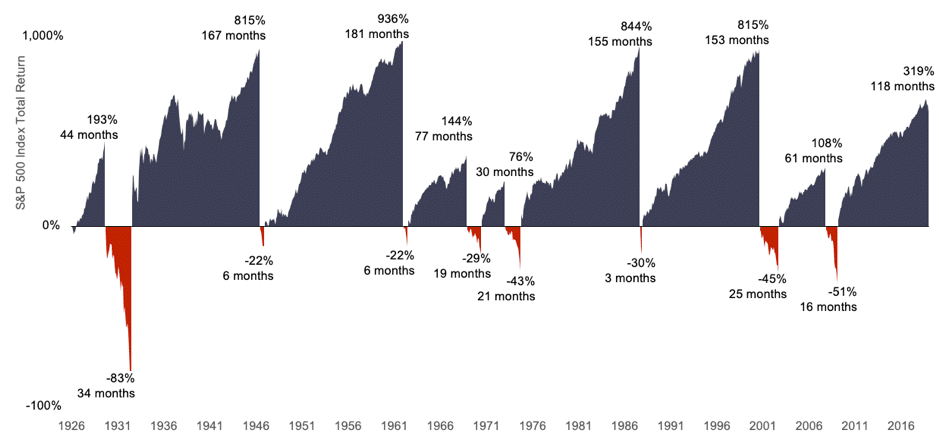

Just take a look at the below chart:

Investing in stocks and shares is emotional, exhausting and exhilarating. Along the way, you can expect some pretty big declines – by as much as 83% in 1929-1933.

But history has shown that the declines are temporary, whereas the advance is permanent.

Learn more on how investing really works and what investment risk really is.

#2 Investment Myth – You get what you pay for

This is the greatest of all the investment myths. It sounds like it makes sense, but it’s completely counter-intuitive.

Naturally, we’re inclined to think price and value are somewhat related.

If I pay more, I’m going to get more, right?

That’s normally the case, but in the world of investing, you get what you don’t pay for.

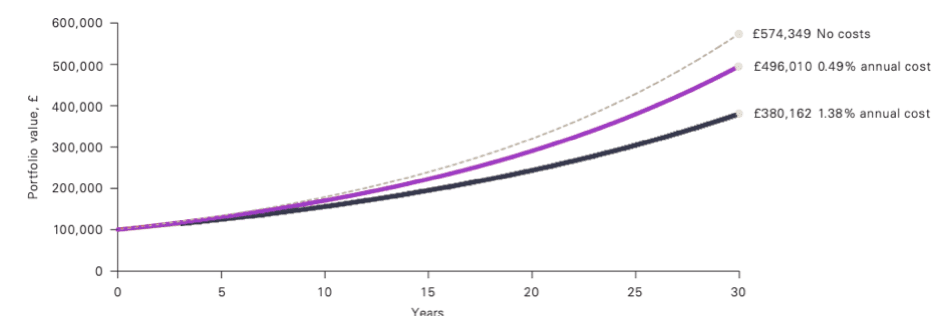

When you think about it, it makes sense. Costs matter, because every pound you pay is a pound less in returns.

What’s more, just like returns, costs compound over time. Seemingly small differences in costs have a big impact over time.

The chart below shows the impact of costs of 1.38% over 30 years. It might not sound like a lot, but over 30 years it’s a difference of nearly £200,000!

(Source – Vanguard)

To quote Warren Buffett, “performance comes and goes, but fees never falter.”

Keeping your costs low is an easy way to improve your chances of investment success.

#3 Investment Myth –You can beat the market

One of the biggest investment myths in investing is that it’s all about beating the market.

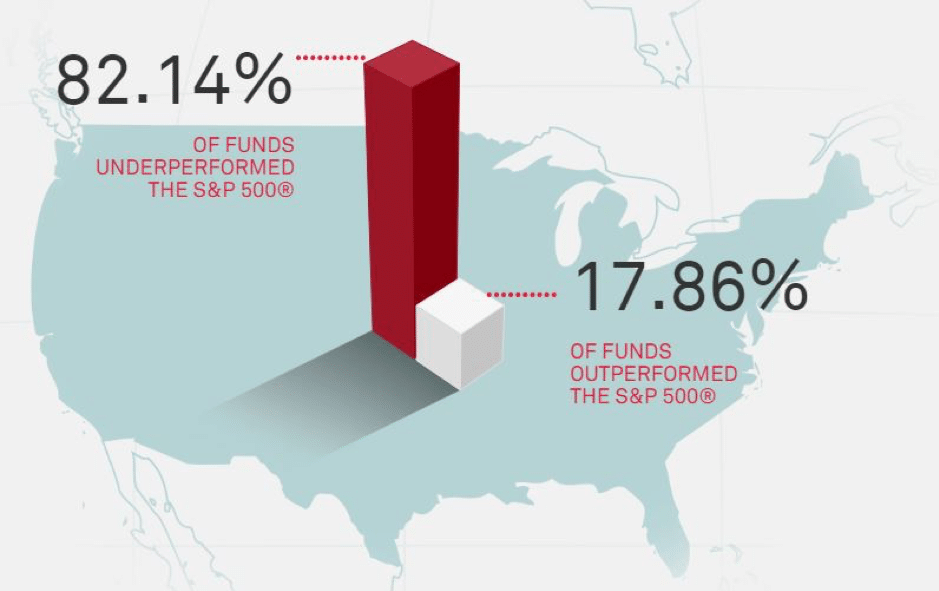

We’re told that you need to pay high fees to an expert investment manager to pick the winning shares.

The problem is, the vast majority of these supposed experts are unable to beat the market themselves. And all you get is average returns, less the high fees.

The below table shows that over the 5 years to 2018, only a handful of fund managers have beaten their benchmark.

(Source – SPIVA)

Even if you do manage to find that elusive “winner”, the chances that they will continue to outperform in the future is no more than random chance. Yesterday’s investment winner is just as likely to be tomorrow’s investment loser.

Neil Woodford’s fall from grace provides a stunning example of elusive the success of star managers can be.

The truth is, markets are hard to beat. Picking stocks is like betting on the horses. It can go either way.

Even Warren Buffett can’t time the market.

Investment Myths Buster

So, there we have it, the 3 big investment myths:

- Stocks and shares are risky

- You get what you pay for

- You can beat the market

By simply avoiding these 3 myths, you will be a better investor than the vast majority of people.

Want more investment tips? Check out the 7 Simple Steps to Investment Success. It’s a free 7-day investment masterclass, designed to help you avoid costly mistakes and tilt the odds in your favour.

All the best,

James Mackay, Independent Financial Adviser in Bristol

P.s – if you want to know more about investing, I’m currently offering a Free Investment Masterclass. This will provide a high-level summary of your investments, showing you how your money is invested and how it’s performing.

.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor Bristol, Clifton.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602