Modified on: June 2024

What is Holistic Financial Planning?

Introduction to Holistic Financial Planning

Holistic Financial Planning looks at all aspects of your personal and financial life, before creating a plan for your money. It takes into account where you are today, where you want to be and then creates a plan to help you get there.

By contrast, traditional financial advice focuses on a specific area of your finances, such as investments, pensions, tax or insurance.

What are the Benefits of Holistic Financial Planning?

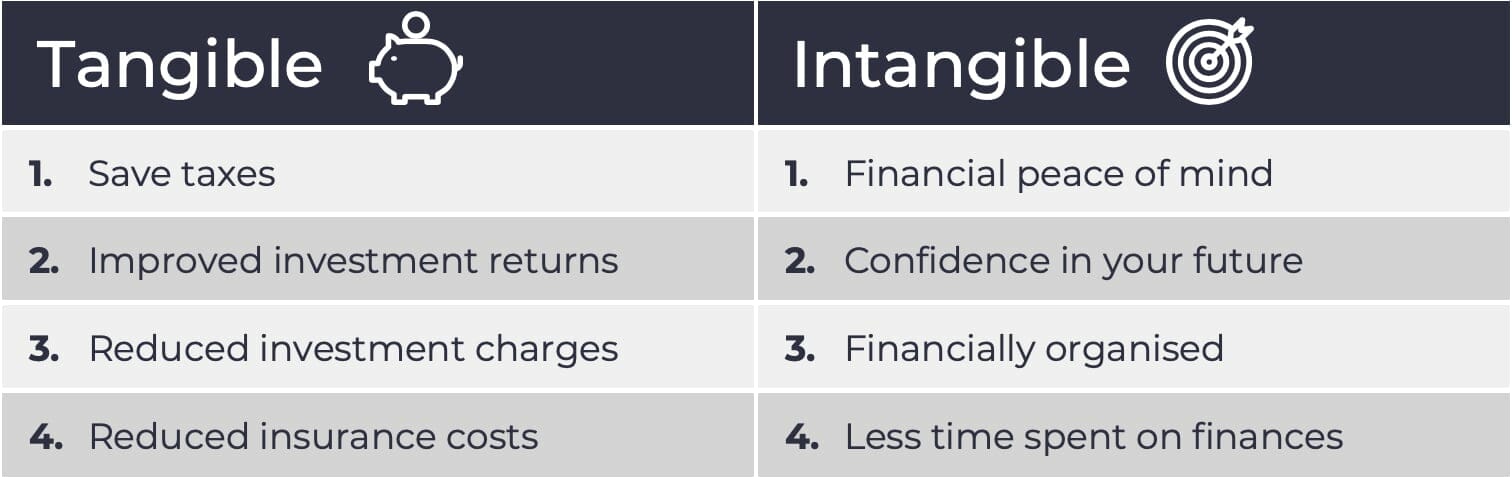

A holistic approach to financial planning helps you identify the actions needed to meet your goals, both today and in the future. The benefits of holistic financial planning are both tangible and intangible:

What is the Holistic Financial Planning Process?

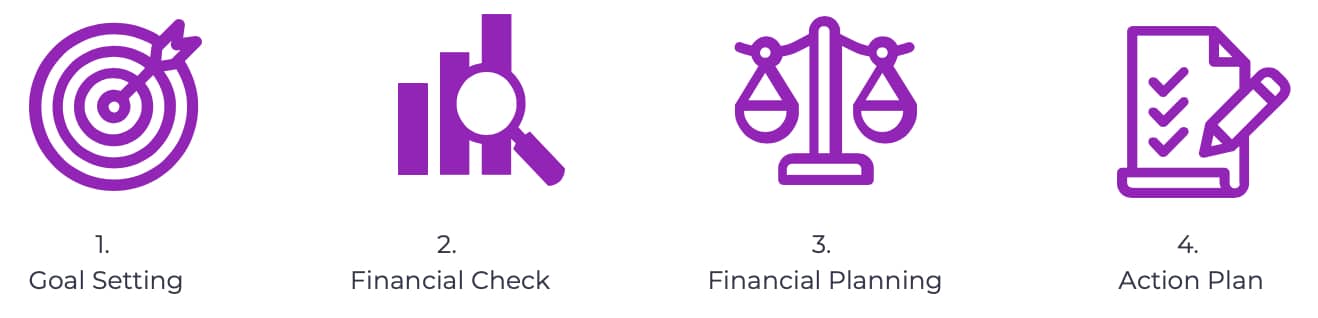

There are typically 4 steps to holistic financial planning:

Financial Goal Setting (Where do you want to be?)

The first step to holistic financial planning is understanding where you want to be.

Before we even get to the money, it’s important to understand what the money is for.

What are your dreams, goals and aspirations for the future? What are the things you want to achieve? What’s on your bucket list?

Maybe you want to retire at 55, or perhaps you just want more freedom to travel. Whatever it is, write it down. These are your markers in the sand, what you’re working, saving and investing for.

Holistic financial planning starts with the end in mind and works back from there. I know this may sound a bit wishy-washy, but if you don’t know what you want from life, you have no framework for making financial decisions.

You get out of life what you put into it. But if you don’t know what you want out of life, how do you know what you need to put into it?

At Frazer James, we take a holistic approach to financial planning. Only by understanding what you want out of life can we advise you what you need to put in.

Financial Health Check (Where are you today?)

The next step to holistic financial planning is understanding where you are today.

This is about getting a really clear picture of your finances. What do you own and how is it performing? If you have an old pension policy, is it working hard or sitting idle? Is it cost-effective or are you paying a fortune in charges? Are the funds it’s invested in the right ones for you?

You need to complete a full audit of your financial assets. From expenses to pensions, insurances to investments, giving an appraisal on your current position and what could be done to improve it.

It helps to answer the important questions, things like:

- Am I saving enough?

- Can my pensions be improved?

- Will I be okay if something goes wrong?

- Can I reduce my tax bill?

The outcome of your financial health check will provide you with a really clear picture of your current financial position.

Financial Planning Analysis (How to get there?)

The next step to holistic financial planning is to create a plan to get you from where you are today to where you want to be.

To do this, you need to create a forecast for your finances.

You start by adding up how much is coming in and how much is going out each month. Then you build in your savings, investments and pensions. You can do this in excel, or you can work with an independent financial adviser.

The outcome is a comprehensive cash flow report. This will show one of two outcomes: either you’re on track to achieve your aims and objectives, or you’re not.

Don’t worry if you’re not on track. There are steps you can take to fix this, such as:

- Improving your investment return

- Reducing your investment costs

- Finding ways to pay less tax

- Saving a little bit more

By the end, you will have a clear plan of action for your finances.

Financial Action Plan (What do you need to do?)

The final step to holistic financial planning is taking action.

You know where you want to be, you know where you are today and have a plan for bridging the gap. But without taking action, nothing is going to change. You need to physically make the changes that have been identified in the previous step.

If you need to save a little more, then contact your pension company to increase contributions. If you need to spend a bit less, then create a budget and get somebody to hold you accountable to it.

Nothing is going to change unless you change it. Here is where working with an independent financial adviser can help. They will check in with you regularly, holding you accountable to your actions.

How Can We Help?

We are a team of Certified and Chartered independent financial advisers. We provide holistic financial planning advice, reviewing all aspects of your finances.

It all starts with an initial conversation about what you want to get out of life. If this sounds like your kind of thing, then why not book in for an initial financial consultation?

As ever, if you have any questions, feel free to drop me a line.

All the best,

James Mackay, Independent Financial Adviser in Bristol

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor Bristol, Clifton.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

About The Author

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement assessment

Retirement assessment  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602