Modified on: December 2023

Don’t rely on past investment performance – do this instead

How to get the best investment return

Much of what you read about investing highlights only the successes. Star fund managers’ reputations are built upon periods of good performance and, despite the warnings in the small print, the funds they manage are heavily promoted based on that past investment performance.

You might, therefore, be surprised at how few fund managers are able to deliver good performance over more than a few years; and how fewer still are able to repeat that good performance. An annual study by Dimensional Fund Advisors reveals how hard it is for investors to pick a winning manager based on past investment performance.

Every year, the study analyses the returns of thousands of US-based mutual funds to determine how many funds outperform an industry benchmark after costs. The study found that on average, only around 25% of funds outperformed the market.

Do winners keep on winning?

You might look at these results and say, why not just pick the funds that outperformed? But this assumes that past performers will keep on winning.

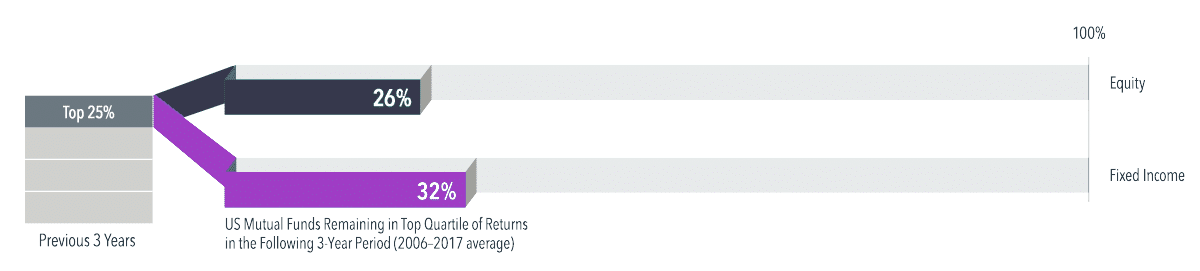

Turn back the clock three years and imagine investing using past investment performance as your guide. If you picked yesterday’s winners, in three years you would find that only 26% of equity funds and 32% of fixed interest funds continued to outperform their benchmarks.

(Source – Dimensional)

You could read this result to mean that a few skilful managers can perform well over more than a handful of years. That might be the case, but the number of funds that did repeat their top quartile performance was about the same as you would expect by random chance alone.

Yesterday’s winner is just as likely to be tomorrow’s loser.

The study concludes that investors should not rely on past investment performance when selecting investment funds. It offers no meaningful guide to future investment returns.

So what should you do instead?

Stop listening to the news, it’s full of investment myths.

Instead of trying to guess tomorrows winner, you should create a sensible investment philosophy, which aims to outperform the market, without outguessing it. We created a systematic approach to investing, which is detailed in the 7 Simple Steps to Investment Success.

It provides you with a proven process to help you avoid the costly mistakes and tilt the odds in your favour.

All the best,

James Mackay, Independent Financial Adviser in Bristol

.

.

Financial Advisor Bristol and Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor based in Clifton, Bristol.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, we’re able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Frazer James Financial Advisers is located at Square Works, 17 – 18 Berkeley Square, Bristol, BS8 1HB.

This article provides information about investing, but not personal advice. If you’re not sure which investments are right for you, please request advice.

Remember that investments can go up and down in value, you may get back less than you put in.

Related news

Get in touch

Schedule a free consultation with one of our financial advisers, or give us call.

0117 990 2602

Client login

Client login  Retirement masterclass

Retirement masterclass  Book a consultation

Book a consultation  0117 990 2602

0117 990 2602